Stock Analysis

- Switzerland

- /

- Medical Equipment

- /

- SWX:STMN

Unveiling High Insider Ownership Growth Companies On SIX Swiss Exchange July 2024

Reviewed by Simply Wall St

Amidst the fluctuations of the Switzerland market, where indices like the SMI have shown a mix of modest gains and losses in a cautious trading environment, investors continue to navigate through uncertain economic signals and interest rate speculations. In such a market scenario, focusing on growth companies with high insider ownership might offer valuable insights into firms that demonstrate confidence from those who know them best.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.1% |

| VAT Group (SWX:VACN) | 10.2% | 23.1% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

| LEM Holding (SWX:LEHN) | 29.9% | 9.4% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.7% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| Sonova Holding (SWX:SOON) | 17.7% | 9% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 80% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Let's dive into some prime choices out of from the screener.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LEM Holding SA operates globally, offering solutions for measuring electrical parameters across various regions including Asia, Europe, the Middle East, Africa, and the Americas, with a market capitalization of approximately CHF 1.62 billion.

Operations: LEM Holding SA generates revenue primarily through two segments: Asia at CHF 201.98 million and Europe/Americas at CHF 203.80 million.

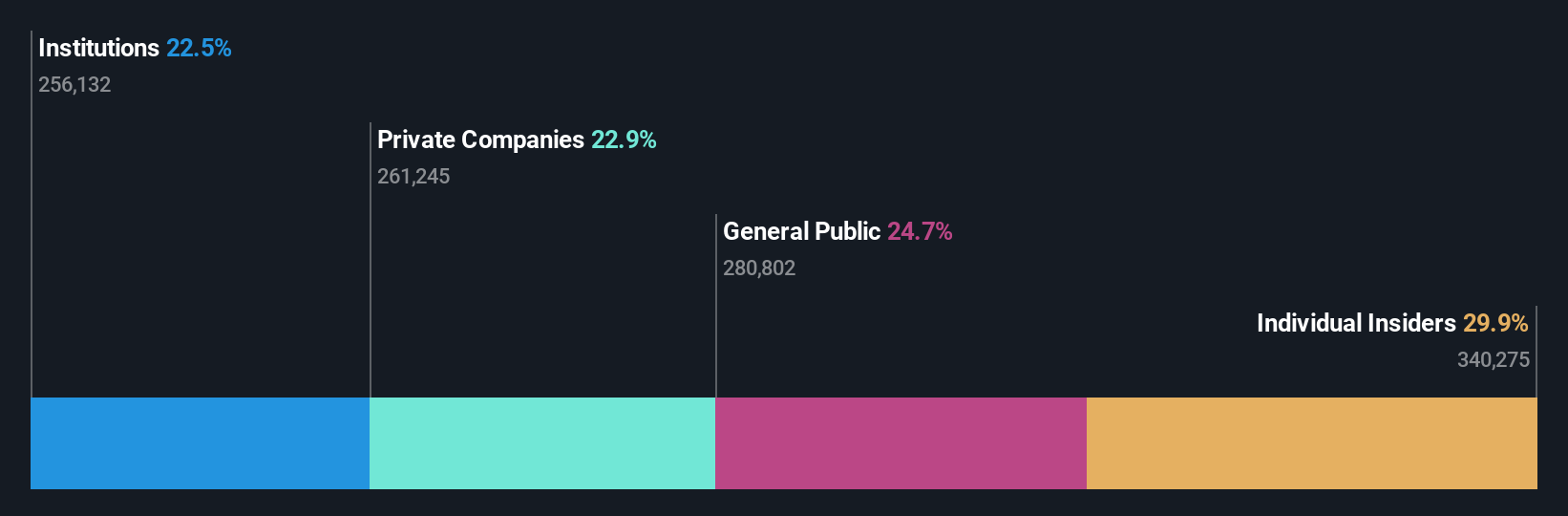

Insider Ownership: 29.9%

LEM Holding SA, a Swiss company with high insider ownership, is trading at 19.4% below its estimated fair value, signaling potential undervaluation. Despite a slight decline in year-over-year sales and net income as of March 2024, the company maintains a robust forecast with earnings expected to grow by 9.42% annually and revenue growth projected to outpace the Swiss market. However, its dividend coverage by free cash flows raises sustainability concerns amidst a highly volatile share price. Analyst consensus suggests a significant upside potential in the stock price.

- Dive into the specifics of LEM Holding here with our thorough growth forecast report.

- The valuation report we've compiled suggests that LEM Holding's current price could be quite moderate.

Stadler Rail (SWX:SRAIL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stadler Rail AG specializes in manufacturing and selling trains across various regions including Switzerland, Germany, Austria, Western and Eastern Europe, the Americas, and the CIS countries, with a market capitalization of approximately CHF 2.64 billion.

Operations: Stadler Rail AG generates revenue primarily through three segments: Rolling Stock, which brought in CHF 3.12 billion, Service & Components with CHF 767.55 million, and Signalling at CHF 102.99 million.

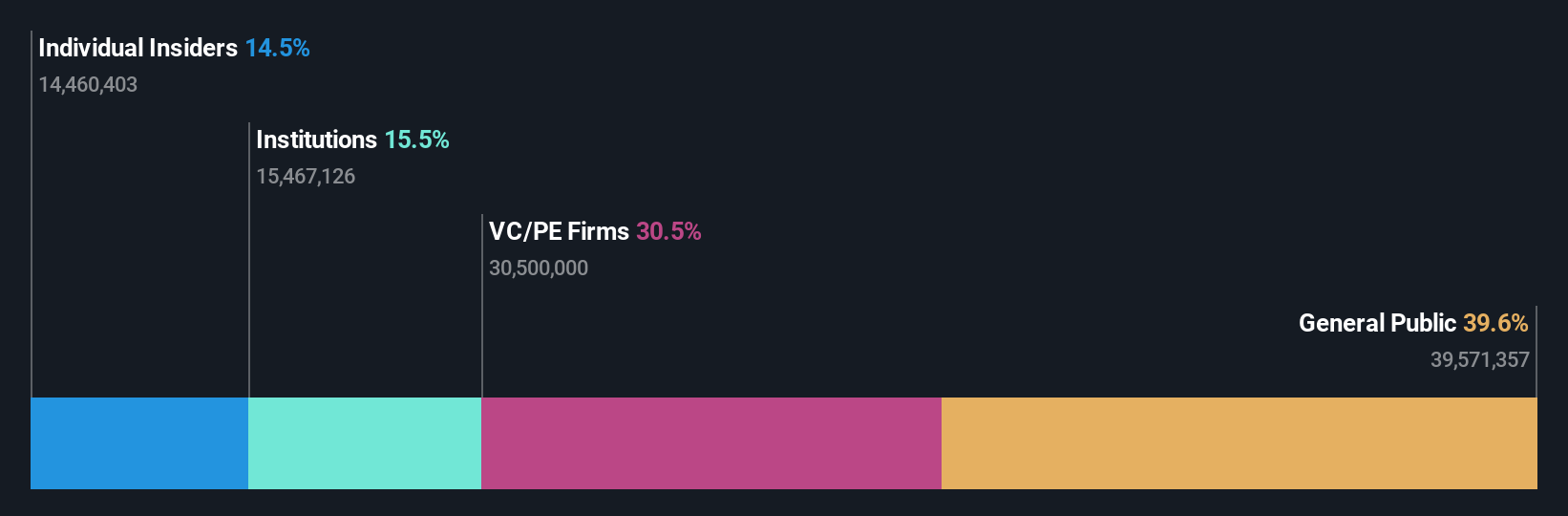

Insider Ownership: 14.5%

Stadler Rail, a Swiss growth company with high insider ownership, shows promising financial forecasts with earnings expected to grow by 23.08% annually, outpacing the Swiss market average of 8.3%. Despite an unstable dividend track record and slower revenue growth projections at 7.7% per year compared to higher industry standards, its price-to-earnings ratio at 21.3x remains slightly below the market average of 21.4x. The company's return on equity is also anticipated to be strong at 23.4% in three years' time.

- Click here and access our complete growth analysis report to understand the dynamics of Stadler Rail.

