- Switzerland

- /

- Pharma

- /

- SWX:NOVN

What Novartis (SWX:NOVN)'s $23 Billion US Investment and Raised Growth Outlook Mean For Shareholders

Reviewed by Sasha Jovanovic

- Novartis recently announced a $23 billion expansion of its US manufacturing footprint, including new state-of-the-art facilities in North Carolina and a focus on end-to-end drug production for the American market.

- The company simultaneously rolled forward its mid-term sales guidance to a 5-6% compound annual growth rate for 2025-2030, underlining strong operational confidence and ambitious growth expectations.

- We'll explore how Novartis's US manufacturing investment and upgraded guidance could influence its long-term growth and competitive strengths.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Novartis Investment Narrative Recap

To be a shareholder in Novartis, you need confidence in its ability to deliver steady revenue and earnings growth through continuous innovation, successful new drug launches, and resilient commercial execution, despite challenges like loss of exclusivity (LOE) and pricing pressures. The latest $23 billion US manufacturing expansion and rolled-forward 5-6% CAGR sales guidance underline the company’s operational confidence, but have limited immediate impact on the short-term risk of LOE for blockbuster drugs like Entresto, which remains a key focus for the near term.

Among recent announcements, the positive results from the KALUMA Phase III study for Novartis’ new malaria treatment stand out by showcasing the company’s ongoing progress in the late-stage pipeline. These developments may prove increasingly important as Novartis looks to offset competitive and market access headwinds through novel therapies that can serve as future growth drivers.

However, even as Novartis invests heavily in expanding its US footprint, investors should be aware that sudden acceleration of patent expiries could…

Read the full narrative on Novartis (it's free!)

Novartis' narrative projects $59.1 billion revenue and $17.3 billion earnings by 2028. This requires 2.3% yearly revenue growth and a $3.6 billion earnings increase from $13.7 billion today.

Uncover how Novartis' forecasts yield a CHF102.12 fair value, in line with its current price.

Exploring Other Perspectives

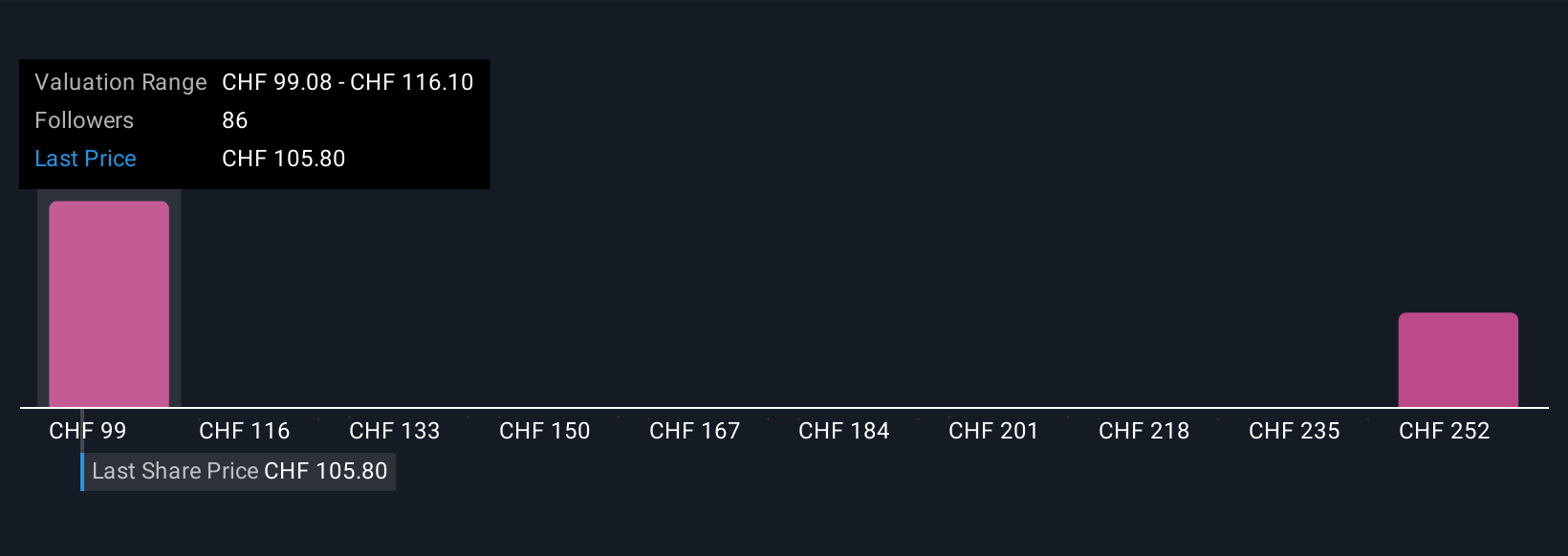

Simply Wall St Community fair value estimates for Novartis span from CHF102.12 to CHF281.51, reflecting four distinct views. While some see major upside, the near-term risk of generic competition remains an important factor to watch for the company’s earnings and growth profile.

Explore 4 other fair value estimates on Novartis - why the stock might be worth over 2x more than the current price!

Build Your Own Novartis Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novartis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Novartis research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novartis' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Novartis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NOVN

Novartis

Researches, develops, manufactures, distributes, markets, and sells pharmaceutical medicines in Switzerland and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives