- Switzerland

- /

- Pharma

- /

- SWX:ROG

Roche Holding (SWX:ROG): Is the Current Valuation Still Compelling After Recent Share Price Swings?

Reviewed by Simply Wall St

See our latest analysis for Roche Holding.

Roche Holding’s share price has seen some turbulence lately, with a 1.73% gain in the last day partly offsetting recent declines, including a 7.95% drop over the past month. Despite short-term choppiness, its total shareholder return over the past year has been modestly positive. This suggests that momentum may be steadying as investors digest mixed signals about its long-term growth prospects and valuation.

Looking beyond Roche, this could be the perfect time to explore other major healthcare names. See the full list for free with our curated See the full list for free..

With shares hovering below analyst price targets and reported growth in revenue and profits, the key question emerges: is Roche truly trading at a discount, or has the market already factored in its future potential?

Most Popular Narrative: 11.6% Undervalued

At CHF264, Roche Holding’s share price sits well below the narrative’s estimated fair value of CHF298.64. This gap highlights diverging views on future growth, setting the stage for a closer look at the factors influencing this valuation.

Roche's strong momentum in launching disruptive diagnostics solutions (for example, next-generation sequencing and digital platforms such as AXELIOS, CGM, and AI-powered diagnostics) positions the company to capture surging demand worldwide from expanding elderly populations and increased chronic disease prevalence. This is expected to drive top-line revenue growth and recurring revenue from a broader, more diversified customer base.

What strategy fuels this optimistic valuation? The answer combines advanced diagnostic developments with ambitious financial forecasts. Want to know which future targets could significantly alter Roche’s profit profile? The details behind this projection may even surprise seasoned investors.

Result: Fair Value of $298.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing challenges such as China’s healthcare pricing reforms and looming patent expirations may undermine Roche’s optimistic outlook and projected earnings growth.

Find out about the key risks to this Roche Holding narrative.

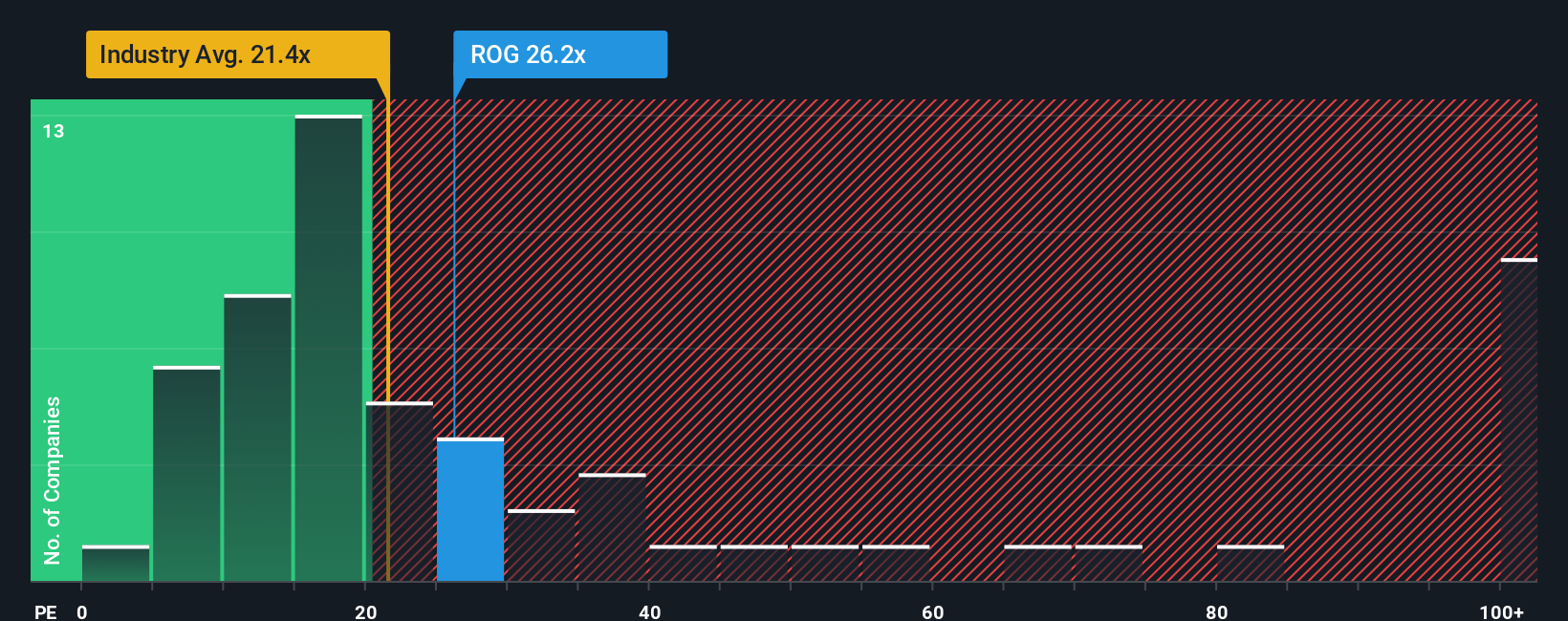

Another Perspective: Market Multiples Tell a Different Story

Looking at Roche’s valuation through the lens of its price-to-earnings ratio reveals a more cautious outlook. The company trades at 23.8 times earnings, slightly above the European Pharmaceuticals industry average of 22.8x. While this isn’t excessive, it does hint at limited upside, especially with the peer average at 76.4x and a fair ratio set at 33.8x. In practical terms, investors face some valuation risk if market sentiment shifts, since the current multiple leaves less room for error. Which view will ultimately shape Roche’s share price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roche Holding Narrative

If you see the story differently or want to dive into the numbers yourself, you can assemble your own Roche Holding narrative in just a few minutes, Do it your way.

A great starting point for your Roche Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t watch great opportunities slip away when you could be targeting the stocks poised to shape tomorrow’s markets. Use our powerful screener to act with confidence and uncover your next winning investment:

- Catch unbeatable value with these 840 undervalued stocks based on cash flows and target companies primed to outperform based on strong cash flow metrics.

- Fuel your portfolio’s future by jumping into these 26 AI penny stocks, where AI-driven innovators are transforming entire industries at record speed.

- Secure dependable income streams by tapping into these 20 dividend stocks with yields > 3% with yields over 3% that can add reliable growth to your investments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and New Zealand.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives