- Chile

- /

- Metals and Mining

- /

- SNSE:MOLYMET

Should You Be Impressed By Molibdenos y Metales' (SNSE:MOLYMET) Returns on Capital?

Finding a business that has the potential to grow substantially is not easy, but it is possible if we look at a few key financial metrics. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after briefly looking over the numbers, we don't think Molibdenos y Metales (SNSE:MOLYMET) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

Understanding Return On Capital Employed (ROCE)

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on Molibdenos y Metales is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.066 = US$72m ÷ (US$1.2b - US$160m) (Based on the trailing twelve months to June 2020).

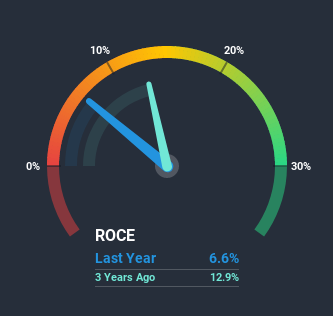

Thus, Molibdenos y Metales has an ROCE of 6.6%. In absolute terms, that's a low return but it's around the Metals and Mining industry average of 8.2%.

View our latest analysis for Molibdenos y Metales

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you'd like to look at how Molibdenos y Metales has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Does the ROCE Trend For Molibdenos y Metales Tell Us?

Over the past five years, Molibdenos y Metales' ROCE and capital employed have both remained mostly flat. Businesses with these traits tend to be mature and steady operations because they're past the growth phase. So unless we see a substantial change at Molibdenos y Metales in terms of ROCE and additional investments being made, we wouldn't hold our breath on it being a multi-bagger.

What We Can Learn From Molibdenos y Metales' ROCE

In a nutshell, Molibdenos y Metales has been trudging along with the same returns from the same amount of capital over the last five years. Since the stock has gained an impressive 64% over the last five years, investors must think there's better things to come. However, unless these underlying trends turn more positive, we wouldn't get our hopes up too high.

On a separate note, we've found 2 warning signs for Molibdenos y Metales you'll probably want to know about.

While Molibdenos y Metales isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Molibdenos y Metales, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SNSE:MOLYMET

Molibdenos y Metales

Engages in the processing of molybdenum concentrate worldwide.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives