As European markets grapple with the impact of higher-than-expected U.S. trade tariffs, leading to significant declines in major indices like the STOXX Europe 600 and Germany's DAX, investors are increasingly seeking stability through dividend stocks. In such uncertain times, a strong dividend yield can offer a measure of resilience and income generation amidst market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.52% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.25% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.94% | ★★★★★★ |

| Mapfre (BME:MAP) | 6.15% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.35% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.89% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.67% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.56% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.90% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.76% | ★★★★★★ |

Click here to see the full list of 247 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

HOMAG Group (DB:HG1)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HOMAG Group AG, with a market cap of €467.50 million, manufactures and sells machines and solutions for the woodworking and timber construction industries worldwide.

Operations: HOMAG Group AG generates revenue through its production and sale of machinery and solutions tailored for the global woodworking and timber construction sectors.

Dividend Yield: 3.4%

HOMAG Group's dividend, recently increased to €1.01 per share, remains stable and reliable over the past decade, though its yield of 3.37% is below the German market's top quartile. Despite a reasonable payout ratio of 50.5%, recent earnings have declined sharply from €34.31 million to €12.46 million, raising concerns about future sustainability amidst high share price volatility and insufficient data on cash flow coverage for dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of HOMAG Group.

- Our valuation report unveils the possibility HOMAG Group's shares may be trading at a premium.

Romande Energie Holding (SWX:REHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Romande Energie Holding SA is involved in the production, distribution, and marketing of electrical and thermal energy in Switzerland with a market cap of CHF1.12 billion.

Operations: Romande Energie Holding SA generates revenue from several segments, including Grids (CHF318.28 million), Corporate (CHF59.89 million), Energy Solutions (CHF486.76 million), and Romande Energie Services (CHF157.72 million).

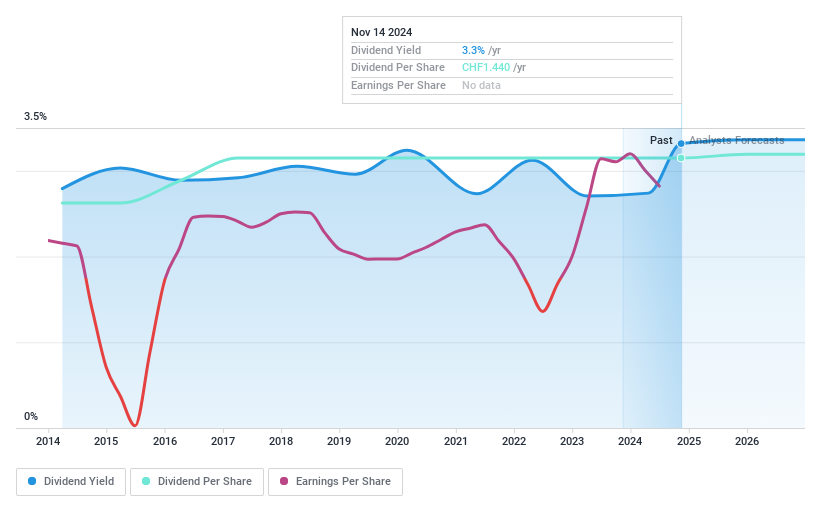

Dividend Yield: 3.3%

Romande Energie Holding's dividend yield of 3.29% is below the top quartile in Switzerland, yet it offers reliability with stable and growing payouts over the past decade. The dividend is well-covered by a low payout ratio of 23.5%, although there's insufficient data on cash flow coverage. Recent announcements confirmed an annual dividend of CHF 1.44 per share payable in May 2025, while leadership changes are underway with François Fellay appointed as future CEO.

- Get an in-depth perspective on Romande Energie Holding's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Romande Energie Holding is trading beyond its estimated value.

Zumtobel Group (WBAG:ZAG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zumtobel Group AG is a global player in the lighting industry with a market cap of €191.61 million.

Operations: Zumtobel Group AG generates its revenue from two main segments: Lighting, contributing €877.94 million, and Components, adding €303.43 million.

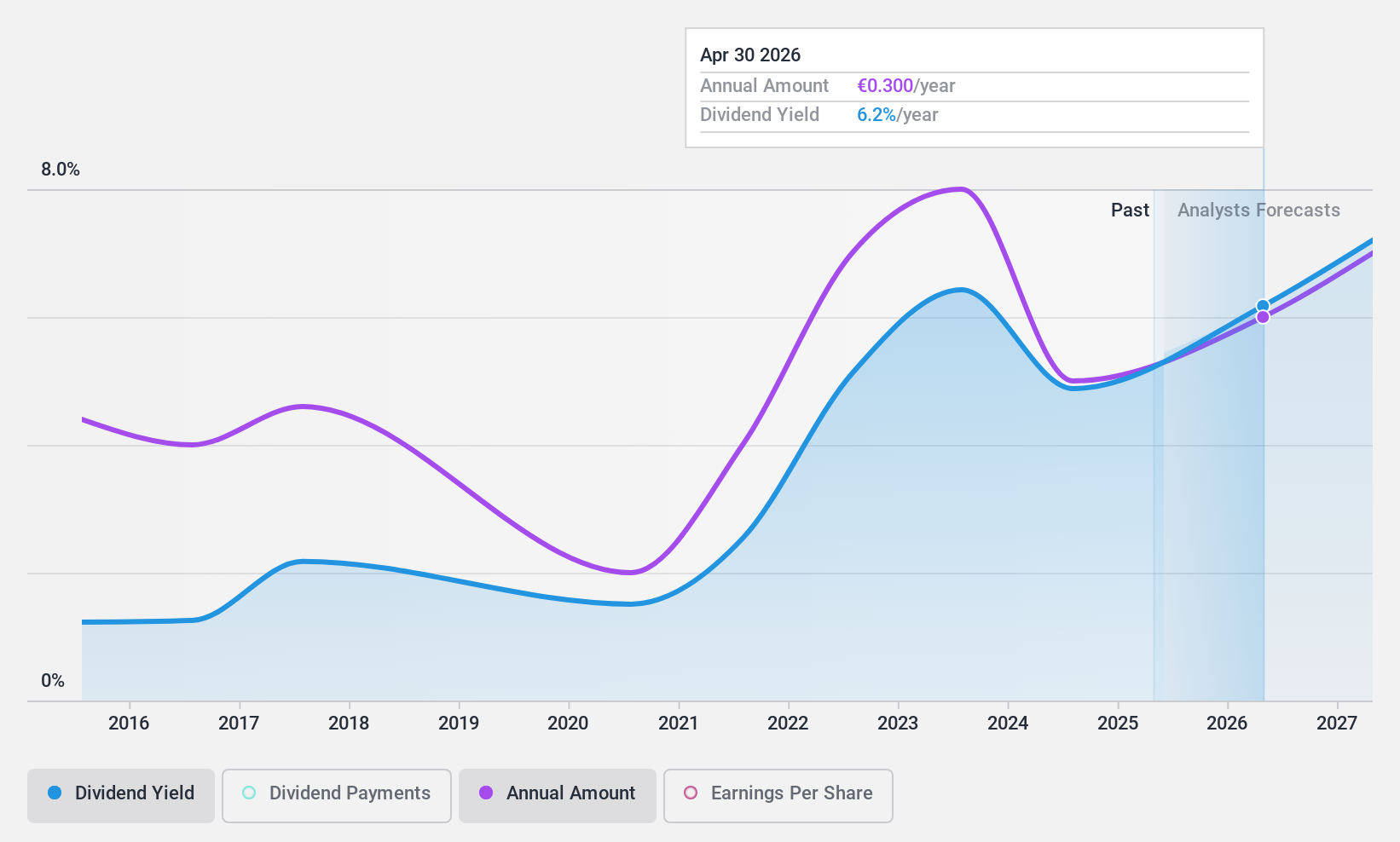

Dividend Yield: 5.6%

Zumtobel Group's dividend yield of 5.56% is slightly below Austria's top quartile, but it's supported by a reasonable payout ratio of 65.7% and strong cash flow coverage at 27.4%. Despite a history of volatility in dividends over the past decade, recent earnings showed challenges with a net loss in Q3 2025 and declining sales to €250.47 million from €265.54 million year-on-year, impacting profitability and future dividend stability prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Zumtobel Group.

- Our expertly prepared valuation report Zumtobel Group implies its share price may be lower than expected.

Turning Ideas Into Actions

- Investigate our full lineup of 247 Top European Dividend Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HOMAG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:HG1

HOMAG Group

Manufactures and sells machines and solutions for wood processing and timber construction industries worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion