Stock Analysis

- Switzerland

- /

- Life Sciences

- /

- SWX:SKAN

Exploring SKAN Group And Two More Undiscovered Swiss Stocks

Reviewed by Simply Wall St

The Switzerland stock market recently experienced a downturn, influenced by global economic uncertainties and disappointing earnings reports from key players in the U.S. and Europe. The SMI index reflected this bearish sentiment, closing lower amidst a broader European market decline. In such a climate, identifying stocks with potential resilience or overlooked value—like SKAN Group and two other lesser-known Swiss entities—can be particularly compelling for investors looking for opportunities in less trodden paths.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| StarragTornos Group | 12.77% | -2.98% | 29.42% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| SKAN Group | 3.57% | 40.44% | 22.38% | ★★★★★☆ |

| naturenergie holding | 9.95% | 16.32% | 40.54% | ★★★★★☆ |

| Elma Electronic | 42.57% | 2.00% | -1.74% | ★★★★★☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

SKAN Group (SWX:SKAN)

Simply Wall St Value Rating: ★★★★★☆

Overview: SKAN Group AG operates globally, offering isolators, cleanroom devices, and decontamination processes primarily for the pharmaceutical and chemical industries, with a market capitalization of CHF 1.75 billion.

Operations: The company generates revenue primarily through its Equipment & Solutions segment, which accounted for CHF 237.11 million, and its Services & Consumables segment, contributing CHF 82.91 million. It maintains a high gross profit margin consistently at or near 100%, indicating effective cost management relative to its revenue generation.

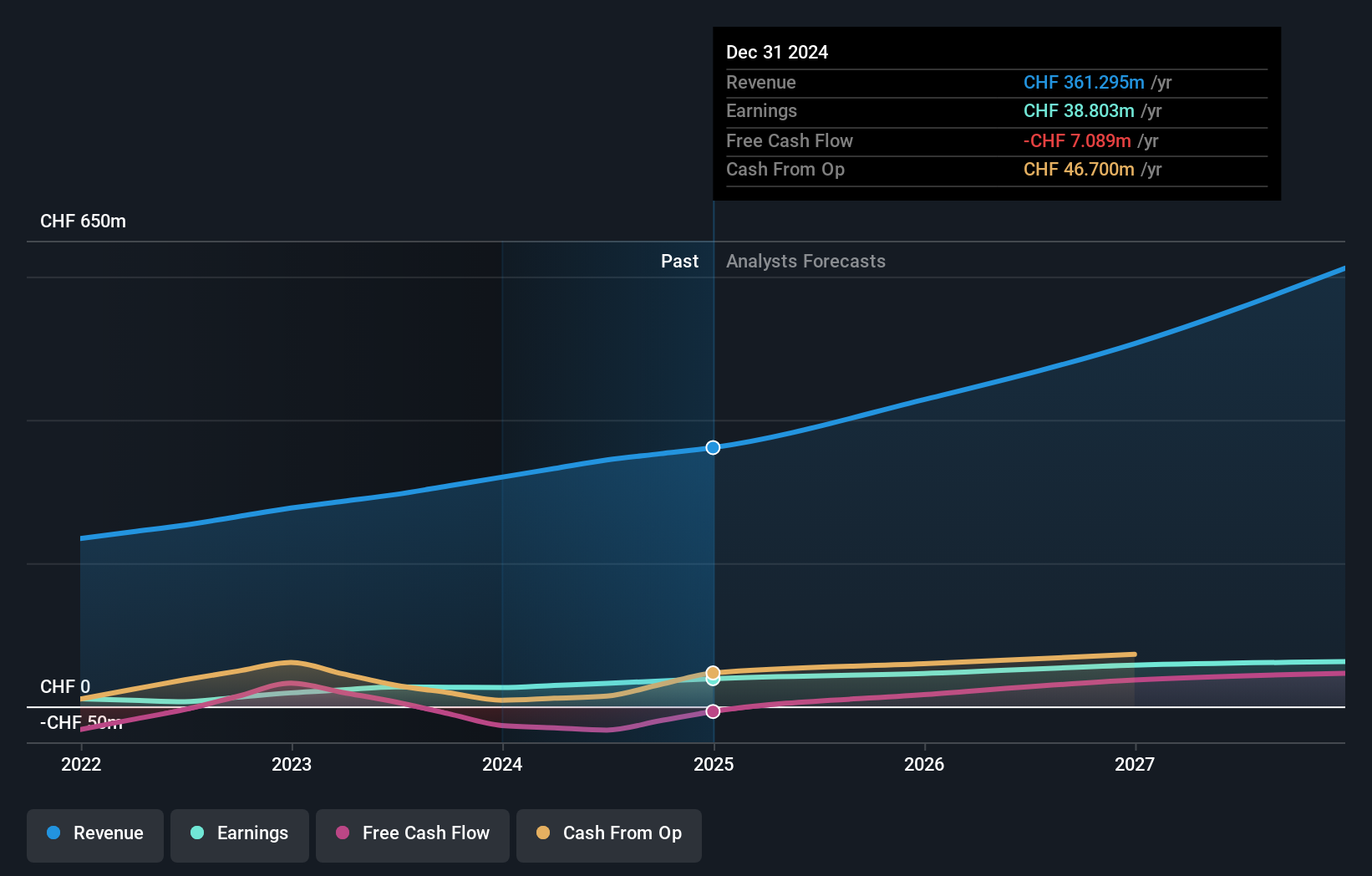

SKAN Group, a standout in the Swiss market, has demonstrated robust financial health with earnings growth of 38.6% last year, surpassing the Life Sciences industry's 6.5%. The company's debt is comfortably exceeded by its cash reserves, and its EBIT covers interest payments by an impressive 104.3 times. Trading at 6.5% below estimated fair value and with earnings projected to grow by 20.57% annually, SKAN represents a compelling opportunity for those seeking growth-oriented investments in lesser-known markets.

- Get an in-depth perspective on SKAN Group's performance by reading our health report here.

Gain insights into SKAN Group's past trends and performance with our Past report.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG is a Swiss conglomerate that manages a diverse portfolio of digital platforms and participations offering information, orientation, entertainment, and support services, with a market capitalization of CHF 1.72 billion.

Operations: TX Group generates its revenue through diverse segments including media, digital platforms, and advertising, with notable contributions from Tamedia (CHF 446.4 million) and Goldbach (CHF 274.7 million). The company's gross profit has seen fluctuations over the years, with a recent margin of approximately 41.83% as of the last recorded period in 2024.

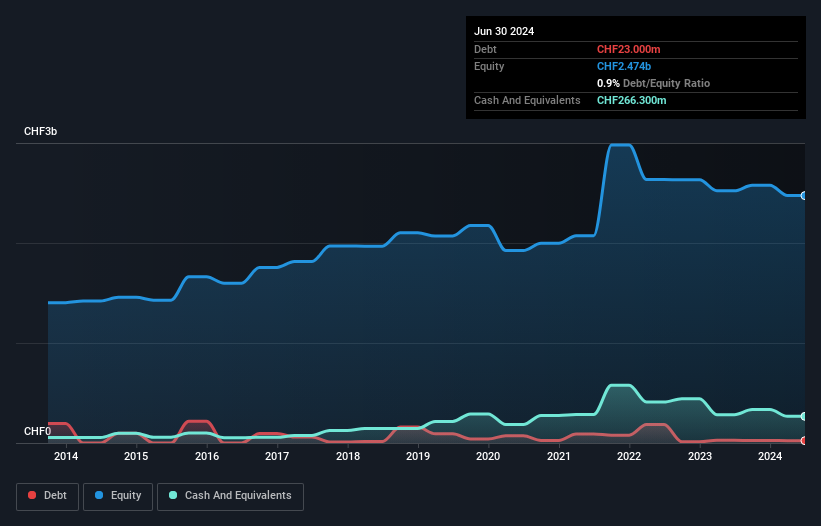

TX Group, a Swiss media company, has recently turned profitable, showcasing its potential in a competitive industry. With earnings forecasted to grow by 23% per year and trading at 74% below its estimated fair value, TX Group presents an intriguing opportunity. The company's financial health is robust, evidenced by a debt-to-equity ratio improvement from 8% to 1% over five years and more cash on hand than total debt. This blend of financial stability and growth prospects positions TX Group as a compelling pick among lesser-known Swiss stocks.

- Click to explore a detailed breakdown of our findings in TX Group's health report.

Explore historical data to track TX Group's performance over time in our Past section.

VP Bank (SWX:VPBN)

Simply Wall St Value Rating: ★★★★★☆

Overview: VP Bank AG operates as a wealth management and investment consulting firm serving private and institutional clients in Liechtenstein, across Europe, and globally, with a market capitalization of approximately CHF 457.34 million.

Operations: The company generates its revenue primarily through international banking services, asset servicing, and operations in Liechtenstein & the British Virgin Islands, with notable contributions of CHF 146.14 million, CHF 43.44 million, and CHF 186.85 million respectively in these segments. It has consistently reported a gross profit margin of 100% across various quarters, highlighting effective cost management despite the absence of detailed COGS data.

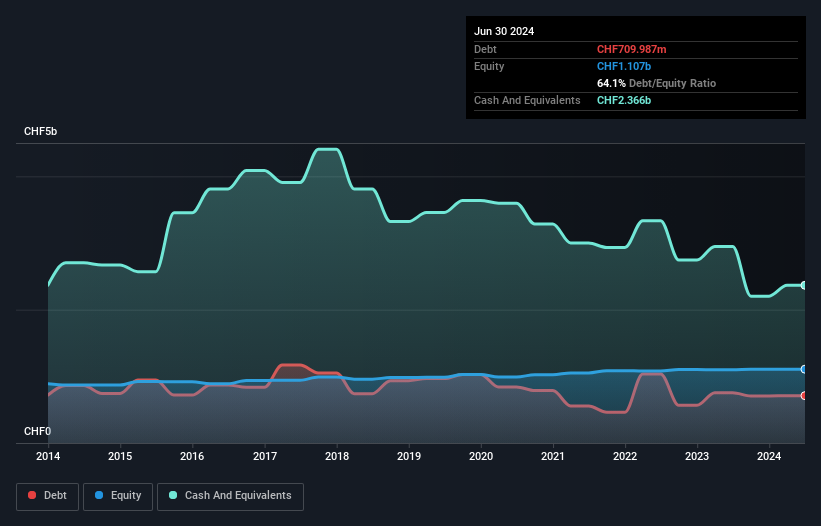

VP Bank, a lesser-highlighted Swiss gem, shows robust financial health with CHF 11.4B in total assets and a strong equity base of CHF 1.1B. Notably, the bank's bad loans are well-managed at only 1.1%, supported by a prudent allowance for these loans at 35%. With customer deposits making up 92% of its liabilities, VP Bank benefits from stable funding sources. Over the past year, earnings have surged by 10.1%, outpacing the industry's growth by 4%. This performance coupled with its trading value being significantly below fair value (37.5%) positions VP Bank as an attractive prospect in the Swiss financial sector.

- Navigate through the intricacies of VP Bank with our comprehensive health report here.

Assess VP Bank's past performance with our detailed historical performance reports.

Where To Now?

- Take a closer look at our SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals list of 18 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SKAN

SKAN Group

Provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries in Asia, Europe, the Americas, and internationally.

Excellent balance sheet with reasonable growth potential.