- The analysis detailed in our Stadler Rail valuation report hints at an inflated share price compared to its estimated value.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Straumann Holding AG specializes in providing tooth replacement and orthodontic solutions globally, with a market capitalization of CHF 18.46 billion.

Operations: Straumann's revenue is derived from various geographic segments, with CHF 1.17 billion from Europe, the Middle East, and Africa (EMEA), CHF 793.05 million from North America (NAM), CHF 451.27 million from Asia Pacific (APAC), and CHF 265.82 million from Latin America (LATAM).

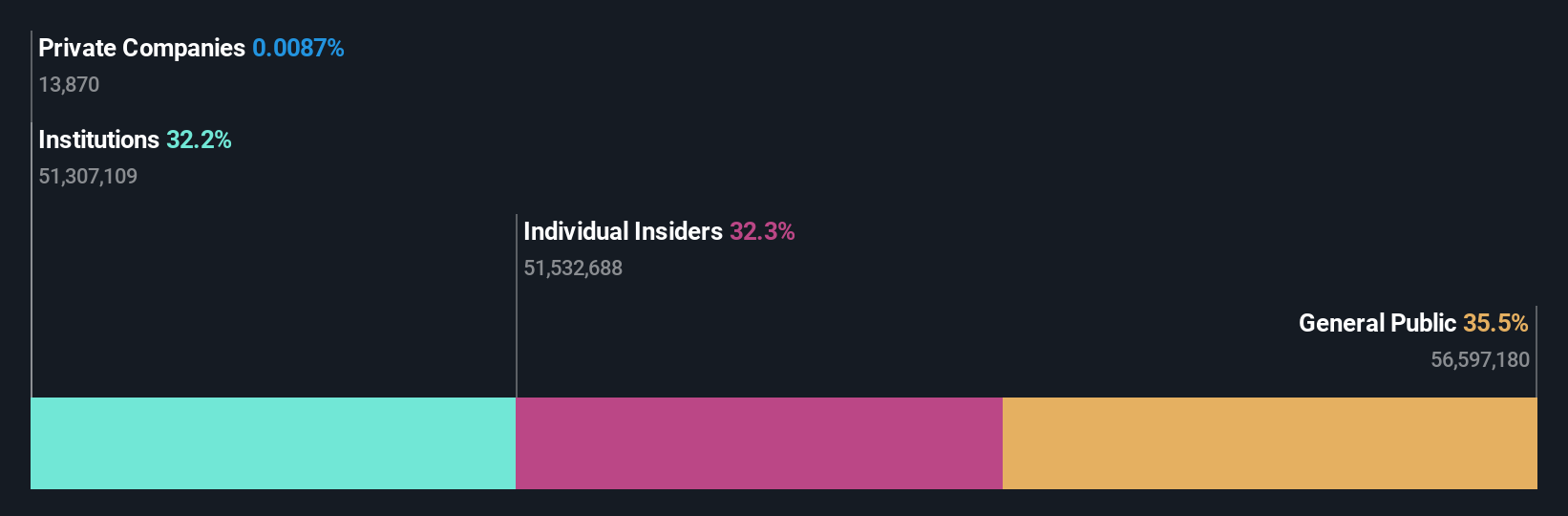

Insider Ownership: 32.7%

Straumann Holding, a growth-oriented Swiss firm with significant insider ownership, is trading at 7.1% below its estimated fair value. Expected to outperform the Swiss market, Straumann's earnings are forecasted to grow by 20.84% annually over the next three years, with a robust projected return on equity of 24%. However, its revenue growth at 9.8% per year is moderate and profit margins have decreased from last year’s 18.7% to this year’s 10.2%. Recent engagements include presentations across major European financial conferences, highlighting its active industry participation and strategic visibility.

- Click to explore a detailed breakdown of our findings in Straumann Holding's earnings growth report.

- Our valuation report here indicates Straumann Holding may be overvalued.

Summing It All Up

- Access the full spectrum of 15 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:STMN

Straumann Holding

Provides tooth replacement and orthodontic solutions worldwide.

Flawless balance sheet with high growth potential.