- Switzerland

- /

- Biotech

- /

- SWX:KURN

Companies Like Kuros Biosciences (VTX:KURN) Are In A Position To Invest In Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. By way of example, Kuros Biosciences (VTX:KURN) has seen its share price rise 148% over the last year, delighting many shareholders. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So notwithstanding the buoyant share price, we think it's well worth asking whether Kuros Biosciences' cash burn is too risky. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Kuros Biosciences

When Might Kuros Biosciences Run Out Of Money?

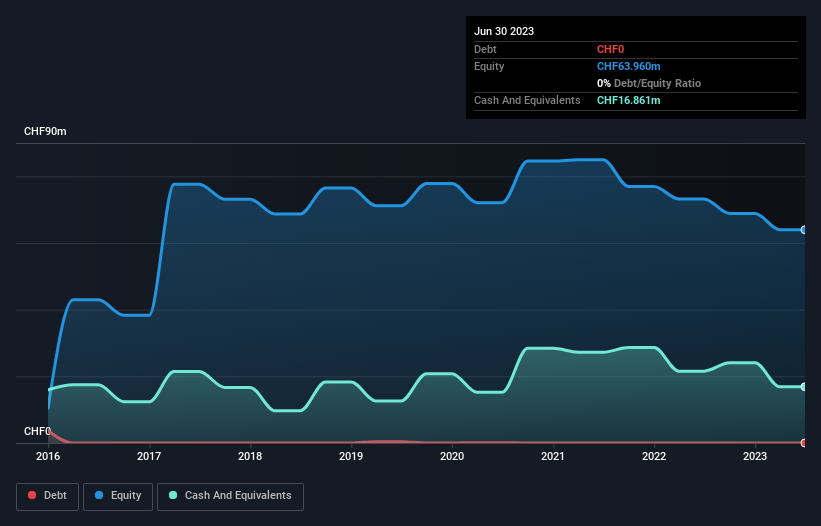

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Kuros Biosciences last reported its balance sheet in June 2023, it had zero debt and cash worth CHF17m. Importantly, its cash burn was CHF7.7m over the trailing twelve months. So it had a cash runway of about 2.2 years from June 2023. That's decent, giving the company a couple years to develop its business. You can see how its cash balance has changed over time in the image below.

How Well Is Kuros Biosciences Growing?

We reckon the fact that Kuros Biosciences managed to shrink its cash burn by 34% over the last year is rather encouraging. On top of that, operating revenue was up 35%, making for a heartening combination It seems to be growing nicely. Of course, we've only taken a quick look at the stock's growth metrics, here. You can take a look at how Kuros Biosciences is growing revenue over time by checking this visualization of past revenue growth.

How Easily Can Kuros Biosciences Raise Cash?

While Kuros Biosciences seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Kuros Biosciences has a market capitalisation of CHF137m and burnt through CHF7.7m last year, which is 5.6% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

So, Should We Worry About Kuros Biosciences' Cash Burn?

It may already be apparent to you that we're relatively comfortable with the way Kuros Biosciences is burning through its cash. In particular, we think its cash burn relative to its market cap stands out as evidence that the company is well on top of its spending. And even though its cash burn reduction wasn't quite as impressive, it was still a positive. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. On another note, we conducted an in-depth investigation of the company, and identified 2 warning signs for Kuros Biosciences (4 are a bit unpleasant!) that you should be aware of before investing here.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if Kuros Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:KURN

Kuros Biosciences

Engages in the commercialization and development of biologic technologies for musculoskeletal care in the United States of America, the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.