Did You Participate In Any Of Blumar's (SNSE:BLUMAR) Fantastic 164% Return ?

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. One great example is Blumar S.A. (SNSE:BLUMAR) which saw its share price drive 119% higher over five years. In more good news, the share price has risen 6.6% in thirty days. But this could be related to good market conditions -- stocks in its market are up 8.7% in the last month.

Check out our latest analysis for Blumar

With just US$448,471,000 worth of revenue in twelve months, we don't think the market considers Blumar to have proven its business plan. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. Investors will be hoping that Blumar can make progress and gain better traction for the business, before it runs low on cash.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Of course, if you time it right, high risk investments like this can really pay off, as Blumar investors might know.

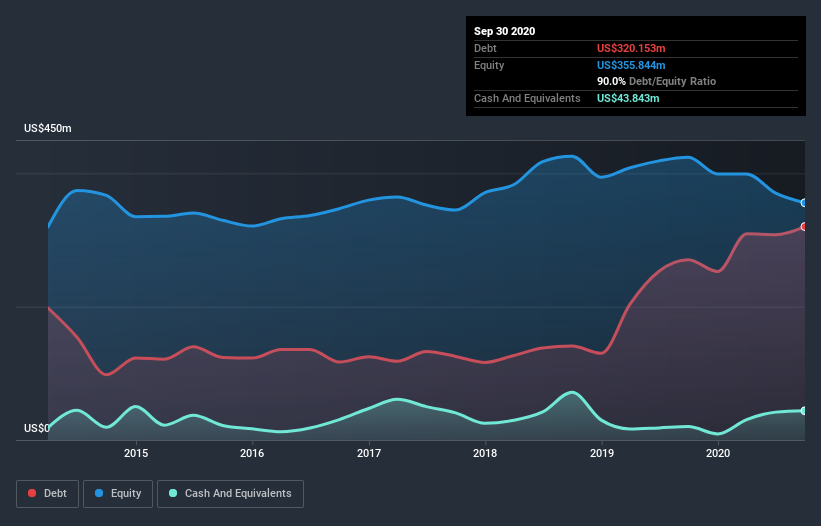

Our data indicates that Blumar had US$484m more in total liabilities than it had cash, when it last reported in September 2020. That puts it in the highest risk category, according to our analysis. So we're surprised to see the stock up 93% per year, over 5 years , but we're happy for holders. Investors must really like its potential. The image below shows how Blumar's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. One thing you can do is check if company insiders are buying shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Blumar's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Blumar's TSR of 164% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We regret to report that Blumar shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 7.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 21% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Blumar is showing 2 warning signs in our investment analysis , you should know about...

Of course Blumar may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

If you’re looking to trade Blumar, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Blumar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:BLUMAR

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives