- Switzerland

- /

- Pharma

- /

- SWX:SDZ

Did Sandoz Group's (SWX:SDZ) Global Biosimilar Deal Mark a Turning Point in Its Oncology Strategy?

Reviewed by Sasha Jovanovic

- Sandoz Group AG recently announced a global license agreement with EirGenix Inc. to commercialize a proposed biosimilar of pertuzumab, a key oncology medicine for HER2-positive breast cancer, granting Sandoz exclusive rights in most global markets with a total consideration of up to US$152 million in milestone payments.

- This agreement further deepens Sandoz’s existing collaboration with EirGenix, expanding its biosimilar oncology portfolio and enhancing its position to access an estimated US$4.1 billion reference pertuzumab medicine market.

- We'll explore how gaining worldwide commercialization rights to a high-value oncology biosimilar could influence Sandoz's ongoing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Sandoz Group Investment Narrative Recap

Investors focused on Sandoz Group often buy into the company's ambition to lead the biosimilar market, especially as new medicines in oncology reach large, underserved patient populations. The recent pertuzumab biosimilar licensing deal with EirGenix further deepens Sandoz’s global pipeline, but it does not shift the most critical short-term catalyst, continued successful biosimilar launches, nor does it remove the biggest risk: intensifying price competition and margin pressure from entrenched and new biosimilar rivals.

Among recent announcements, the FDA approvals and US launch of Wyost and Jubbonti in June 2025 stand out as the most relevant in context. Both products mark assertive moves into primary care and osteoporosis markets, directly supporting Sandoz’s core catalyst of expanding higher-margin biosimilar revenue, while competing head-to-head in increasingly crowded therapeutic areas.

However, in contrast, investors should be aware that reliance on third-party partnerships for key pipeline assets may limit Sandoz’s control over…

Read the full narrative on Sandoz Group (it's free!)

Sandoz Group's outlook projects $12.7 billion in revenue and $1.7 billion in earnings by 2028. This requires 6.3% annual revenue growth and a $1.47 billion increase in earnings from the current $227.0 million.

Uncover how Sandoz Group's forecasts yield a CHF52.05 fair value, a 5% downside to its current price.

Exploring Other Perspectives

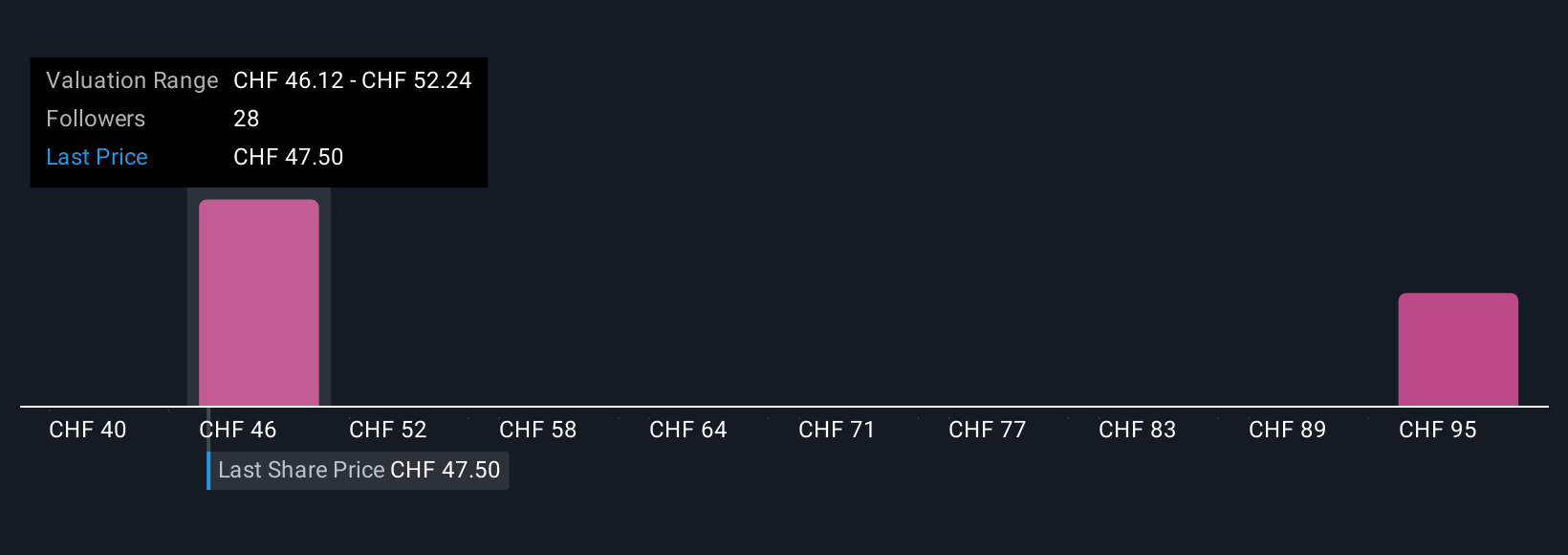

Fair value estimates for Sandoz Group from the Simply Wall St Community range widely between CHF40 and CHF86.97 based on four unique viewpoints. Many see opportunities in pipeline expansion, yet persistent price competition remains a central concern for future performance.

Explore 4 other fair value estimates on Sandoz Group - why the stock might be worth 27% less than the current price!

Build Your Own Sandoz Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sandoz Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sandoz Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sandoz Group's overall financial health at a glance.

No Opportunity In Sandoz Group?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SDZ

Sandoz Group

Develops, manufactures, and markets generic pharmaceuticals and biosimilars worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives