- Chile

- /

- Construction

- /

- SNSE:SALFACORP

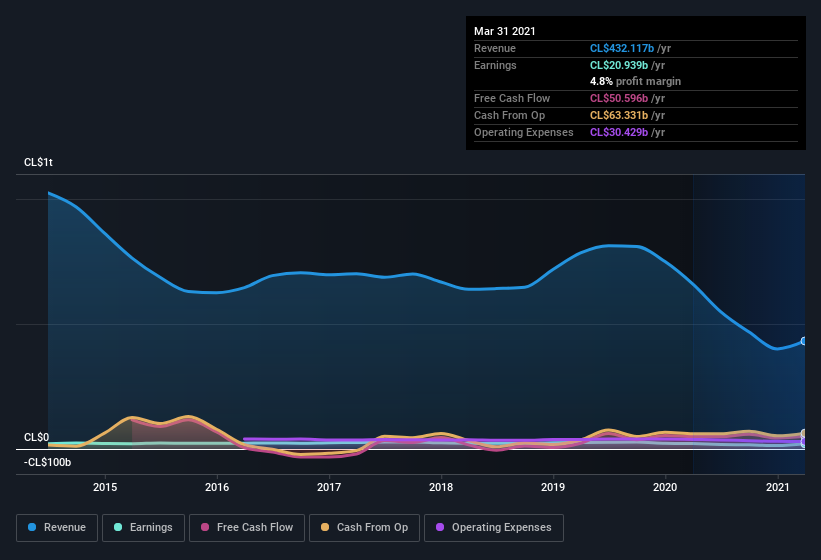

We Think You Can Look Beyond SalfaCorp's (SNSE:SALFACORP) Lackluster Earnings

SalfaCorp S.A.'s (SNSE:SALFACORP) recent weak earnings report didn't cause a big stock movement. We think that investors are worried about some weaknesses underlying the earnings.

See our latest analysis for SalfaCorp

Our Take On SalfaCorp's Profit Performance

Because of this, we think that it may be that SalfaCorp's statutory profits are better than its underlying earnings power. If you'd like to know more about SalfaCorp as a business, it's important to be aware of any risks it's facing. Every company has risks, and we've spotted 5 warning signs for SalfaCorp (of which 2 don't sit too well with us!) you should know about.

Our examination of SalfaCorp has focussed on certain factors that can make its earnings look better than they are. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:SALFACORP

SalfaCorp

Engages in engineering, construction, and real estate businesses in Chile and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026