- Switzerland

- /

- Life Sciences

- /

- SWX:SFZN

These 4 Measures Indicate That Siegfried Holding (VTX:SFZN) Is Using Debt Reasonably Well

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Siegfried Holding AG (VTX:SFZN) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Siegfried Holding

What Is Siegfried Holding's Debt?

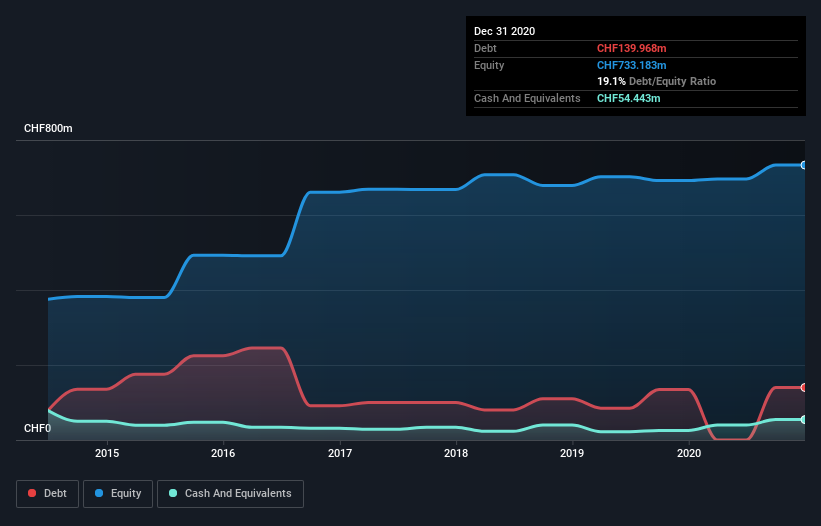

The chart below, which you can click on for greater detail, shows that Siegfried Holding had CHF140.0m in debt in December 2020; about the same as the year before. However, it does have CHF54.4m in cash offsetting this, leading to net debt of about CHF85.5m.

How Healthy Is Siegfried Holding's Balance Sheet?

According to the last reported balance sheet, Siegfried Holding had liabilities of CHF193.6m due within 12 months, and liabilities of CHF315.5m due beyond 12 months. On the other hand, it had cash of CHF54.4m and CHF275.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CHF179.3m.

Given Siegfried Holding has a market capitalization of CHF3.42b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Siegfried Holding's net debt is only 0.64 times its EBITDA. And its EBIT easily covers its interest expense, being 31.6 times the size. So we're pretty relaxed about its super-conservative use of debt. In addition to that, we're happy to report that Siegfried Holding has boosted its EBIT by 40%, thus reducing the spectre of future debt repayments. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Siegfried Holding can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Siegfried Holding's free cash flow amounted to 45% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

Siegfried Holding's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Zooming out, Siegfried Holding seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. Over time, share prices tend to follow earnings per share, so if you're interested in Siegfried Holding, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Siegfried Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:SFZN

Siegfried Holding

Engages in contract development and manufacturing of active pharmaceutical ingredient (API) and finished dosage forms worldwide.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives