Stock Analysis

- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

SIX Swiss Exchange Growth Leaders With High Insider Ownership May 2024

Reviewed by Simply Wall St

The Switzerland market recently experienced a downturn, ending a prolonged period of gains as investors displayed caution in anticipation of upcoming economic data from Europe and the U.S. The benchmark SMI index reflected this cautious sentiment, closing lower by 0.3%. In such a market environment, stocks with high insider ownership can be particularly noteworthy, as they often indicate strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 23.4% |

| VAT Group (SWX:VACN) | 10.2% | 21.2% |

| Straumann Holding (SWX:STMN) | 32.7% | 21% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 14.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.7% |

| LEM Holding (SWX:LEHN) | 34.5% | 9.9% |

| Sonova Holding (SWX:SOON) | 17.7% | 10.4% |

| Sensirion Holding (SWX:SENS) | 20.7% | 84.7% |

| Arbonia (SWX:ARBN) | 28.8% | 80% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

Here's a peek at a few of the choices from the screener.

INFICON Holding (SWX:IFCN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: INFICON Holding AG specializes in developing instruments for gas analysis, measurement, and control, operating both in Switzerland and internationally, with a market capitalization of approximately CHF 3.48 billion.

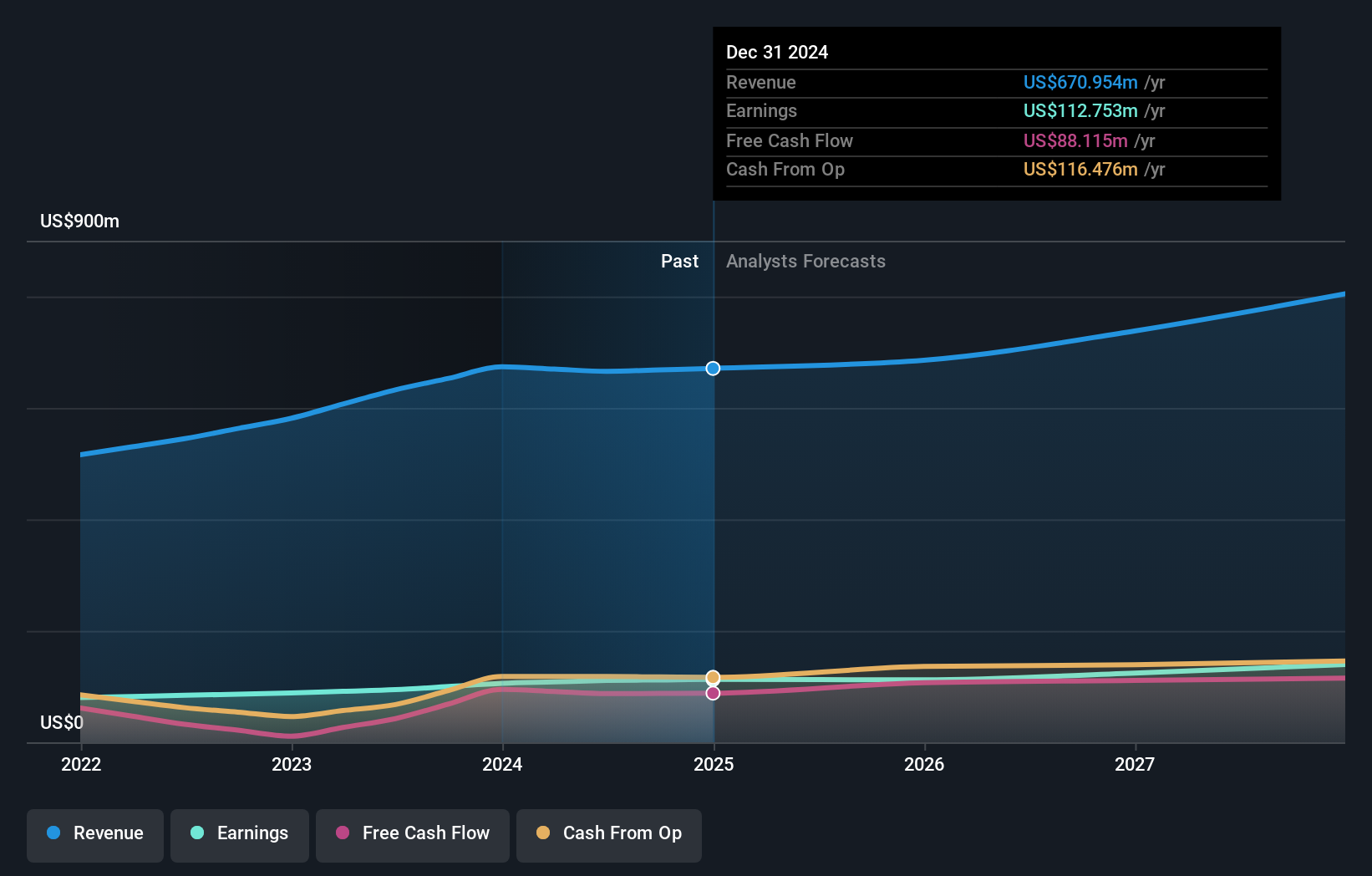

Operations: The company generates revenue primarily through its global supply of instrumentation for gas analysis, measurement, and control, totaling $673.71 million.

Insider Ownership: 10.3%

Return On Equity Forecast: 28% (2026 estimate)

INFICON Holding AG, demonstrating solid financial performance, reported a significant increase in annual sales to US$673.71 million and net income to US$105.68 million for 2023. Despite this growth, its projected revenue and earnings growth rates of 7.2% and 9.9% respectively are modest compared to more aggressive market benchmarks. Notably, the company's return on equity is expected to be robust at 27.6% in three years, highlighting efficient management despite a lack of substantial insider trading activity recently.

- Delve into the full analysis future growth report here for a deeper understanding of INFICON Holding.

- According our valuation report, there's an indication that INFICON Holding's share price might be on the expensive side.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

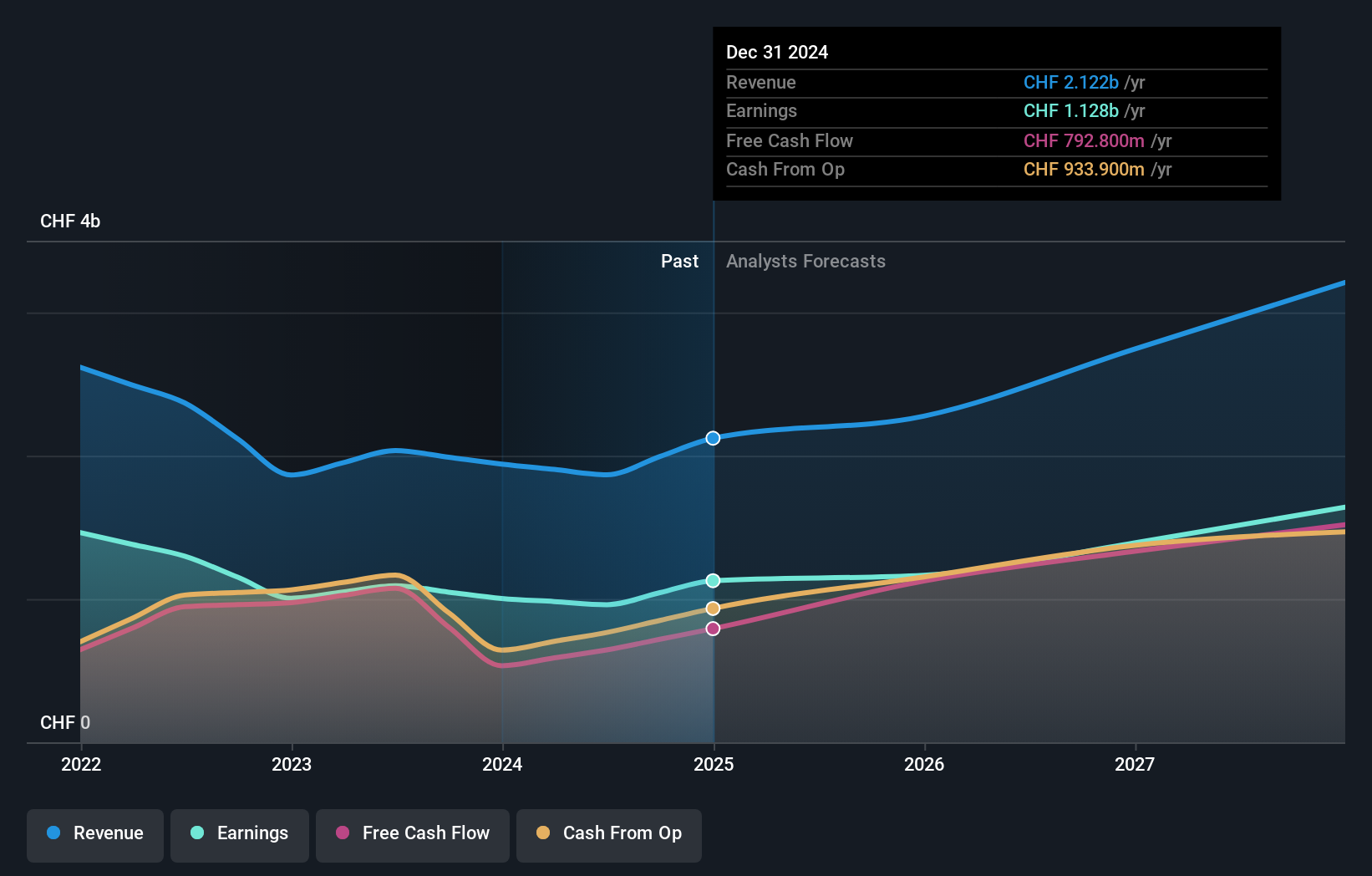

Overview: Partners Group Holding AG is a global private equity firm that manages investments across multiple asset classes including private equity, real estate, infrastructure, and debt, with a market capitalization of approximately CHF 32.83 billion.

Operations: The company generates revenue from various segments, with private equity leading at CHF 1.17 billion, followed by infrastructure at CHF 379.20 million, private credit at CHF 211.30 million, and real estate at CHF 186.90 million.

Insider Ownership: 17.1%

Return On Equity Forecast: 50% (2026 estimate)

Partners Group Holding, amidst active M&A discussions, is considering the sale of key assets like Formosa Solar and VSB Holding GmbH, potentially fetching significant sums. While its full-year earnings slightly dipped to CHF 1.003 billion from CHF 1.005 billion previously, it maintains a robust forecast with revenue and earnings growth outpacing the Swiss market at 13.7% and 13.6% respectively per year. Despite high debt levels, its projected return on equity remains very high at 50.3%.

- Dive into the specifics of Partners Group Holding here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Partners Group Holding is priced higher than what may be justified by its financials.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VAT Group AG specializes in developing, manufacturing, and supplying vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows globally, with a market capitalization of CHF 14.06 billion.

Operations: VAT Group's revenue is primarily derived from its Valves segment, generating CHF 782.74 million, and its Global Service segment, contributing CHF 172.87 million.

Insider Ownership: 10.2%

Return On Equity Forecast: 39% (2026 estimate)

VAT Group, a Swiss company with high insider ownership, recently reported a decline in annual sales to CHF 885.32 million and net income to CHF 190.31 million. Despite this, earnings are expected to grow by 21.17% annually, outpacing the broader Swiss market forecast of 8.1%. The company's revenue growth is also projected to exceed the market average at a rate of 15.5% per year. VAT Group has faced significant share price volatility over the past three months but maintains a strong forecast return on equity of 39.1%.

- Click here to discover the nuances of VAT Group with our detailed analytical future growth report.

- Our valuation report here indicates VAT Group may be overvalued.

Summing It All Up

- Navigate through the entire inventory of 17 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Partners Group Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Reasonable growth potential with adequate balance sheet.