Top 3 Stocks Estimated To Be Undervalued On SIX Swiss Exchange In August 2024

Reviewed by Simply Wall St

The Switzerland market ended on a dismal note on Friday with stocks falling lower and lower as the session progressed amid fears the U.S. could fall into a recession. Investors digested Swiss consumer price inflation data, and a slew of quarterly earnings updates, leading to significant losses in the benchmark SMI index. In such volatile conditions, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities. Here are three stocks estimated to be undervalued on the SIX Swiss Exchange in August 2024.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1206.00 | CHF1766.77 | 31.7% |

| Georg Fischer (SWX:GF) | CHF62.60 | CHF112.36 | 44.3% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF586.00 | CHF965.76 | 39.3% |

| Clariant (SWX:CLN) | CHF12.75 | CHF21.71 | 41.3% |

| Swissquote Group Holding (SWX:SQN) | CHF263.60 | CHF405.79 | 35% |

| Temenos (SWX:TEMN) | CHF56.15 | CHF79.85 | 29.7% |

| SGS (SWX:SGSN) | CHF93.28 | CHF144.51 | 35.5% |

| VAT Group (SWX:VACN) | CHF388.40 | CHF558.05 | 30.4% |

| ARYZTA (SWX:ARYN) | CHF1.641 | CHF3.08 | 46.7% |

| Montana Aerospace (SWX:AERO) | CHF18.60 | CHF25.27 | 26.4% |

Let's take a closer look at a couple of our picks from the screened companies.

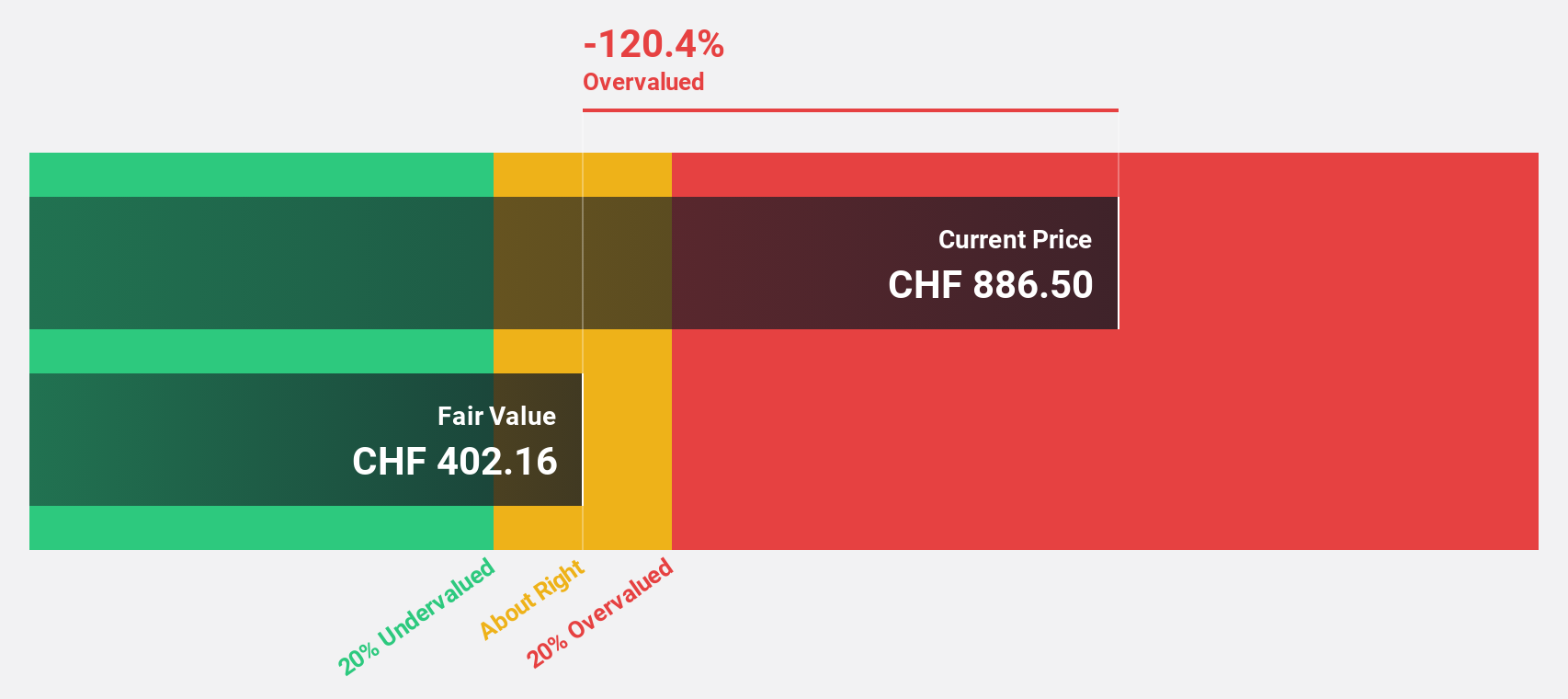

Barry Callebaut (SWX:BARN)

Overview: Barry Callebaut AG, with a market cap of CHF7.80 billion, manufactures and sells chocolate and cocoa products through its subsidiaries.

Operations: Barry Callebaut generates revenue primarily from its Global Cocoa segment, amounting to CHF5.31 billion.

Estimated Discount To Fair Value: 15.4%

Barry Callebaut, trading at CHF1425, is 15.4% below its estimated fair value of CHF1683.44. Despite a highly volatile share price over the past three months, the company's earnings are forecast to grow significantly at 24.91% per year and outpace the Swiss market's growth rate of 9.1%. However, its dividend yield of 2.04% is not well covered by free cash flows and its return on equity is expected to be low at 14.7% in three years' time.

- The analysis detailed in our Barry Callebaut growth report hints at robust future financial performance.

- Take a closer look at Barry Callebaut's balance sheet health here in our report.

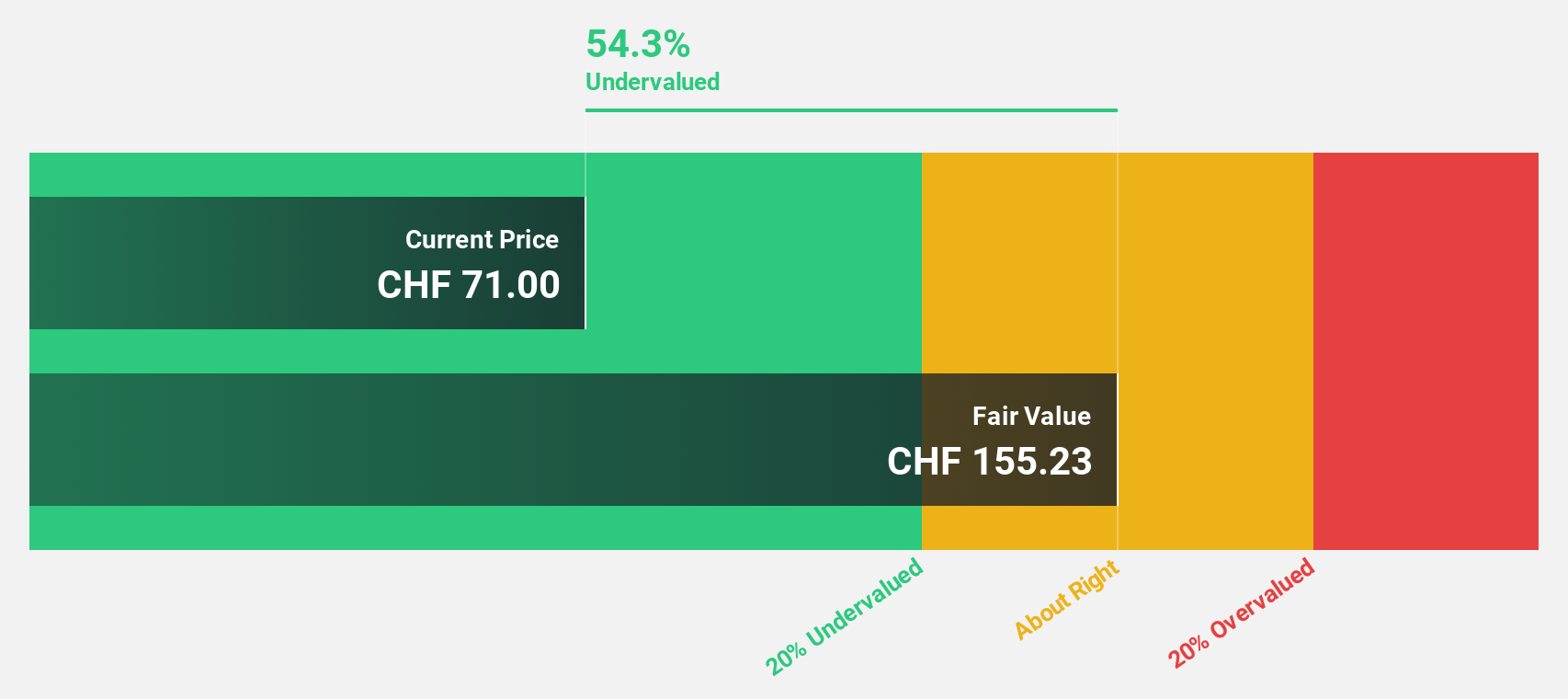

Sensirion Holding (SWX:SENS)

Overview: Sensirion Holding AG develops, produces, sells, and services sensor systems, modules, and components globally with a market cap of CHF1.27 billion.

Operations: The company's revenue primarily comes from its sensor systems, modules, and components segment, which generated CHF233.17 million.

Estimated Discount To Fair Value: 12.7%

Sensirion Holding, trading at CHF81.3, is 12.6% below its estimated fair value of CHF93.02 based on discounted cash flow analysis. Despite a highly volatile share price over the past three months, earnings are forecast to grow significantly at 79.98% per year, and revenue is expected to increase by 13.3% annually—outpacing the Swiss market's growth rate of 4.8%. Recent advancements in subcutaneous drug delivery technology could further enhance its profitability outlook within the next three years.

- Insights from our recent growth report point to a promising forecast for Sensirion Holding's business outlook.

- Navigate through the intricacies of Sensirion Holding with our comprehensive financial health report here.

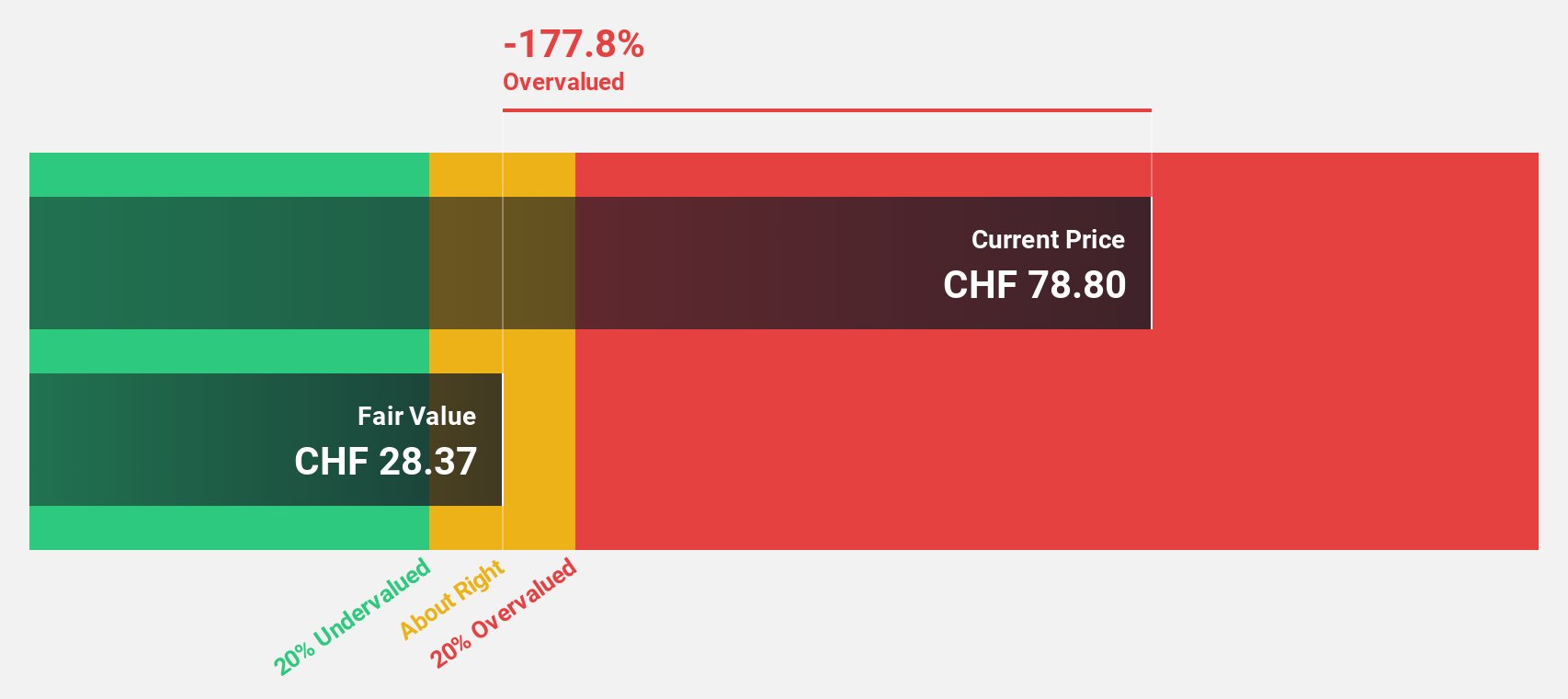

SKAN Group (SWX:SKAN)

Overview: SKAN Group AG, with a market cap of CHF1.77 billion, provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries globally.

Operations: The company's revenue segments are CHF237.11 million from Equipment & Solutions and CHF82.91 million from Services & Consumables.

Estimated Discount To Fair Value: 16.1%

SKAN Group, trading at CHF78.8, is 16.1% below its estimated fair value of CHF93.9 based on discounted cash flow analysis. Earnings grew by 38.6% over the past year and are forecast to grow significantly at 20.6% annually, outpacing the Swiss market's growth rate of 9.1%. Revenue is expected to increase by 15.7% per year, also faster than the market average of 4.8%. Despite high non-cash earnings, SKAN remains undervalued with strong growth prospects ahead.

- According our earnings growth report, there's an indication that SKAN Group might be ready to expand.

- Get an in-depth perspective on SKAN Group's balance sheet by reading our health report here.

Taking Advantage

- Embark on your investment journey to our 17 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components in the Asia Pacific, Europe, the Middle East, Africa, and the Americas.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives