Stock Analysis

- Switzerland

- /

- Pharma

- /

- SWX:ROG

Exploring Swiss Dividend Stocks In May 2024

Reviewed by Simply Wall St

Amidst a cautious atmosphere driven by inflation concerns and interest rate outlooks, the Swiss market experienced a downturn, with the benchmark SMI index closing lower. In such a fluctuating environment, dividend stocks can offer investors potential stability and regular income, attributes that are particularly appealing when market volatility is high.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Roche Holding (SWX:ROG) | 4.20% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.62% | ★★★★★★ |

| Vontobel Holding (SWX:VONN) | 5.50% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.61% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.28% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.59% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.58% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.81% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.65% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 5.19% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA is a global interdealer broker dealing in financial and non-financial products, with a market capitalization of approximately CHF 1.19 billion.

Operations: Compagnie Financière Tradition generates its revenue from three primary geographical segments: Americas (CHF 350.89 million), Asia-Pacific (CHF 271.44 million), and Europe, Middle East and Africa (CHF 431.78 million).

Dividend Yield: 3.9%

Compagnie Financière Tradition has demonstrated a consistent dividend track record, with stable payments over the past decade and a recent yield of 3.91%, slightly below the top Swiss performers. Dividends are well-supported by both earnings and cash flows, with payout ratios of 47.2% and 40.8% respectively, indicating sustainability. Despite some shareholder dilution last year, the firm's financial health remains robust, evidenced by revenue growth to CHF 983.3 million and net income rising to CHF 94.42 million in 2023.

- Take a closer look at Compagnie Financière Tradition's potential here in our dividend report.

- Upon reviewing our latest valuation report, Compagnie Financière Tradition's share price might be too pessimistic.

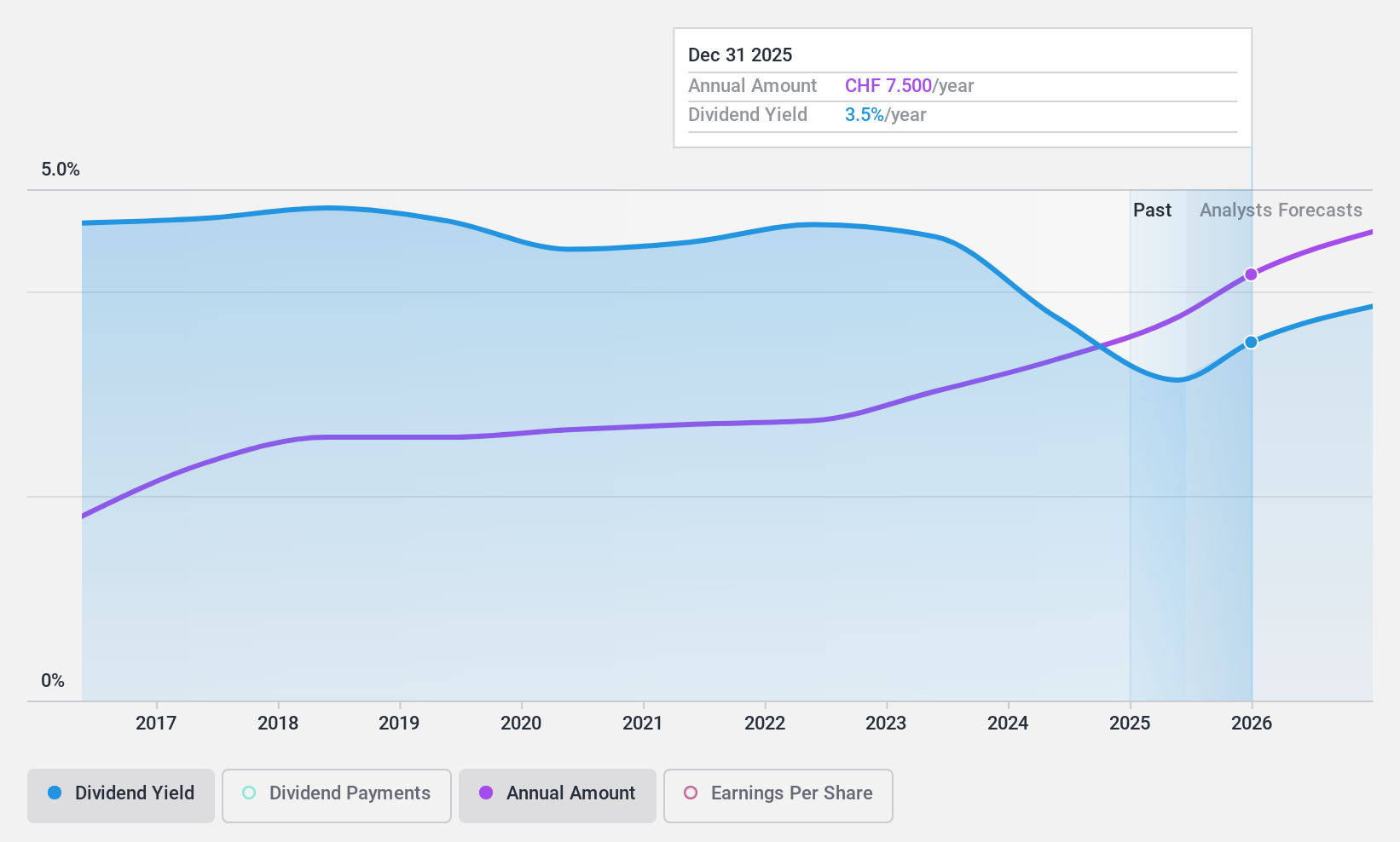

Novartis (SWX:NOVN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Novartis AG is a global healthcare company based in Switzerland, specializing in the research, development, manufacture, and marketing of various healthcare products, with a market capitalization of approximately CHF 185.90 billion.

Operations: Novartis AG generates $47.73 billion in revenue from its Innovative Medicines segment.

Dividend Yield: 3.6%

Novartis has maintained a consistent dividend over the past decade, offering a yield of 3.59%, slightly below Switzerland's top dividend payers. The dividends are well-supported with an earnings payout ratio of 88.7% and a cash flow payout ratio of 60.7%, indicating sustainability despite being lower than some peers. Recent strategic developments, including promising trial results for new treatments such as Fabhalta and expansions in peptide discovery collaborations, highlight ongoing efforts to bolster its market position and future revenue streams, which could influence long-term dividend reliability and growth potential.

- Get an in-depth perspective on Novartis' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Novartis is priced lower than what may be justified by its financials.

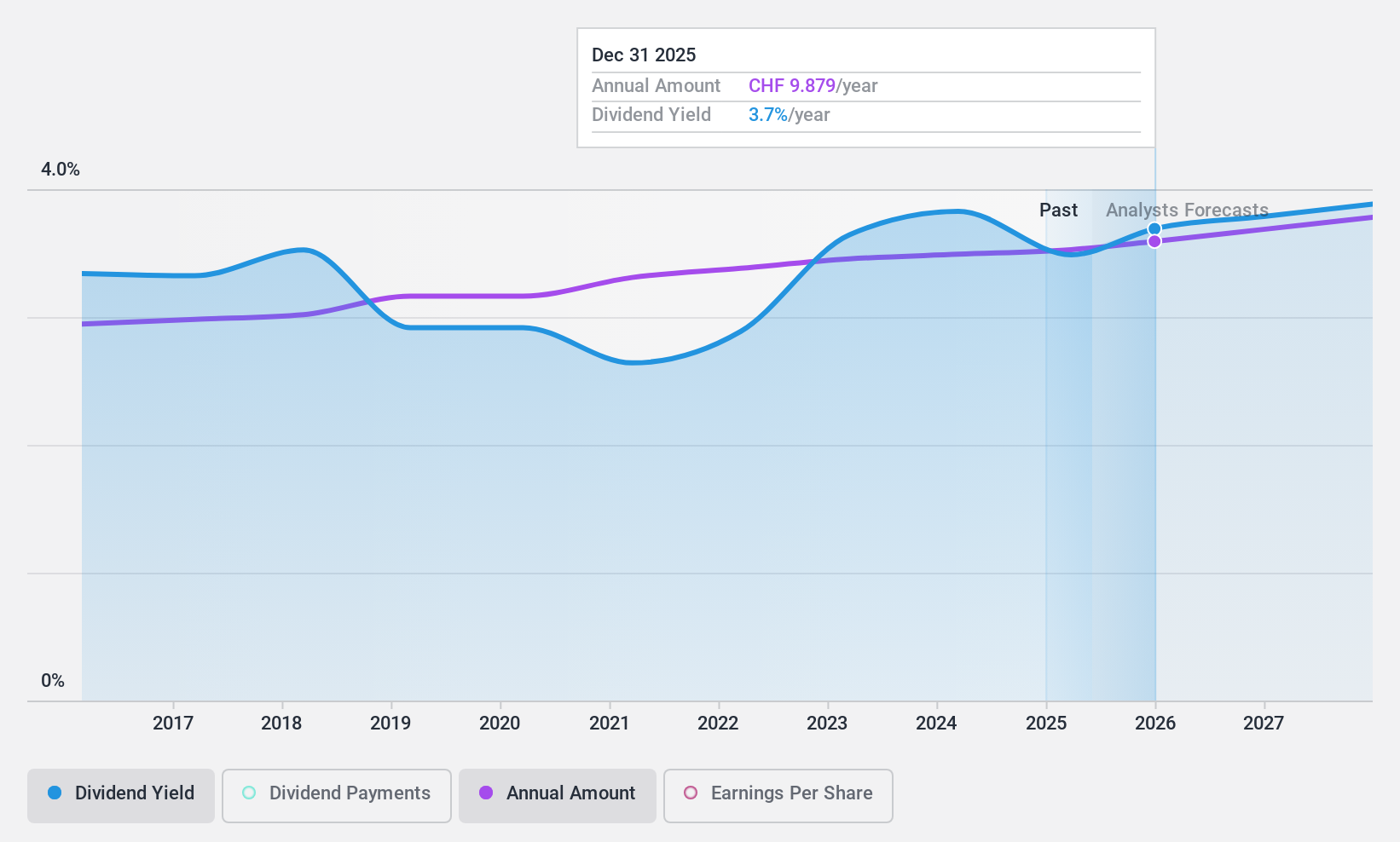

Roche Holding (SWX:ROG)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Roche Holding AG operates in the pharmaceuticals and diagnostics sectors across various global regions, with a market capitalization of approximately CHF 184.88 billion.

Operations: Roche Holding AG generates CHF 44.43 billion from its Roche Pharmaceuticals segment and CHF 7.20 billion from Chugai Pharmaceuticals, alongside CHF 14.16 billion in diagnostics revenue.

Dividend Yield: 4.2%

Roche Holding's dividend stability is underscored by a decade of consistent payouts, currently offering a 4.2% yield. Trading at 68% below estimated fair value and with dividends well-covered by earnings and cash flows (payout ratio: 66.7%, cash payout ratio: 66.9%), the stock presents good value relative to peers. Recent strategic moves, including an extended partnership with Hitachi High-Tech and leadership changes, align with its innovative edge in diagnostics and pharmaceuticals, potentially bolstering future financial health despite its high debt levels.

- Delve into the full analysis dividend report here for a deeper understanding of Roche Holding.

- Our expertly prepared valuation report Roche Holding implies its share price may be lower than expected.

Where To Now?

- Dive into all 27 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Roche Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ROG

Roche Holding

Engages in the pharmaceuticals and diagnostics businesses in Europe, North America, Latin America, Asia, Africa, Australia, and Oceania.

Undervalued established dividend payer.