- Switzerland

- /

- Semiconductors

- /

- SWX:WIHN

WISeKey International Holding (VTX:WIHN) swells 20% this week, taking one-year gains to 396%

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When an investor finds a multi-bagger (a stock that goes up over 200%), it makes a big difference to their portfolio. In the case of WISeKey International Holding AG (VTX:WIHN), the share price is up an incredible 396% in the last year alone. On top of that, the share price is up 87% in about a quarter. And shareholders have also done well over the long term, with an increase of 136% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Because WISeKey International Holding made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year WISeKey International Holding saw its revenue shrink by 43%. So it's very confusing to see that the share price gained a whopping 396%. There can be no doubt this kind of decoupling of revenue growth and share price growth is unusual to see in loss making companies. While this gain looks like speculative buying to us, sometimes speculation pays off.

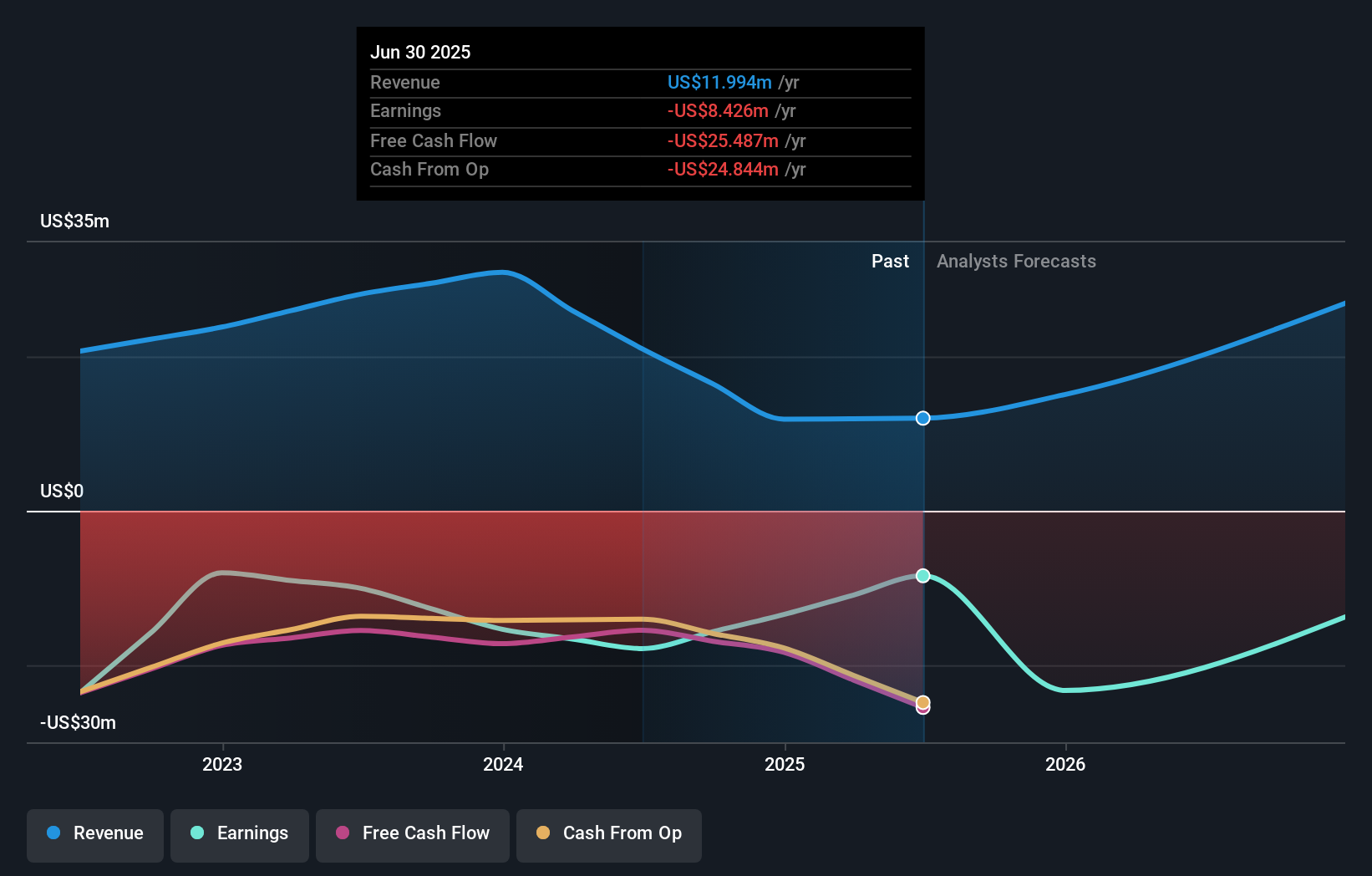

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that WISeKey International Holding shareholders have received a total shareholder return of 396% over the last year. Notably the five-year annualised TSR loss of 7% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 5 warning signs we've spotted with WISeKey International Holding (including 2 which are concerning) .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

Valuation is complex, but we're here to simplify it.

Discover if WISeKey International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:WIHN

WISeKey International Holding

A cybersecurity company, provides integrated security solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives