As European markets remain steady with the pan-European STOXX Europe 600 Index ending roughly flat, investors are keeping a close eye on U.S. and European trade talks, while key indices like Italy’s FTSE MIB and the UK’s FTSE 100 show modest gains. In this environment, identifying high-growth tech stocks involves looking for companies that can leverage economic stability and trade developments to expand their market presence and drive innovation.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Archos | 24.72% | 39.34% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| innoscripta | 24.76% | 26.32% | ★★★★★★ |

| Bonesupport Holding | 23.98% | 62.26% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Rubean | 45.56% | 108.82% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Northern Data (DB:NB2)

Simply Wall St Growth Rating: ★★★★☆☆

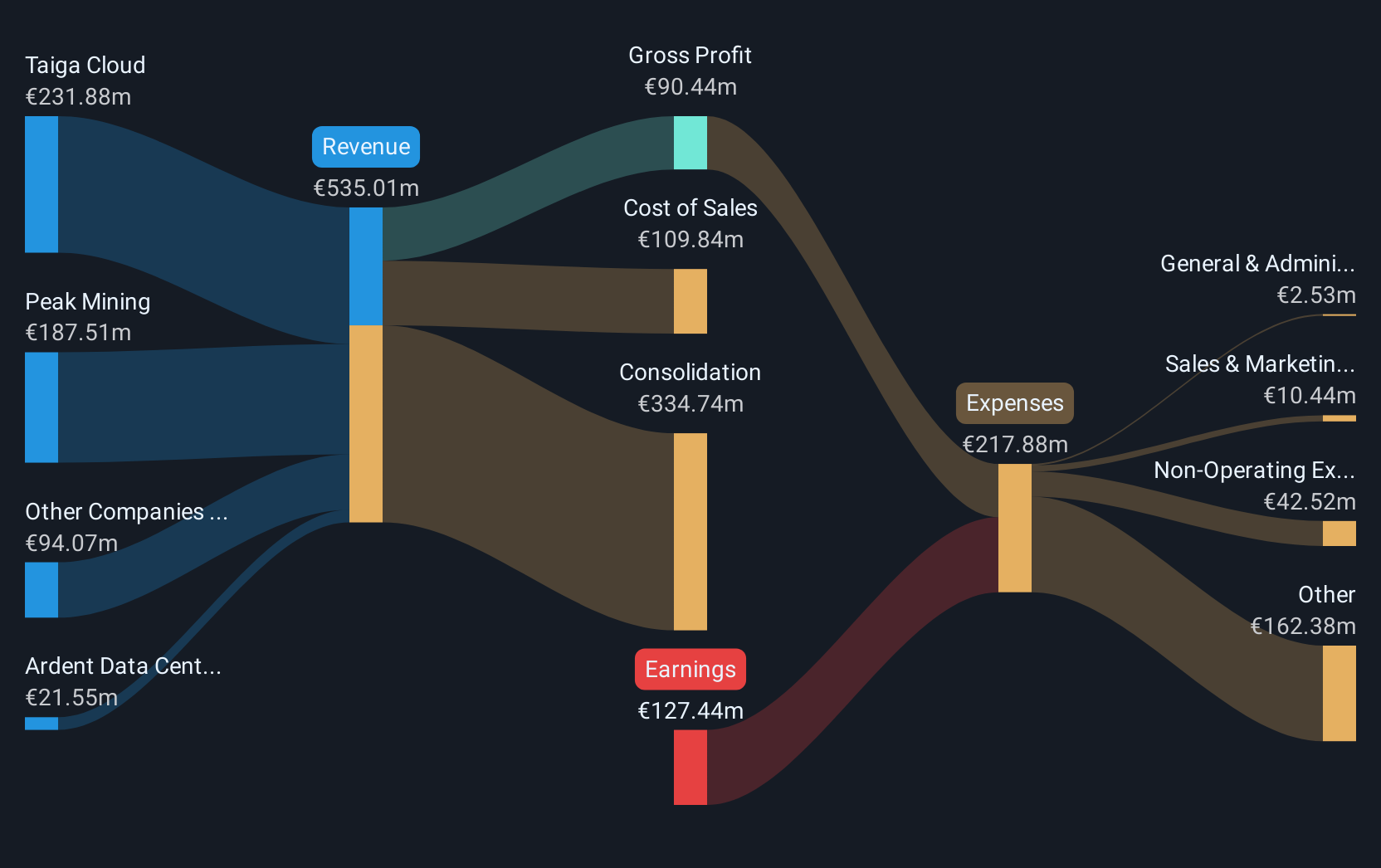

Overview: Northern Data AG focuses on developing and operating high-performance computing and artificial intelligence solutions across Europe and North America, with a market cap of approximately €1.46 billion.

Operations: The company generates revenue primarily through its Taiga Cloud and Peak Mining segments, with Taiga Cloud contributing €231.88 million and Peak Mining adding €187.51 million. Ardent Data Centers also contribute €21.55 million to the revenue stream.

Northern Data AG's strategic expansion into North America with a new AI and HPC data center in Pittsburgh, alongside a pivotal AI Factory partnership with Deloitte in Europe, underscores its commitment to enhancing AI infrastructure capabilities. The company has projected an impressive annual earnings growth of 98.1% and anticipates revenue between EUR 240 million to EUR 320 million for 2025. These developments not only expand Northern Data’s operational footprint but also solidify its role in supporting enterprise-level AI transformations, ensuring it remains at the forefront of technological advancements while navigating the complexities of rapid growth within the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Northern Data.

Assess Northern Data's past performance with our detailed historical performance reports.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Growth Rating: ★★★★☆☆

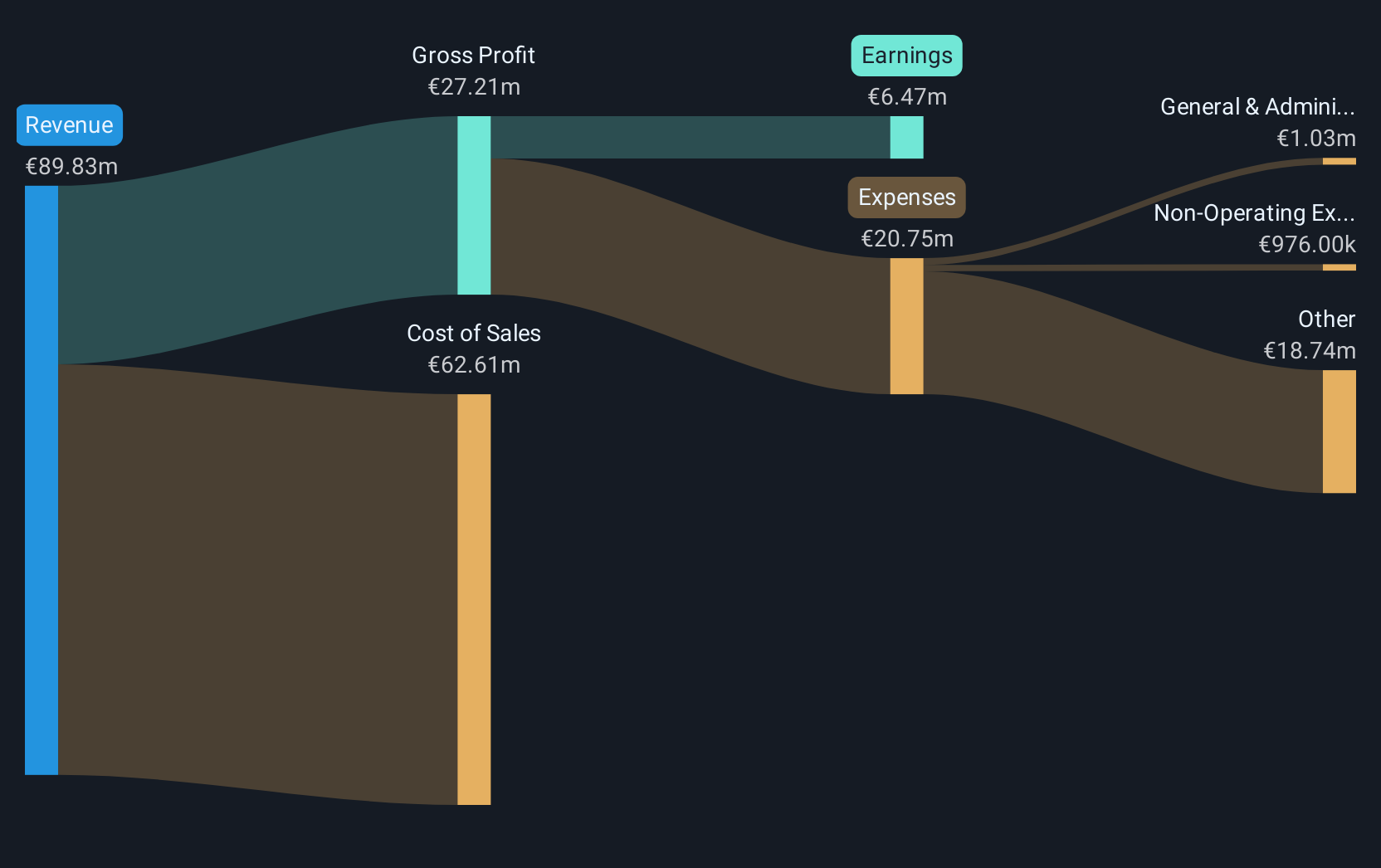

Overview: Bittium Oyj is a company that offers communication and connectivity solutions, healthcare technology products and services, as well as biosignal measuring and monitoring in Finland, Germany, and the United States, with a market capitalization of €375.44 million.

Operations: Bittium Oyj generates revenue primarily from its Defense & Security and Medical segments, contributing €51.60 million and €29.80 million, respectively. The company's Engineering Services add another €14.32 million to its revenue streams.

Bittium Oyj, a Finnish tech firm, has recently made significant strides in high-growth sectors such as tactical communications and satellite connectivity. The company's revenue is expected to grow at 10.2% annually, outpacing the Finnish market's 3.7%. Moreover, Bittium's earnings are forecasted to surge by 24.2% per year, well above the market average of 14.5%. These projections are underpinned by recent strategic collaborations like the EUR 2 million partnership with Terrestar Solutions Inc., aimed at developing a pioneering direct-to-mobile satellite connectivity solution showcased at Mobile World Congress 2025. This venture not only extends mobile services into remote areas but also aligns with Bittium’s R&D focus on enhancing wireless communication technologies—a sector where it reinvests significantly to stay ahead in innovation and efficiency.

- Delve into the full analysis health report here for a deeper understanding of Bittium Oyj.

Understand Bittium Oyj's track record by examining our Past report.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

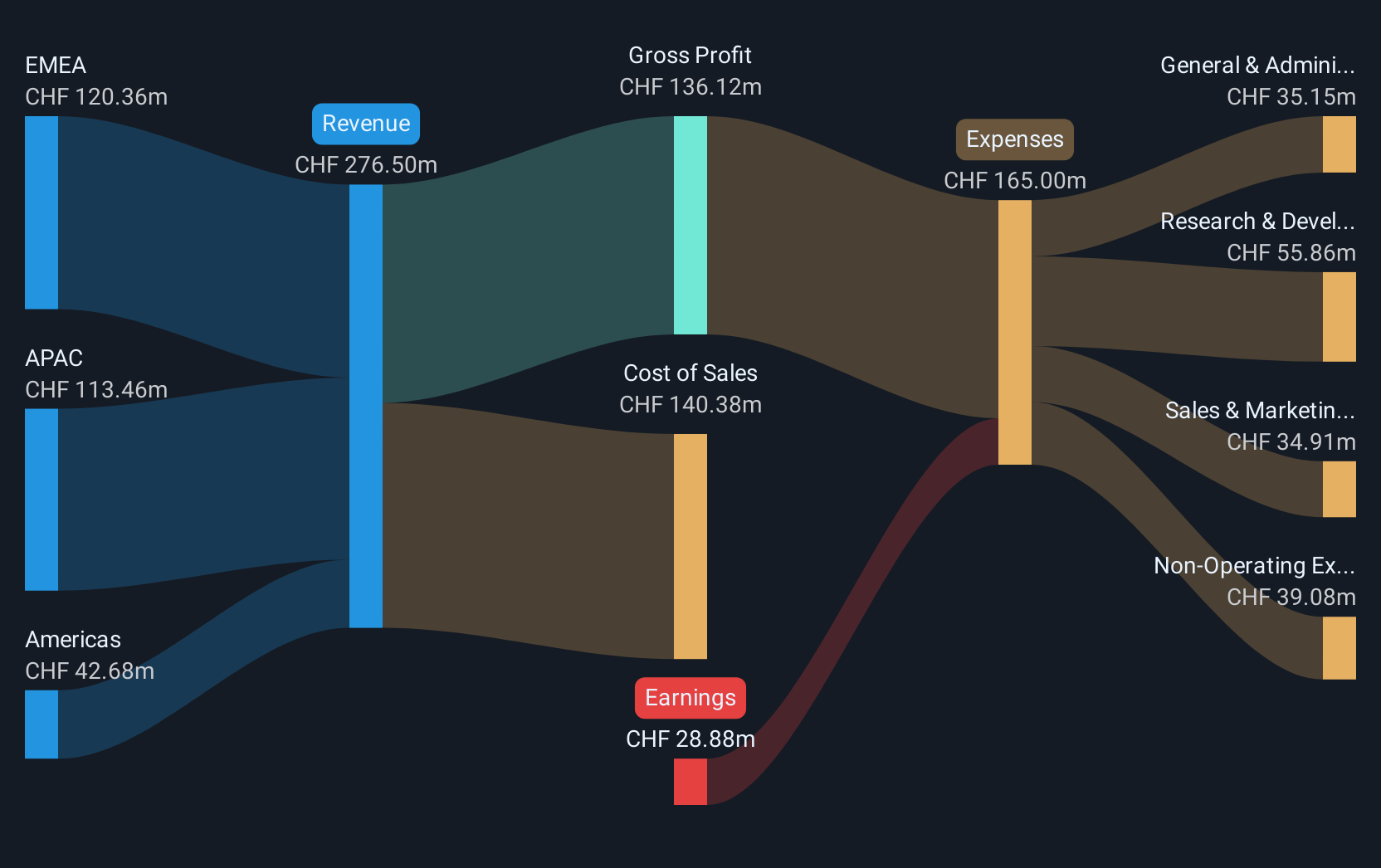

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components across various regions including the Asia Pacific, Europe, the Middle East, Africa, and the Americas with a market capitalization of CHF1.30 billion.

Operations: The company generates revenue primarily from its sensor systems, modules, and components business, amounting to CHF276.50 million.

Sensirion Holding AG, a Swiss tech company, has been making significant strides in sensor technology, evidenced by its recent product launches and strategic partnerships. The company's revenue is projected to grow at 10% annually, outpacing the Swiss market average of 3.9%. Sensirion's journey towards profitability is underscored by an expected annual earnings growth of 70.7%, positioning it well above its industry peers. This financial trajectory is bolstered by recent collaborations like the one with Sintropy.ai, which leverages Sensirion’s sensors for advanced AI-driven automation solutions. These initiatives not only enhance Sensirion's product offerings but also expand its market reach and innovation capabilities in high-demand sectors such as environmental monitoring and data-driven technologies.

- Dive into the specifics of Sensirion Holding here with our thorough health report.

Gain insights into Sensirion Holding's past trends and performance with our Past report.

Seize The Opportunity

- Explore the 231 names from our European High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives