- Romania

- /

- Hospitality

- /

- BVB:SFG

European Value Stocks That May Be Priced Below Their Estimated Worth

Reviewed by Simply Wall St

As European markets navigate mixed performances, with the STOXX Europe 600 Index recently experiencing a slight decline amid stable ECB interest rates and near-target inflation, investors are increasingly on the lookout for opportunities that may be undervalued. In this environment, identifying stocks that are priced below their estimated worth can offer potential value, particularly when economic conditions suggest stability and modest growth in key regions like France and Spain.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.024 | €6.04 | 49.9% |

| Vinext (BIT:VNXT) | €3.38 | €6.63 | 49% |

| tonies (DB:TNIE) | €8.73 | €17.06 | 48.8% |

| Roche Bobois (ENXTPA:RBO) | €36.00 | €70.56 | 49% |

| Prosegur Cash (BME:CASH) | €0.68 | €1.35 | 49.8% |

| Nokian Panimo Oyj (HLSE:BEER) | €2.49 | €4.91 | 49.3% |

| Mo-BRUK (WSE:MBR) | PLN295.50 | PLN587.42 | 49.7% |

| Lingotes Especiales (BME:LGT) | €5.55 | €11.01 | 49.6% |

| Ferrari Group (ENXTAM:FERGR) | €8.11 | €15.88 | 48.9% |

| Allcore (BIT:CORE) | €1.37 | €2.69 | 49% |

We're going to check out a few of the best picks from our screener tool.

Sphera Franchise Group (BVB:SFG)

Overview: Sphera Franchise Group S.A., along with its subsidiaries, operates quick service and takeaway restaurants and has a market cap of RON1.46 billion.

Operations: Sphera Franchise Group's revenue segments include RON1.35 billion from Kentucky Fried Chicken (KFC), RON109.24 million from Pizza Hut, and RON99.77 million from Taco Bell.

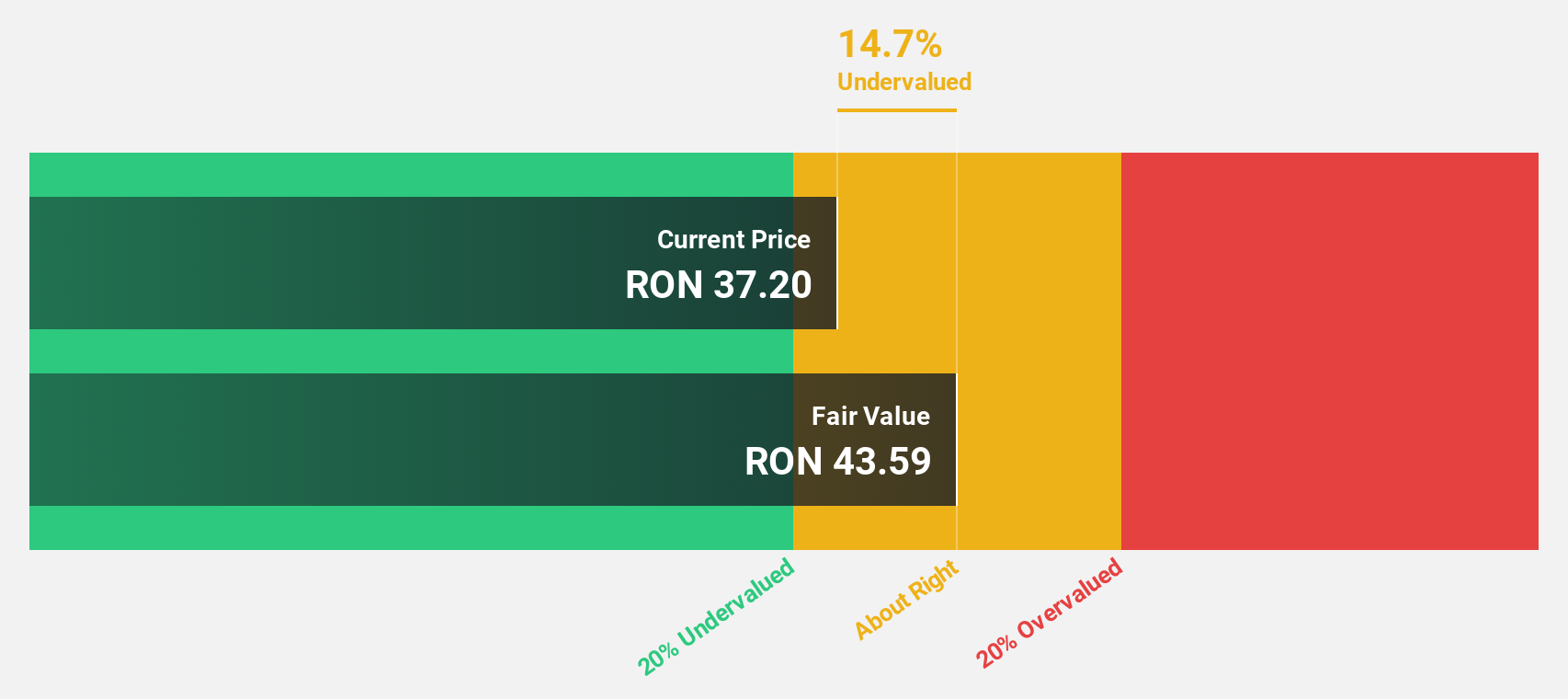

Estimated Discount To Fair Value: 15.7%

Sphera Franchise Group's current trading price of RON37.85 is 15.7% below its estimated fair value of RON44.89, suggesting it may be undervalued based on cash flows despite a high debt level and declining profit margins from 6.3% to 4%. Earnings are forecasted to grow at 14.5% annually, outpacing the Romanian market average of 6.3%, while revenue growth is expected at a slower pace than initially budgeted for 2025, between RON1.6 billion and RON1.65 billion.

- Upon reviewing our latest growth report, Sphera Franchise Group's projected financial performance appears quite optimistic.

- Dive into the specifics of Sphera Franchise Group here with our thorough financial health report.

PolyPeptide Group (SWX:PPGN)

Overview: PolyPeptide Group AG is a contract development and manufacturing company operating in Europe, the United States, and India with a market cap of CHF828.09 million.

Operations: The company's revenue segments include Custom Projects (€120.47 million), Contract Manufacturing (€192.49 million), and Generics and Cosmetics (€55.88 million).

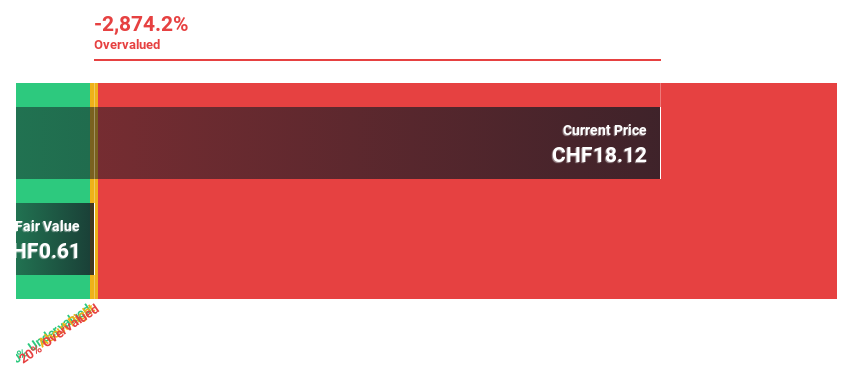

Estimated Discount To Fair Value: 15%

PolyPeptide Group's current share price of CHF25.1 is 15% below its fair value estimate of CHF29.54, reflecting potential undervaluation based on discounted cash flows despite recent volatility and a net loss increase to EUR 26.54 million for H1 2025. The company's strategic EUR 100 million modular expansion in Malmo, funded by a major pharmaceutical partner, aims to double SPPS capacity and support revenue growth projected at 14.9% annually, surpassing the Swiss market average growth rate of 4.1%.

- Our growth report here indicates PolyPeptide Group may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of PolyPeptide Group stock in this financial health report.

u-blox Holding (SWX:UBXN)

Overview: u-blox Holding AG develops, manufactures, and markets products and services for GPS/GNSS satellite positioning systems across various sectors including automotive, healthcare, and industrial automation with a market cap of CHF1.04 billion.

Operations: The company's revenue is primarily derived from its Wireless Communications Equipment segment, which generated CHF292.48 million.

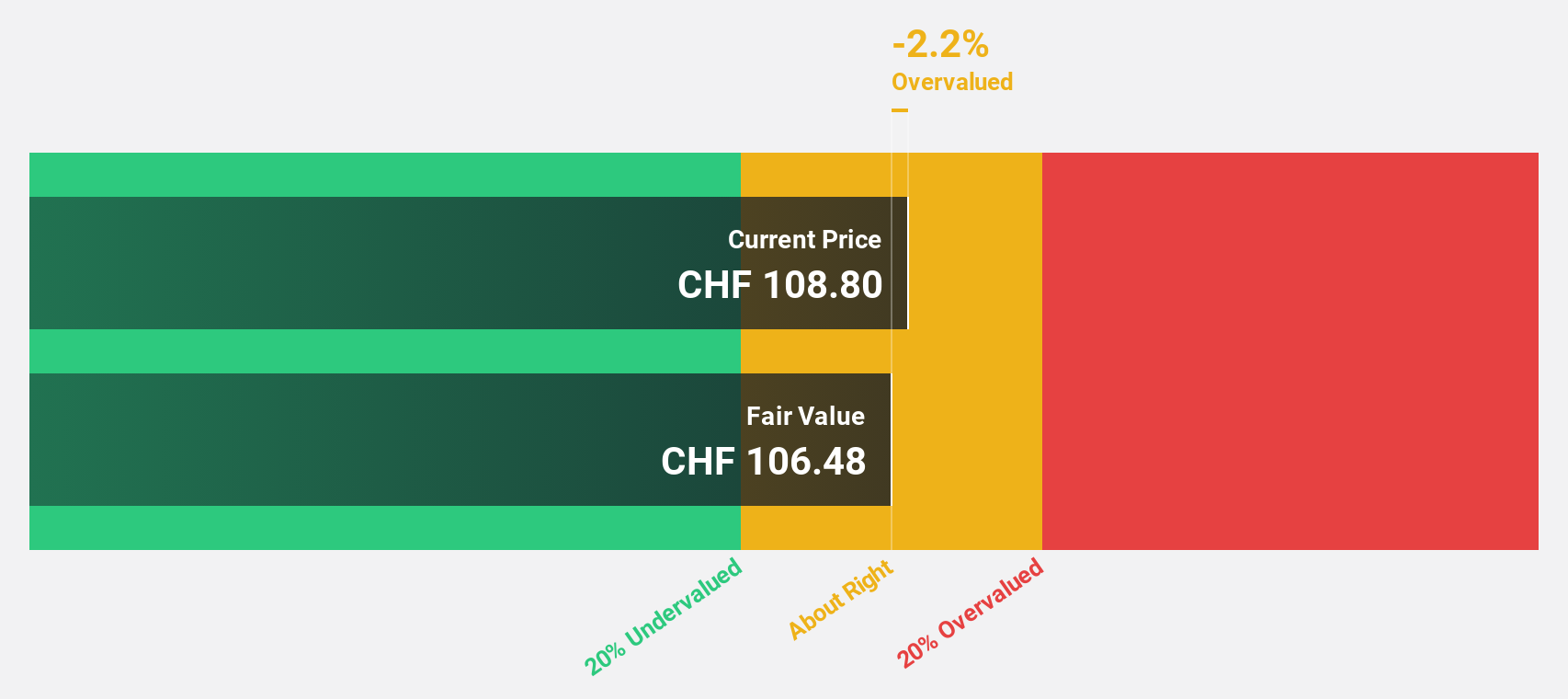

Estimated Discount To Fair Value: 25.5%

u-blox Holding's current trading price of CHF135 is 25.5% below its estimated fair value of CHF181.31, highlighting potential undervaluation based on discounted cash flows despite recent executive changes and a volatile share price. The company's earnings are projected to grow significantly, with profitability expected within three years, surpassing average market growth rates. Recently acquired by ZI Zenith S.à r.l for CHF1 billion, u-blox plans to delist from the SIX Swiss Exchange following regulatory approvals and shareholder acceptance.

- Our comprehensive growth report raises the possibility that u-blox Holding is poised for substantial financial growth.

- Take a closer look at u-blox Holding's balance sheet health here in our report.

Where To Now?

- Gain an insight into the universe of 201 Undervalued European Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:SFG

Reasonable growth potential second-rate dividend payer.

Market Insights

Community Narratives