- Switzerland

- /

- Pharma

- /

- SWX:GALD

Investors Appear Satisfied With Galderma Group AG's (VTX:GALD) Prospects As Shares Rocket 28%

Those holding Galderma Group AG (VTX:GALD) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last 30 days bring the annual gain to a very sharp 36%.

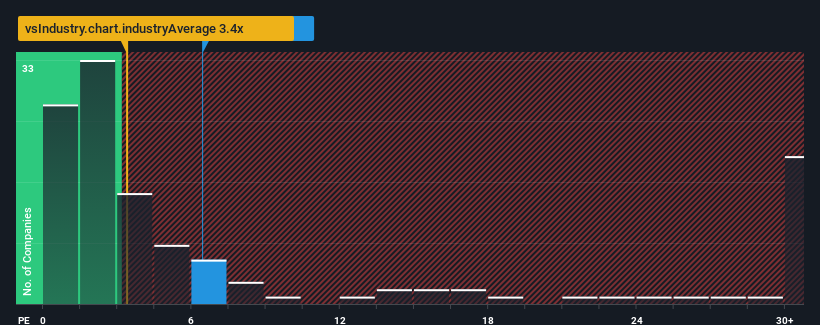

Following the firm bounce in price, when almost half of the companies in Switzerland's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 4x, you may consider Galderma Group as a stock not worth researching with its 6.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

We've discovered 1 warning sign about Galderma Group. View them for free.View our latest analysis for Galderma Group

What Does Galderma Group's Recent Performance Look Like?

There hasn't been much to differentiate Galderma Group's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to improve, justifying the currently elevated P/S. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Galderma Group's future stacks up against the industry? In that case, our free report is a great place to start.How Is Galderma Group's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Galderma Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.8%. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 13% per year during the coming three years according to the eleven analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 3.3% each year, which is noticeably less attractive.

With this information, we can see why Galderma Group is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Galderma Group's P/S?

Galderma Group's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Galderma Group shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Galderma Group that you need to be mindful of.

If you're unsure about the strength of Galderma Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:GALD

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives