3 European Growth Stocks With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the European markets experience mixed performances, with the pan-European STOXX Europe 600 Index recently pulling back after reaching fresh highs, investor attention is increasingly turning towards growth companies with high insider ownership. In this environment, stocks that combine robust growth potential and significant insider investment can offer unique insights into confidence levels within a company, making them noteworthy for investors seeking opportunities in a fluctuating market landscape.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 12% | 58.2% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 95.9% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85.9% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.5% |

| CD Projekt (WSE:CDR) | 29.7% | 49.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 51.4% |

Let's explore several standout options from the results in the screener.

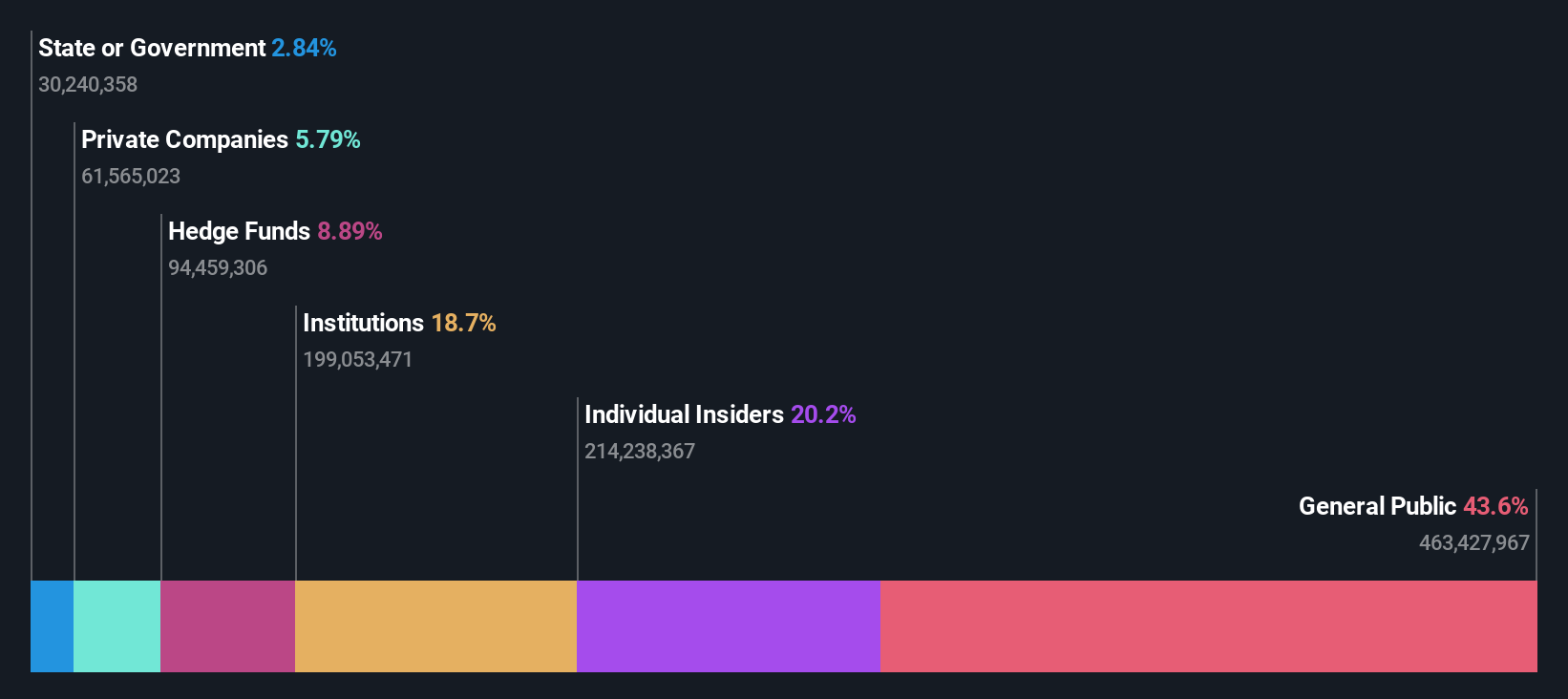

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm focusing on middle market secondaries, infrastructure, credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €15.35 billion.

Operations: The firm's revenue segments include Credit (€197.65 million), Secondaries (€124.38 million), and Private Equity (€951.11 million).

Insider Ownership: 20.2%

CVC Capital Partners, a private equity firm with substantial insider ownership, is navigating a complex landscape of mergers and acquisitions. Despite exiting the La Trobe Financial bid and grappling with Cognita's stake sale challenges, CVC remains active in strategic investments such as considering stakes in Avendus Capital. The firm's earnings are projected to grow at 13.07% annually, surpassing Dutch market averages. Trading below fair value estimates suggests potential upside amidst high debt levels.

- Unlock comprehensive insights into our analysis of CVC Capital Partners stock in this growth report.

- Upon reviewing our latest valuation report, CVC Capital Partners' share price might be too pessimistic.

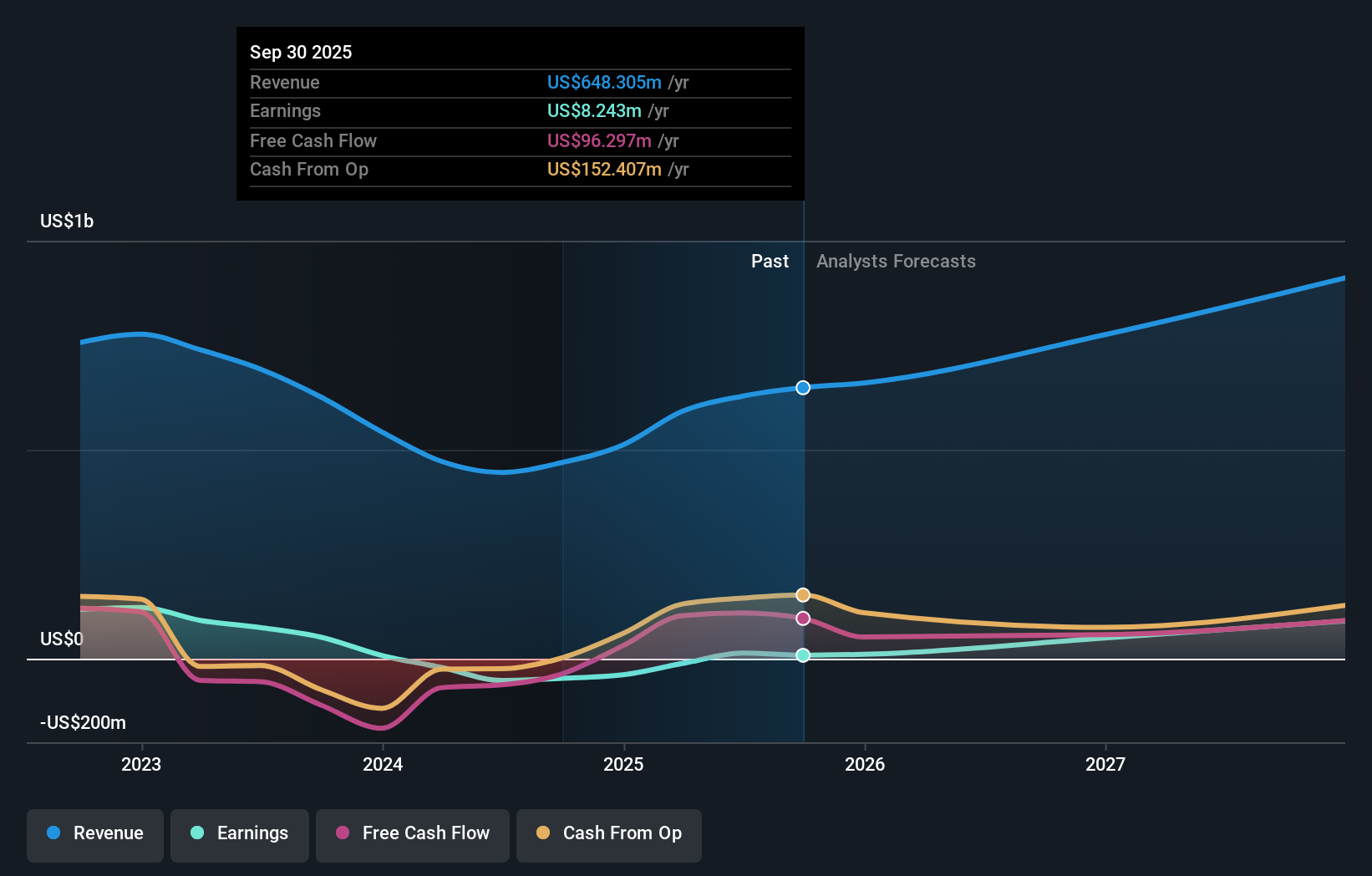

Nordic Semiconductor (OB:NOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordic Semiconductor ASA is a fabless semiconductor company that develops and sells integrated circuits for short- and long-range wireless applications across Europe, the Americas, and the Asia Pacific, with a market cap of NOK28.16 billion.

Operations: The company's revenue segment is primarily from the design and sale of integrated circuits and related solutions, totaling $648.30 million.

Insider Ownership: 10.4%

Nordic Semiconductor is experiencing significant earnings growth, projected at over 51% annually, outpacing the Norwegian market. Despite a modest revenue growth forecast of 12.8%, it remains above the national average. Recent financials show improved profitability with net income reaching US$12.14 million for nine months ending September 2025, reversing previous losses. However, low return on equity and a recent follow-on equity offering of NOK 1.05 billion may signal capital structure adjustments amidst its expansion efforts.

- Click here to discover the nuances of Nordic Semiconductor with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Nordic Semiconductor is priced higher than what may be justified by its financials.

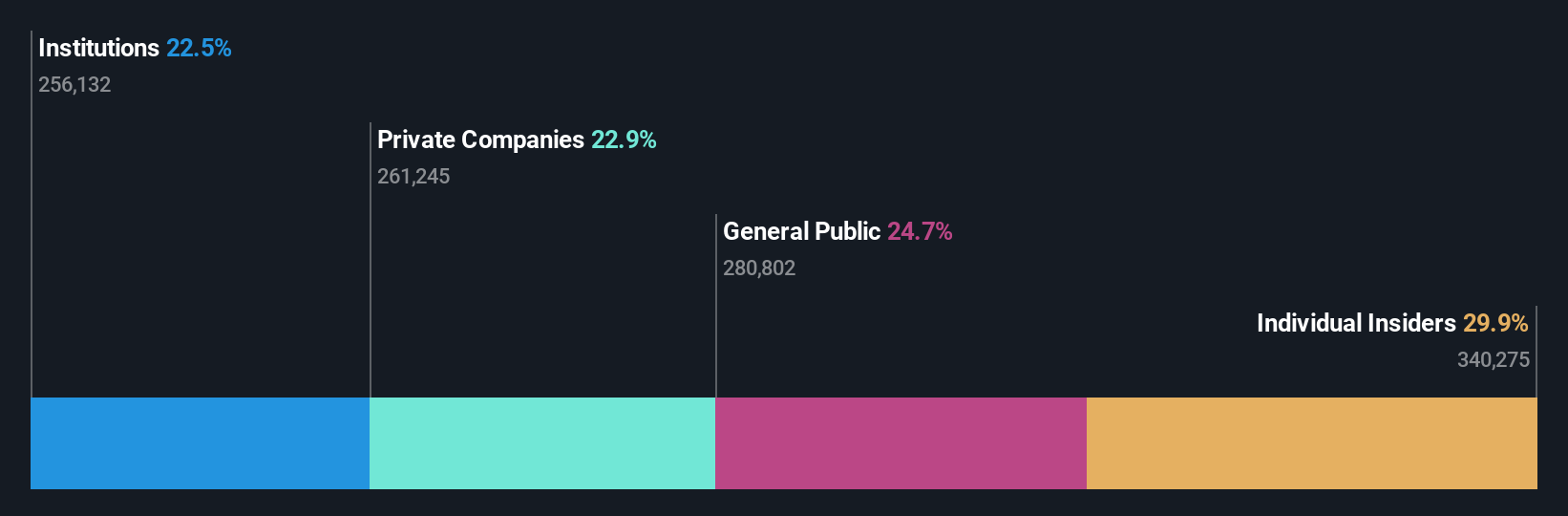

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LEM Holding SA, with a market cap of CHF494.66 million, operates globally through its subsidiaries to offer solutions for measuring electrical parameters across regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Operations: LEM Holding's revenue primarily stems from its global operations, where it delivers solutions for electrical parameter measurement across diverse regions such as China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Insider Ownership: 29.9%

LEM Holding is projected to achieve significant earnings growth at 50.74% annually, surpassing the Swiss market's average. Despite this, its revenue growth forecast of 9.3% per year lags behind its earnings trajectory. The company's return on equity is expected to reach a robust 23%, though profit margins have decreased from last year. Trading significantly below estimated fair value suggests potential upside, but high debt levels and recent share price volatility may pose risks for investors seeking stability.

- Take a closer look at LEM Holding's potential here in our earnings growth report.

- Upon reviewing our latest valuation report, LEM Holding's share price might be too optimistic.

Key Takeaways

- Click this link to deep-dive into the 191 companies within our Fast Growing European Companies With High Insider Ownership screener.

- Contemplating Other Strategies? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:LEHN

LEM Holding

Provides solutions for measuring electrical parameters in China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives