- Chile

- /

- Metals and Mining

- /

- SNSE:PUCOBRE

Does Sociedad Punta del Cobre (SNSE:PUCOBRE) Have The Makings Of A Multi-Bagger?

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So when we looked at Sociedad Punta del Cobre (SNSE:PUCOBRE) and its trend of ROCE, we really liked what we saw.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Sociedad Punta del Cobre, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.15 = US$76m ÷ (US$615m - US$119m) (Based on the trailing twelve months to December 2020).

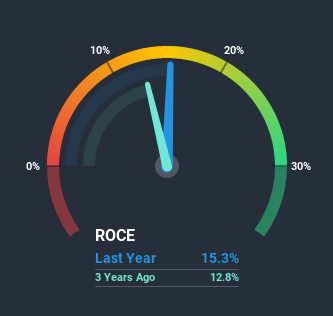

Therefore, Sociedad Punta del Cobre has an ROCE of 15%. By itself that's a normal return on capital and it's in line with the industry's average returns of 15%.

View our latest analysis for Sociedad Punta del Cobre

Historical performance is a great place to start when researching a stock so above you can see the gauge for Sociedad Punta del Cobre's ROCE against it's prior returns. If you'd like to look at how Sociedad Punta del Cobre has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

So How Is Sociedad Punta del Cobre's ROCE Trending?

We like the trends that we're seeing from Sociedad Punta del Cobre. The data shows that returns on capital have increased substantially over the last five years to 15%. The company is effectively making more money per dollar of capital used, and it's worth noting that the amount of capital has increased too, by 46%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

The Key Takeaway

A company that is growing its returns on capital and can consistently reinvest in itself is a highly sought after trait, and that's what Sociedad Punta del Cobre has. And a remarkable 120% total return over the last year tells us that investors are expecting more good things to come in the future. So given the stock has proven it has promising trends, it's worth researching the company further to see if these trends are likely to persist.

Sociedad Punta del Cobre does have some risks though, and we've spotted 1 warning sign for Sociedad Punta del Cobre that you might be interested in.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

When trading Sociedad Punta del Cobre or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:PUCOBRE

Sociedad Punta del Cobre

Engages in the development and exploitation of mineral resources primarily in the Atacama Region.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success