- Switzerland

- /

- Biotech

- /

- SWX:KURN

Shareholders May Find It Hard To Justify Increasing Kuros Biosciences AG's (VTX:KURN) CEO Compensation For Now

Shareholders of Kuros Biosciences AG (VTX:KURN) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. The AGM coming up on the 19 April 2021 could be an opportunity for shareholders to bring these concerns to the board's attention. They could also influence management through voting on resolutions such as executive remuneration. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Kuros Biosciences

Comparing Kuros Biosciences AG's CEO Compensation With the industry

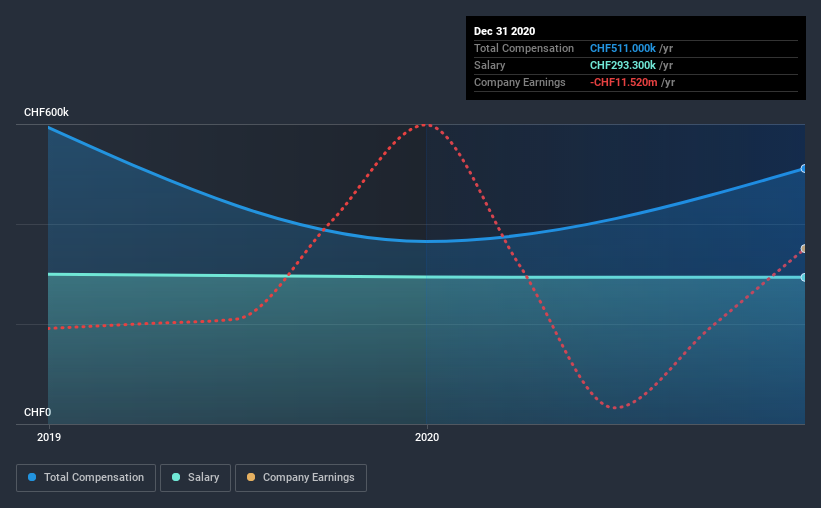

According to our data, Kuros Biosciences AG has a market capitalization of CHF68m, and paid its CEO total annual compensation worth CHF511k over the year to December 2020. Notably, that's an increase of 40% over the year before. We note that the salary of CHF293.3k makes up a sizeable portion of the total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under CHF184m, the reported median total CEO compensation was CHF401k. From this we gather that Joost de Bruijn is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CHF293k | CHF294k | 57% |

| Other | CHF218k | CHF71k | 43% |

| Total Compensation | CHF511k | CHF365k | 100% |

Speaking on an industry level, nearly 57% of total compensation represents salary, while the remainder of 43% is other remuneration. Although there is a difference in how total compensation is set, Kuros Biosciences more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Kuros Biosciences AG's Growth

Kuros Biosciences AG's earnings per share (EPS) grew 53% per year over the last three years. Its revenue is up 58% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Kuros Biosciences AG Been A Good Investment?

With a total shareholder return of -74% over three years, Kuros Biosciences AG shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 3 warning signs for Kuros Biosciences that investors should think about before committing capital to this stock.

Switching gears from Kuros Biosciences, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Kuros Biosciences, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kuros Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:KURN

Kuros Biosciences

Engages in the commercialization and development of biologic technologies for musculoskeletal care in the United States of America, the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives