- Switzerland

- /

- Pharma

- /

- SWX:ROG

Roche Holding (SWX:ROG) Is Up 7.6% After Key Drug Approvals and Oncology Collaboration – What's Changed

Reviewed by Sasha Jovanovic

- In the past week, Roche announced a series of major developments, including the European Commission's conditional approval of Lunsumio subcutaneous for relapsed/refractory follicular lymphoma, positive phase III results for fenebrutinib in multiple sclerosis, and a new clinical trial collaboration with KaliVir Immunotherapeutics to advance novel combination immunotherapies in oncology.

- These milestones highlight Roche's continued expansion across oncology and neurology, with new treatment options and partnerships potentially broadening patient access and strengthening its competitive positioning.

- We'll look at how the Lunsumio subcutaneous approval and other clinical trial successes may impact Roche's investment narrative going forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Roche Holding Investment Narrative Recap

Roche appeals to shareholders who believe in the long-term value of innovation-led pharmaceutical pipelines, recurring diagnostics revenues, and a diversified global business model that can withstand pricing and patent pressures. Recent regulatory approvals and clinical milestones are supportive for investor sentiment, but these do not materially change the central near-term risk, which remains the ongoing margin and revenue impact of healthcare pricing reforms and procurement pressures in China, an area critical to Roche’s growth outlook.

The European approval of Lunsumio subcutaneous stands out as particularly relevant, given its potential to expand Roche’s competitive edge in hematology through more convenient, outpatient-friendly treatments for relapsed and refractory follicular lymphoma. As pipeline and product launches accelerate, they may partially offset external headwinds, yet investors must stay focused on the pace of biosimilar competition and reimbursement trends.

Yet, despite these advances, it’s important to remember the uncertainty posed by China’s continued push on healthcare pricing, something investors should be aware of because...

Read the full narrative on Roche Holding (it's free!)

Roche Holding's outlook forecasts revenues of CHF67.3 billion and earnings of CHF16.8 billion by 2028. This is based on a projected annual revenue growth rate of 1.9% and an earnings increase of CHF7.4 billion from the current earnings of CHF9.4 billion.

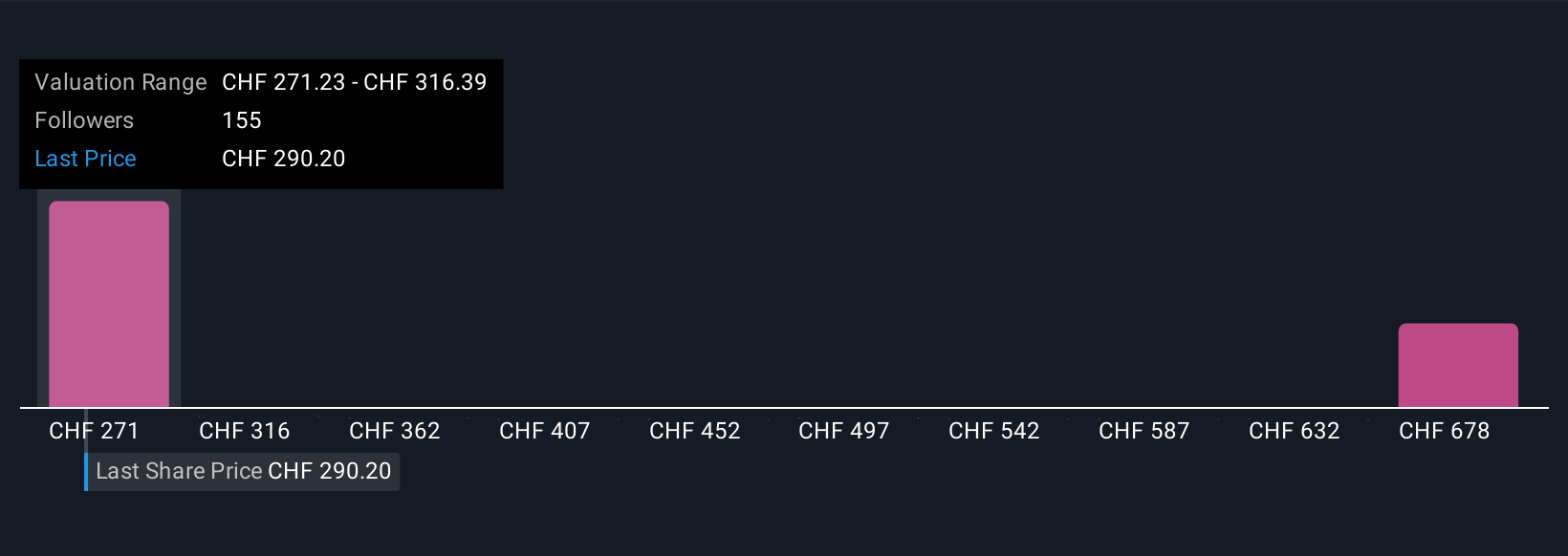

Uncover how Roche Holding's forecasts yield a CHF304.50 fair value, in line with its current price.

Exploring Other Perspectives

Seven varied fair value estimates from the Simply Wall St Community span CHF302.06 to CHF705.80, reflecting substantial divergence in expectations. With China’s pricing environment weighing on margins and growth, readers can explore why these views differ so much and what they suggest for Roche’s future.

Explore 7 other fair value estimates on Roche Holding - why the stock might be worth just CHF302.06!

Build Your Own Roche Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Roche Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Roche Holding's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives