- Switzerland

- /

- Life Sciences

- /

- SWX:PPGN

3 European Stocks Estimated To Be Up To 45.4% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets reach record highs, buoyed by a rally in technology stocks and expectations for lower U.S. borrowing costs, investors are keenly exploring opportunities that may be undervalued amidst the broader economic optimism. In this environment, identifying stocks trading below their intrinsic value can offer potential advantages as market sentiment continues to shift.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.16 | €2.30 | 49.6% |

| SBO (WBAG:SBO) | €27.10 | €53.22 | 49.1% |

| Midsummer (OM:MIDS) | SEK2.71 | SEK5.36 | 49.4% |

| LINK Mobility Group Holding (OB:LINK) | NOK29.90 | NOK59.75 | 50% |

| Lingotes Especiales (BME:LGT) | €5.60 | €11.08 | 49.4% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.50 | €12.62 | 48.5% |

| E-Globe (BIT:EGB) | €0.665 | €1.31 | 49.1% |

| DSV (CPSE:DSV) | DKK1339.50 | DKK2649.40 | 49.4% |

| Atea (OB:ATEA) | NOK143.20 | NOK278.18 | 48.5% |

| Aquafil (BIT:ECNL) | €1.93 | €3.85 | 49.8% |

Underneath we present a selection of stocks filtered out by our screen.

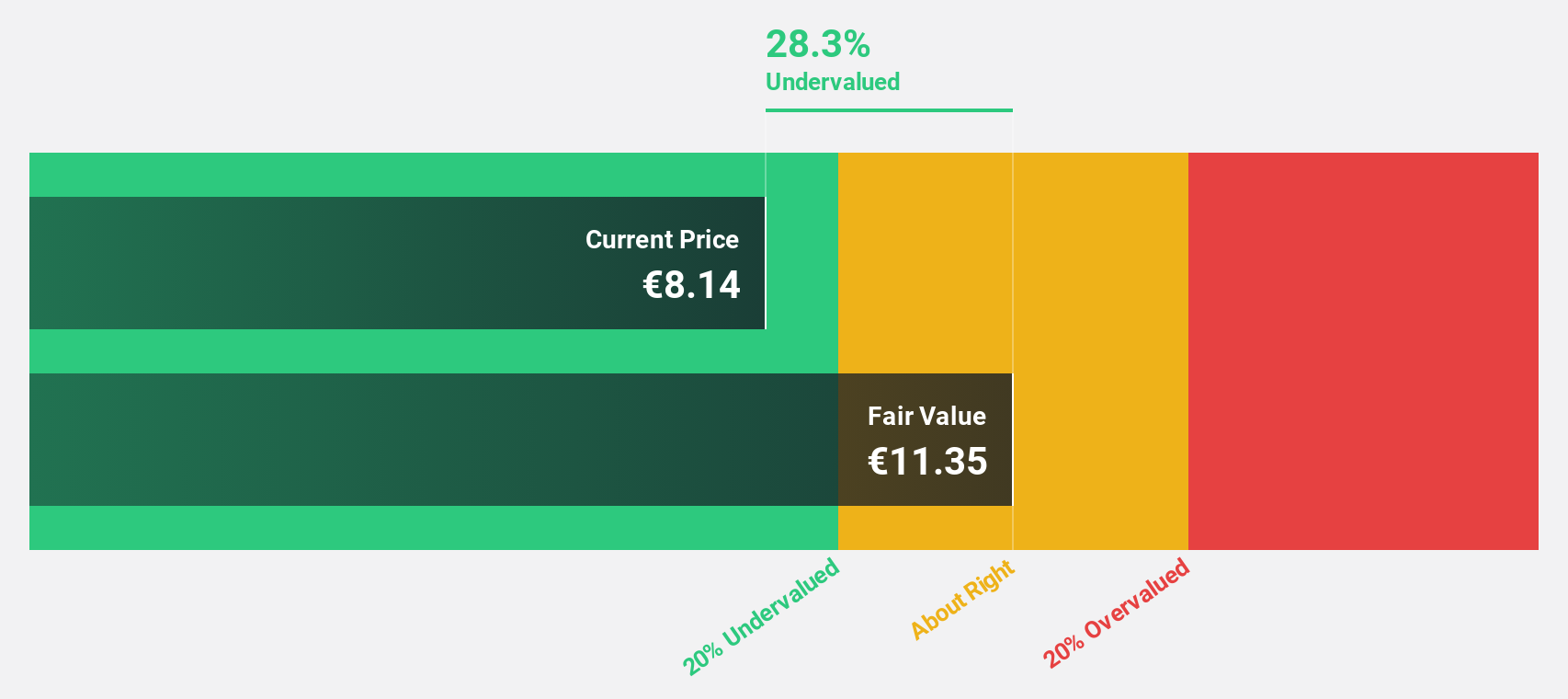

Zignago Vetro (BIT:ZV)

Overview: Zignago Vetro S.p.A., along with its subsidiaries, produces, markets, and sells hollow glass containers in Italy, the rest of Europe, and internationally with a market cap of €725.54 million.

Operations: The company's revenue segments include Vetro Revet Srl with €13.30 million, Zignago Vetro SpA contributing €325.67 million, Zignago Glass USA Inc. at €4.50 million, Italian Glass Moulds Srl with €4.09 million, Zignago Vetro Brosse SAS generating €52.41 million, and Zignago Vetro Polska S.A. at €80.10 million after adjustment of consolidation effects amounting to -€41.61 million.

Estimated Discount To Fair Value: 28.1%

Zignago Vetro is trading at €8.22, significantly below its estimated fair value of €11.43, suggesting potential undervaluation based on cash flows. With forecasted annual earnings growth of 32.6%, outpacing the Italian market's 9.7%, the stock shows promise despite recent declines in sales and net income for H1 2025 compared to last year. However, a high debt level and unsustainable dividend coverage are concerns that investors should consider carefully.

- Insights from our recent growth report point to a promising forecast for Zignago Vetro's business outlook.

- Click here to discover the nuances of Zignago Vetro with our detailed financial health report.

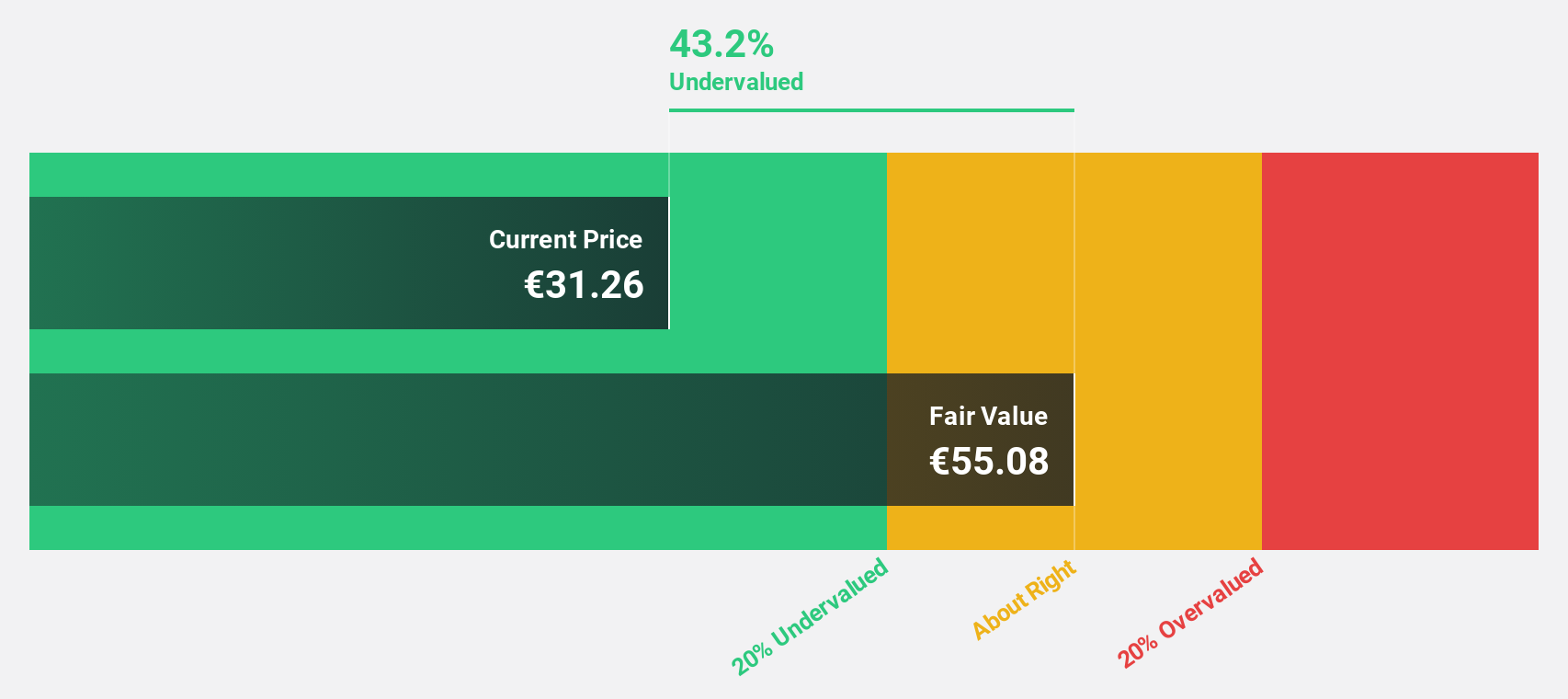

Técnicas Reunidas (BME:TRE)

Overview: Técnicas Reunidas, S.A. is an engineering and construction company that specializes in designing and managing industrial plant projects globally, with a market cap of €2.34 billion.

Operations: The company's revenue segments include Natural Gas (€3.72 billion), Petrochemical (€640.21 million), Low Carbon Technologies (€154.03 million), and Upstream & Refining (€500.25 million).

Estimated Discount To Fair Value: 45.4%

Técnicas Reunidas is trading at €30, well below its estimated fair value of €54.95, highlighting undervaluation based on cash flows. Despite a slower revenue growth forecast of 4.3% annually compared to the Spanish market, earnings are expected to grow significantly at 21.6% per year. Recent collaborations, such as the joint venture for a green hydrogen project in Saudi Arabia potentially worth billions, could enhance future cash flow prospects despite recent share price volatility.

- Our earnings growth report unveils the potential for significant increases in Técnicas Reunidas' future results.

- Click to explore a detailed breakdown of our findings in Técnicas Reunidas' balance sheet health report.

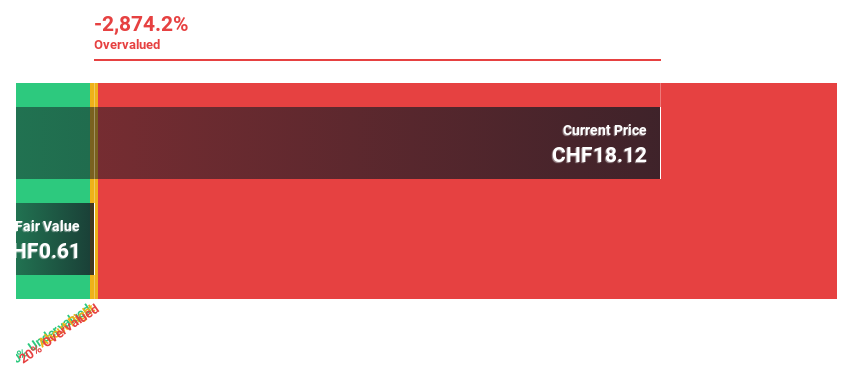

PolyPeptide Group (SWX:PPGN)

Overview: PolyPeptide Group AG is a contract development and manufacturing company operating in Europe, the United States, and India with a market cap of CHF824.79 million.

Operations: PolyPeptide Group AG generates revenue from three main segments: Custom Projects (€120.47 million), Contract Manufacturing (€192.49 million), and Generics and Cosmetics (€55.88 million).

Estimated Discount To Fair Value: 19.5%

PolyPeptide Group is trading at CHF25, below its estimated fair value of CHF31.07, indicating undervaluation based on cash flows. Despite a volatile share price and a net loss reported for the first half of 2025, revenue growth is forecasted at 14.9% annually, surpassing the Swiss market average. The recent modular expansion in Malmo aims to double SPPS capacity and could support long-term growth initiatives amidst revised earnings guidance towards the upper range for 2025.

- In light of our recent growth report, it seems possible that PolyPeptide Group's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of PolyPeptide Group stock in this financial health report.

Turning Ideas Into Actions

- Access the full spectrum of 207 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PPGN

PolyPeptide Group

Operates as a contract development and manufacturing company in Europe, the United States, and India.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives