Stock Analysis

- Switzerland

- /

- Machinery

- /

- SWX:GF

Exploring Hidden Gems: Three Stocks on SIX Swiss Exchange That May Be Trading Below Their Estimated True Value

Reviewed by Simply Wall St

The Swiss market recently faced a downturn, closing moderately lower last Friday amidst a global IT outage that disrupted industries worldwide. This incident highlights the interconnectedness and vulnerabilities within global markets, including Switzerland's SMI which saw a decrease of 0.61%. In such fluctuating market conditions, identifying stocks that may be trading below their true value could offer potential opportunities for discerning investors looking for stability and growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF133.00 | CHF220.59 | 39.7% |

| COLTENE Holding (SWX:CLTN) | CHF45.50 | CHF73.91 | 38.4% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF611.00 | CHF855.38 | 28.6% |

| Swissquote Group Holding (SWX:SQN) | CHF271.20 | CHF359.48 | 24.6% |

| Georg Fischer (SWX:GF) | CHF64.05 | CHF84.86 | 24.5% |

| Julius Bär Gruppe (SWX:BAER) | CHF51.08 | CHF93.64 | 45.5% |

| Sonova Holding (SWX:SOON) | CHF262.50 | CHF467.40 | 43.8% |

| medmix (SWX:MEDX) | CHF12.88 | CHF22.99 | 44% |

| Comet Holding (SWX:COTN) | CHF358.50 | CHF589.58 | 39.2% |

| Medartis Holding (SWX:MED) | CHF69.50 | CHF131.36 | 47.1% |

Underneath we present a selection of stocks filtered out by our screen.

Georg Fischer (SWX:GF)

Overview: Georg Fischer AG operates globally, offering piping systems as well as casting and machining solutions, with a market capitalization of CHF 5.25 billion.

Operations: The company's revenue is primarily derived from its GF Piping Systems at CHF 1.99 billion, followed by GF Casting Solutions and GF Machining Solutions which generated CHF 901 million and CHF 853 million respectively.

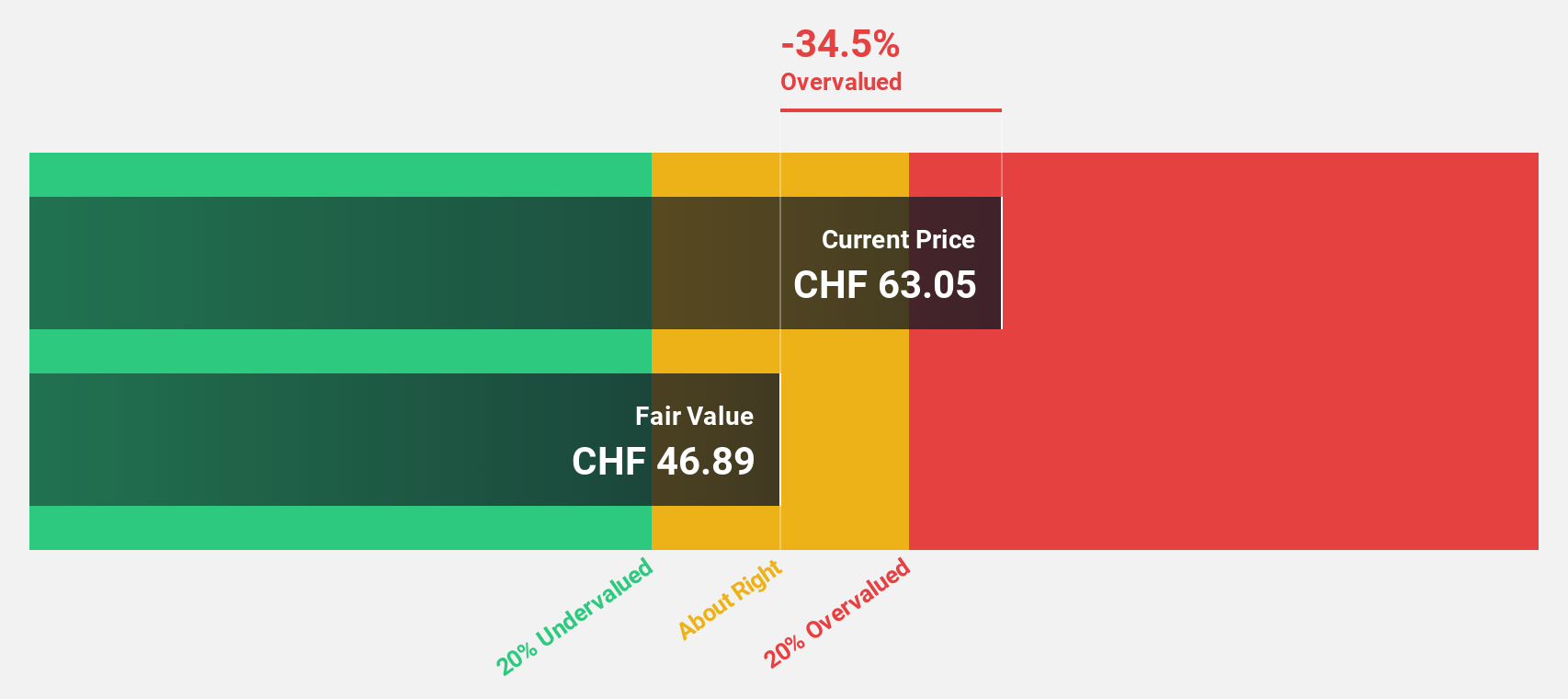

Estimated Discount To Fair Value: 24.5%

Georg Fischer AG, trading at CHF64.05, is perceived as undervalued by 24.5%, with a fair value estimate of CHF84.86 based on discounted cash flow analysis. Despite slower revenue growth at 6.6% annually compared to the broader market's 20%, its earnings are anticipated to surge significantly over the next three years, outpacing the Swiss market's average. However, concerns include a lower net profit margin this year and an unstable dividend track record, coupled with debt not well covered by operating cash flows.

- The growth report we've compiled suggests that Georg Fischer's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Georg Fischer.

Helvetia Holding (SWX:HELN)

Overview: Helvetia Holding AG operates in the life and non-life insurance and reinsurance sectors across Switzerland, Germany, Austria, Spain, Italy, France, and other international markets with a market capitalization of CHF 6.74 billion.

Operations: Helvetia Holding's revenue is primarily derived from its non-life insurance segment, which generated CHF 7.09 billion, and its life insurance segment, contributing CHF 1.81 billion.

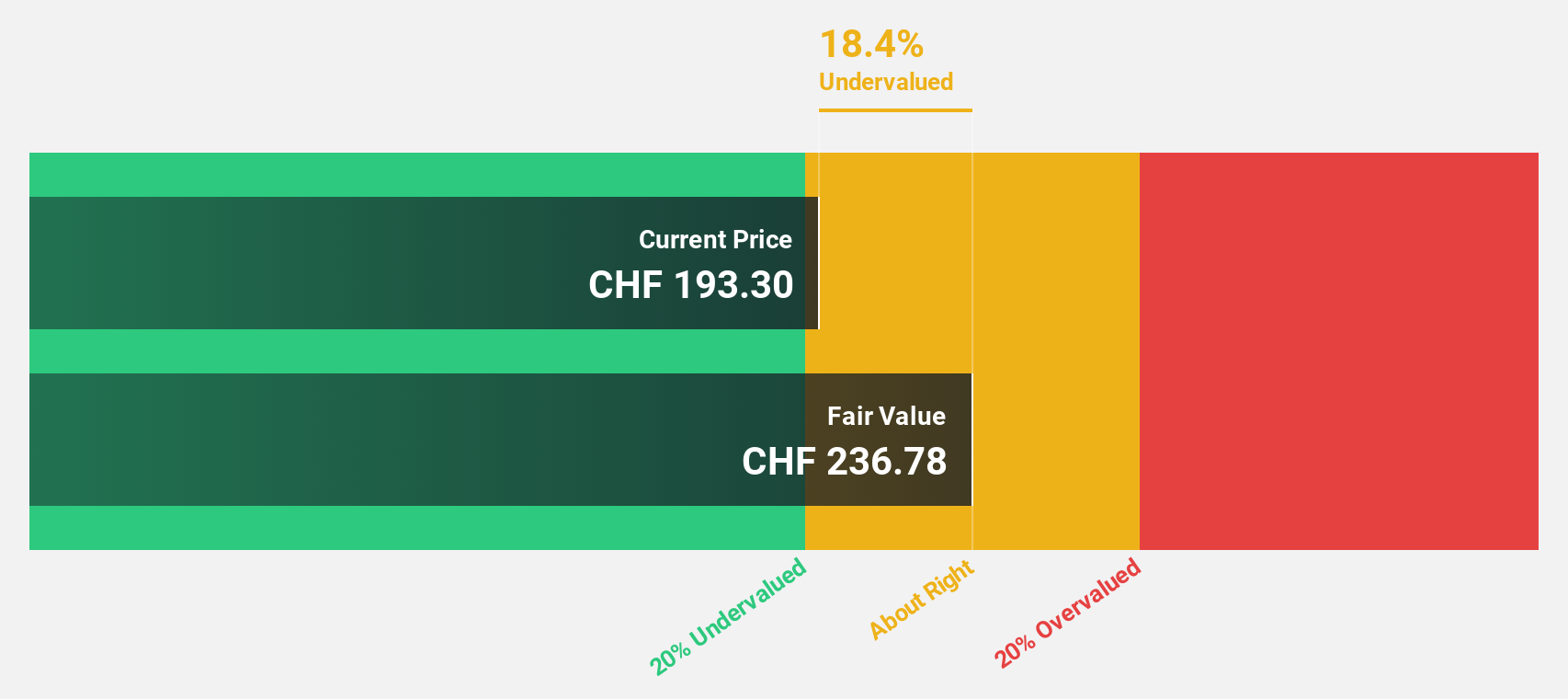

Estimated Discount To Fair Value: 15%

Helvetia Holding, priced at CHF127.5, is considered undervalued with a fair value estimate of CHF149.93. While its revenue growth at 7.2% annually outpaces the Swiss market's 4.8%, its earnings are expected to grow by a very large 22.66% per year, exceeding the market's 8.2%. However, its dividend coverage by earnings is weak and profit margins have declined from last year's 5.1% to this year's 3%.

- Insights from our recent growth report point to a promising forecast for Helvetia Holding's business outlook.

- Dive into the specifics of Helvetia Holding here with our thorough financial health report.

LEM Holding (SWX:LEHN)

Overview: LEM Holding SA operates globally, offering solutions for measuring electrical parameters across various regions including Asia, Europe, and the Americas, with a market capitalization of approximately CHF 1.55 billion.

Operations: The company generates revenue primarily through two segments: Asia (CHF 201.98 million) and Europe/Americas (CHF 203.80 million).

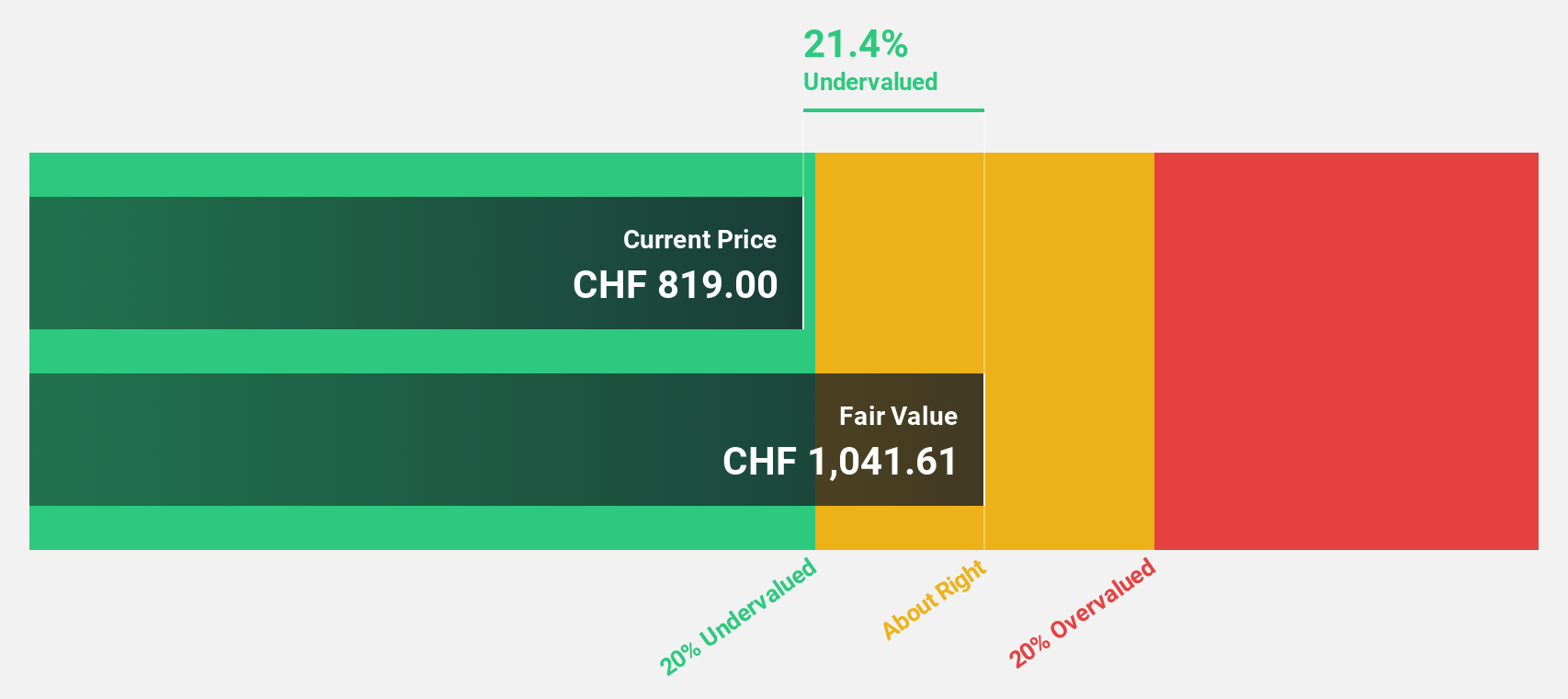

Estimated Discount To Fair Value: 22.8%

LEM Holding SA, trading at CHF1360, is valued below its fair value of CHF1761.59, indicating potential undervaluation based on cash flows. Its revenue growth forecast at 8.2% annually surpasses the Swiss market's 4.8%, and earnings are expected to increase by 9.5% per year, also above the market's 8.2%. However, its dividend coverage is weak due to insufficient free cash flow support and recent financial results showed a decline in net income from CHF75.34 million to CHF65.33 million year-over-year.

- Upon reviewing our latest growth report, LEM Holding's projected financial performance appears quite optimistic.

- Get an in-depth perspective on LEM Holding's balance sheet by reading our health report here.

Taking Advantage

- Navigate through the entire inventory of 17 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GF

Georg Fischer

Engages in the provision of piping systems, and casting and machining solutions in Europe, the Americas, Asia, and internationally.

Good value with reasonable growth potential and pays a dividend.