- Switzerland

- /

- Semiconductors

- /

- SWX:WIHN

Could WISeKey International Holding (SWX:WIHN) Expand Its Competitive Moat With Quantum-Resistant Satellite Collaboration?

Reviewed by Sasha Jovanovic

- WISeSat.Space, a subsidiary of WISeKey International Holding, recently signed a Memorandum of Understanding with South Korea's INNOSPACE to collaborate on deploying next-generation, quantum-resistant satellites using the HANBIT-SERIES launch vehicles.

- This partnership expands WISeSat.Space's global reach by leveraging South Korea’s growing space sector and supports secure Internet of Things and cybersecurity applications through diversified launch options.

- We'll explore how leveraging INNOSPACE’s launch capabilities could reshape WISeKey’s investment narrative and adoption of quantum-resistant satellite technology.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is WISeKey International Holding's Investment Narrative?

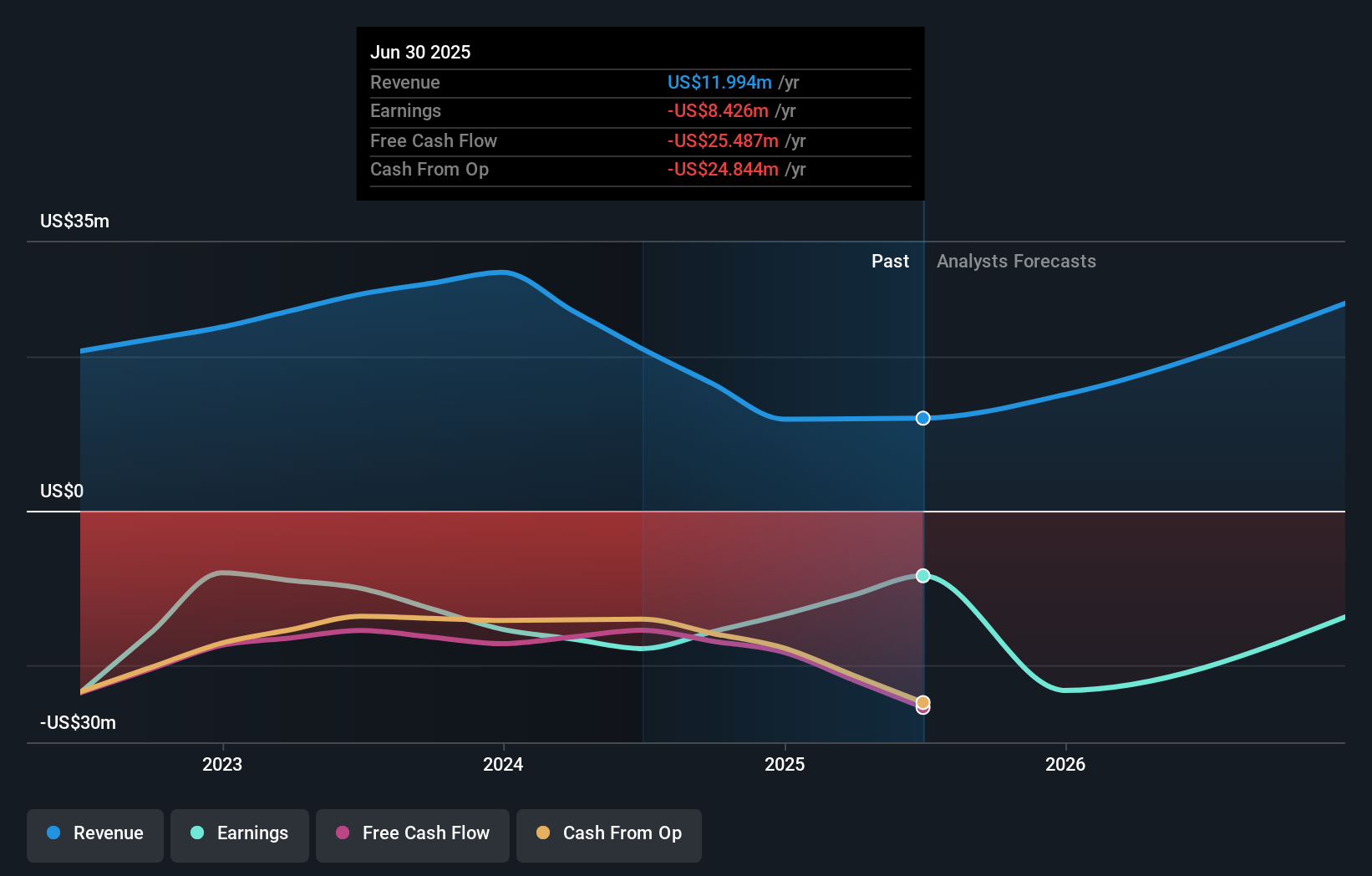

For anyone watching WISeKey International Holding, the big question often comes down to whether its bold innovations can translate into sustained growth, given its continued unprofitability and volatile share price history. The new partnership between WISeSat.Space and INNOSPACE comes at a critical time, as management has set ambitious revenue targets anchored in new quantum-resistant technologies and strategic alliances. Before this deal, short term catalysts revolved around rolling out PQC chips, expanding IoT networks, and booking revenue from recent acquisitions, but the INNOSPACE collaboration could shift expectations if it accelerates secure satellite deployment and opens commercial channels in Asia. However, rapid revenue growth estimates, ongoing losses and dilution risks still loom large, and with shares now far above earlier levels, much of the excitement over future growth could already be reflected in the price. That makes the real near-term catalyst the successful execution of these launches, with the risk that any delays or missed targets could quickly reset market expectations.

But with the spotlight on record returns, potential dilution remains a risk investors should not overlook.

Exploring Other Perspectives

Explore 2 other fair value estimates on WISeKey International Holding - why the stock might be worth less than half the current price!

Build Your Own WISeKey International Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WISeKey International Holding research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free WISeKey International Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WISeKey International Holding's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WISeKey International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:WIHN

WISeKey International Holding

A cybersecurity company, provides integrated security solutions in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion