European Penny Stocks: 3 Picks With Market Caps Over €100M To Watch

Reviewed by Simply Wall St

The European market has shown resilience with the pan-European STOXX Europe 600 Index closing 2.35% higher, indicating a positive trend across major single-country stock indexes. As investors navigate these evolving market conditions, penny stocks—despite their somewhat outdated label—continue to present intriguing opportunities for those seeking growth at lower price points. Typically representing smaller or newer companies, these stocks can offer hidden value when backed by strong financials and solid fundamentals, making them worth watching for potential long-term gains.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.64 | €82.4M | ✅ 4 ⚠️ 1 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.02 | €15.15M | ✅ 4 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €234.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Enervit (BIT:ENV) | €3.80 | €67.64M | ✅ 2 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.16 | €67.03M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.42 | €390.66M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.89 | €75.86M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.27 | €313.76M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.842 | €28.2M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

AROBS Transilvania Software (BVB:AROBS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AROBS Transilvania Software S.A. offers customized software services across Romania, Europe, the United States, Asia, and the Middle East with a market cap of RON693.23 million.

Operations: The company's revenue is primarily derived from Software Services (RON305.80 million), followed by Software Products (RON94.51 million) and Integrated Systems (RON36.67 million).

Market Cap: RON693.23M

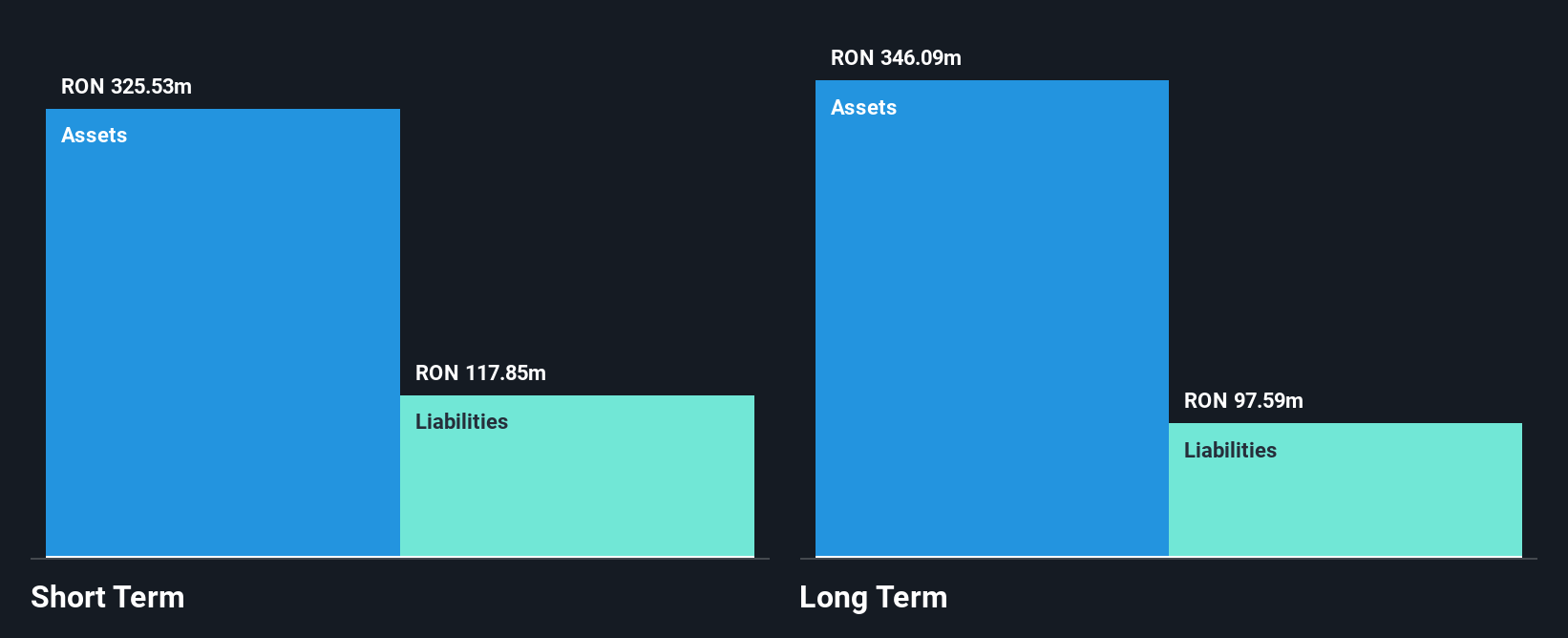

AROBS Transilvania Software has demonstrated significant revenue growth, reaching RON328.48 million for the nine months ending September 2025, up from RON306.16 million a year earlier. The company's net profit margin improved to 5.5%, and its earnings grew by 21.5% over the past year, surpassing industry averages. AROBS's debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating strong financial health despite low return on equity at 5.1%. With short-term assets exceeding both long-term liabilities and short-term liabilities, AROBS maintains a robust balance sheet position while trading below estimated fair value.

- Click to explore a detailed breakdown of our findings in AROBS Transilvania Software's financial health report.

- Understand AROBS Transilvania Software's earnings outlook by examining our growth report.

BIMobject (OM:BIM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BIMobject AB is a software company that develops cloud solutions and services for building information modelling (BIM) globally, with a market cap of SEK722.10 million.

Operations: BIMobject's revenue is primarily derived from its CAD/CAM software segment, totaling SEK181.87 million.

Market Cap: SEK722.1M

BIMobject AB, with a market cap of SEK722.10 million, has demonstrated resilience despite being unprofitable. The company reported third-quarter revenue of SEK41.04 million, slightly down from the previous year, and a net loss of SEK3.93 million compared to a small profit previously. BIMobject's short-term assets significantly exceed both its short- and long-term liabilities, indicating solid financial stability without debt concerns. A recent strategic partnership with Sveriges Elgrossister aims to enhance sustainability data sharing in the electrical industry, potentially boosting market position through improved efficiency and transparency. Leadership changes are underway as Niklas Agevik is set to become CEO in 2026.

- Navigate through the intricacies of BIMobject with our comprehensive balance sheet health report here.

- Gain insights into BIMobject's past trends and performance with our report on the company's historical track record.

Molecular Partners (SWX:MOLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Molecular Partners AG is a clinical-stage biotechnology company focused on designing and developing ankyrin repeat protein therapeutics for oncology treatment in Switzerland, with a market cap of CHF119.68 million.

Operations: Molecular Partners AG has not reported any specific revenue segments.

Market Cap: CHF119.68M

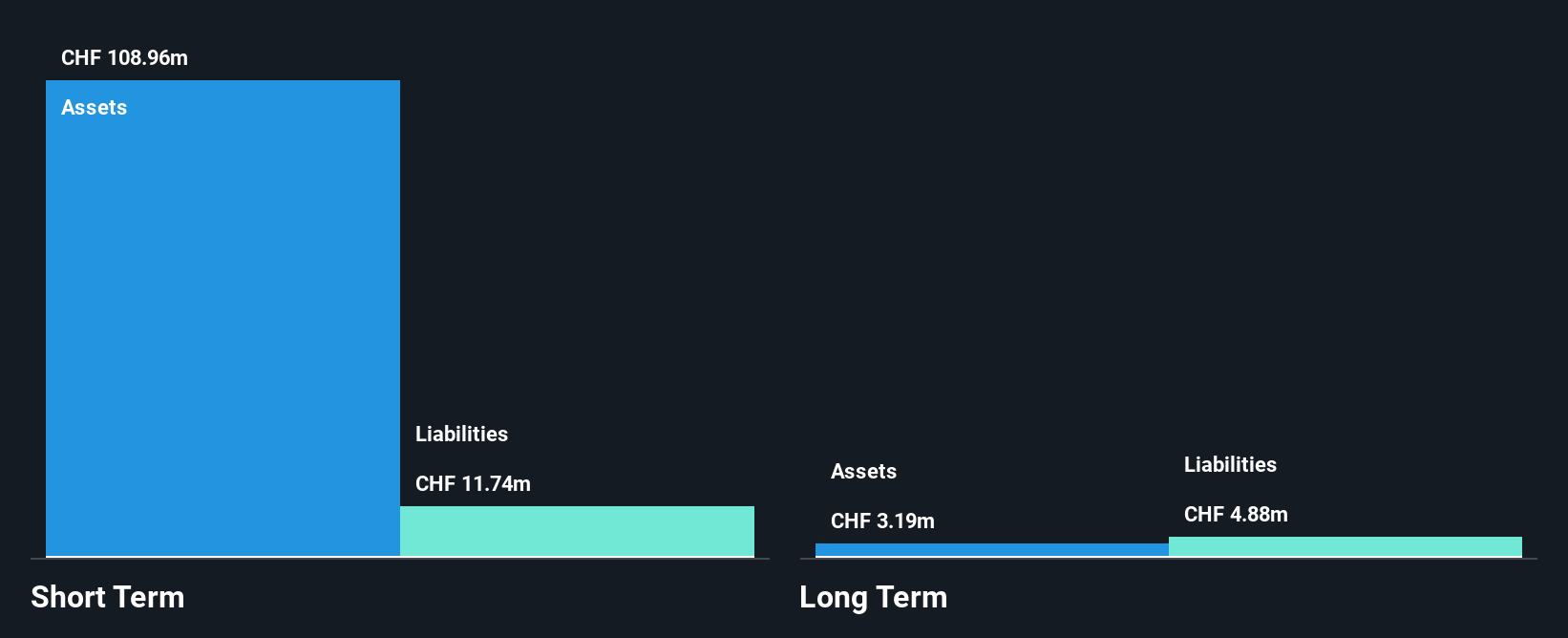

Molecular Partners AG, with a market cap of CHF119.68 million, is pre-revenue and currently unprofitable, though it maintains financial stability with short-term assets exceeding liabilities and no debt. The company recently presented promising data on MP0712 at the Targeted Radiopharmaceuticals Summit Europe, highlighting potential in treating small cell lung cancer and other neuroendocrine cancers. Despite high share price volatility and forecasted earnings decline over the next three years, Molecular Partners has a sufficient cash runway for over two years. Ongoing strategic developments include an IND application for MP0712 in the US, pending FDA clearance to initiate Phase 1 trials by year-end 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Molecular Partners.

- Gain insights into Molecular Partners' future direction by reviewing our growth report.

Summing It All Up

- Take a closer look at our European Penny Stocks list of 277 companies by clicking here.

- Curious About Other Options? Uncover 14 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BIMobject might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIM

BIMobject

A software company, engages in the development of cloud solutions and services within building information modelling (BIM) worldwide.

Flawless balance sheet with minimal risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026