Reflecting on Landis+Gyr Group's (VTX:LAND) Share Price Returns Over The Last Year

Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. Unfortunately the Landis+Gyr Group AG (VTX:LAND) share price slid 31% over twelve months. That falls noticeably short of the market decline of around 1.6%. At least the damage isn't so bad if you look at the last three years, since the stock is down 17% in that time. More recently, the share price has dropped a further 19% in a month.

Check out our latest analysis for Landis+Gyr Group

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

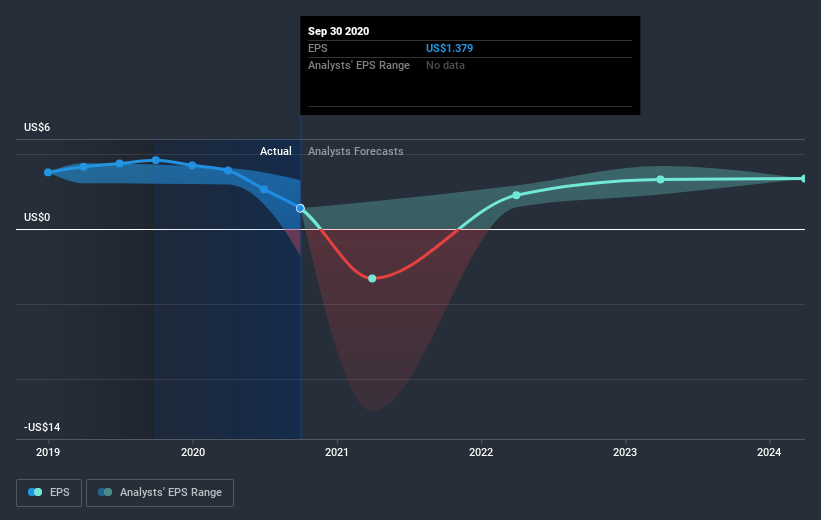

Unfortunately Landis+Gyr Group reported an EPS drop of 70% for the last year. The share price fall of 31% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. Indeed, with a P/E ratio of 49.09 there is obviously some real optimism that earnings will bounce back.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Landis+Gyr Group has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Landis+Gyr Group, it has a TSR of -29% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Landis+Gyr Group shareholders are down 29% for the year, (even including dividends), but the broader market is up 1.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 2.6% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand Landis+Gyr Group better, we need to consider many other factors. To that end, you should be aware of the 4 warning signs we've spotted with Landis+Gyr Group .

Of course Landis+Gyr Group may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

If you’re looking to trade Landis+Gyr Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:LAND

Landis+Gyr Group

Provides integrated energy management solutions to utility sector in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives