- Switzerland

- /

- Life Sciences

- /

- SWX:TECN

Why We Think Shareholders May Be Considering Bumping Up Tecan Group AG's (VTX:TECN) CEO Compensation

Key Insights

- Tecan Group will host its Annual General Meeting on 18th of April

- Salary of CHF660.0k is part of CEO Achim von Leoprechting's total remuneration

- Total compensation is 33% below industry average

- Over the past three years, Tecan Group's EPS grew by 15% and over the past three years, the total shareholder return was 33%

Shareholders will be pleased by the impressive results for Tecan Group AG (VTX:TECN) recently and CEO Achim von Leoprechting has played a key role. This would be kept in mind at the upcoming AGM on 18th of April which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

See our latest analysis for Tecan Group

Comparing Tecan Group AG's CEO Compensation With The Industry

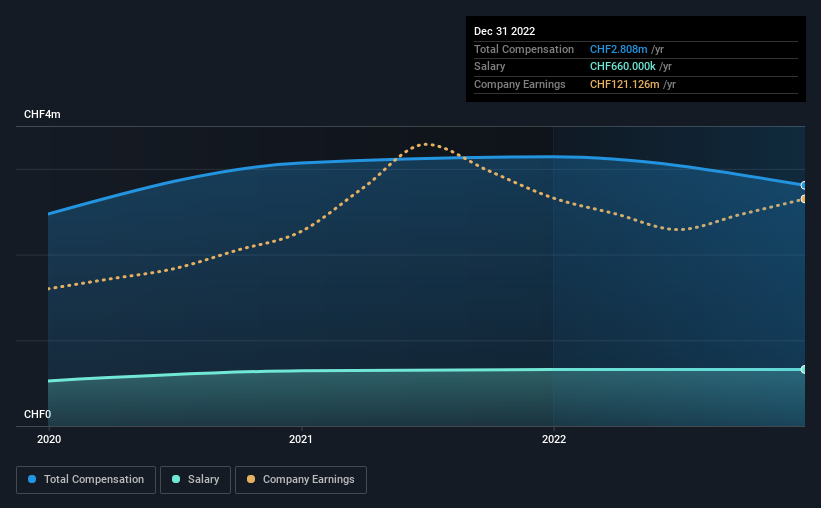

At the time of writing, our data shows that Tecan Group AG has a market capitalization of CHF5.0b, and reported total annual CEO compensation of CHF2.8m for the year to December 2022. That's a notable decrease of 11% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at CHF660k.

On examining similar-sized companies in the Swiss Life Sciences industry with market capitalizations between CHF3.6b and CHF11b, we discovered that the median CEO total compensation of that group was CHF4.2m. Accordingly, Tecan Group pays its CEO under the industry median. Moreover, Achim von Leoprechting also holds CHF1.9m worth of Tecan Group stock directly under their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CHF660k | CHF660k | 24% |

| Other | CHF2.1m | CHF2.5m | 76% |

| Total Compensation | CHF2.8m | CHF3.1m | 100% |

On an industry level, around 25% of total compensation represents salary and 75% is other remuneration. Although there is a difference in how total compensation is set, Tecan Group more or less reflects the market in terms of setting the salary. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Tecan Group AG's Growth Numbers

Over the past three years, Tecan Group AG has seen its earnings per share (EPS) grow by 15% per year. Its revenue is up 21% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's a real positive to see this sort of revenue growth in a single year. That suggests a healthy and growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Tecan Group AG Been A Good Investment?

We think that the total shareholder return of 33%, over three years, would leave most Tecan Group AG shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Tecan Group.

Important note: Tecan Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Tecan Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:TECN

Tecan Group

Provides laboratory instruments and solutions in biopharmaceuticals, forensics, and clinical diagnostics in Europe, North America, Asia, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives