- Switzerland

- /

- Life Sciences

- /

- SWX:BANB

A Look at Bachem Holding (SWX:BANB) Valuation Following CEO Successor Announcement

Reviewed by Simply Wall St

Bachem Holding (SWX:BANB) has announced a CEO transition, with Anne-Kathrin Stoller set to take the helm from Thomas Meier at the start of 2026. Executive changes like this can prompt investors to reassess expectations for the company’s direction.

See our latest analysis for Bachem Holding.

Bachem’s leadership shake-up has arrived after a challenging period for shareholders. The stock is trading at CHF 51.9, and while the CEO transition could spark fresh optimism, market sentiment has yet to shift. Over the past year, the share price is down more than 12%, and the total shareholder return sits at -29%. This follows a larger three-year slump, highlighting that momentum is still fading even as the company gears up for a new strategic phase.

If this kind of executive transition makes you want to broaden your search, now's the time to discover fast growing stocks with high insider ownership.

With the stock trading well below analyst targets but facing sluggish momentum, investors are left wondering if the current price offers a compelling entry or if the market has already anticipated the company’s next growth chapter.

Most Popular Narrative: 30.5% Undervalued

According to the most popular narrative, Bachem Holding’s fair value estimate stands notably above the recent close and sets up a significant potential upside if analyst projections play out.

“Bachem's substantial investment in expanding large-scale manufacturing capacity, particularly with the new Building K expected to enter GMP production in 2025 and begin significant revenue contribution in 2026, positions the company to capture accelerating demand from high-growth peptide and oligonucleotide drug markets, supporting outsized future revenue growth.”

Can Bachem’s coming transformation deliver on these outsized growth assumptions? Find out which ambitious forecasts and financial bets are driving this eye-catching valuation. What’s behind the math may surprise you.

Result: Fair Value of $74.7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant capital investment needs and ongoing currency volatility could threaten Bachem’s growth ambitions and test the optimism built into analyst forecasts.

Find out about the key risks to this Bachem Holding narrative.

Another View: Multiples Tell a Different Story

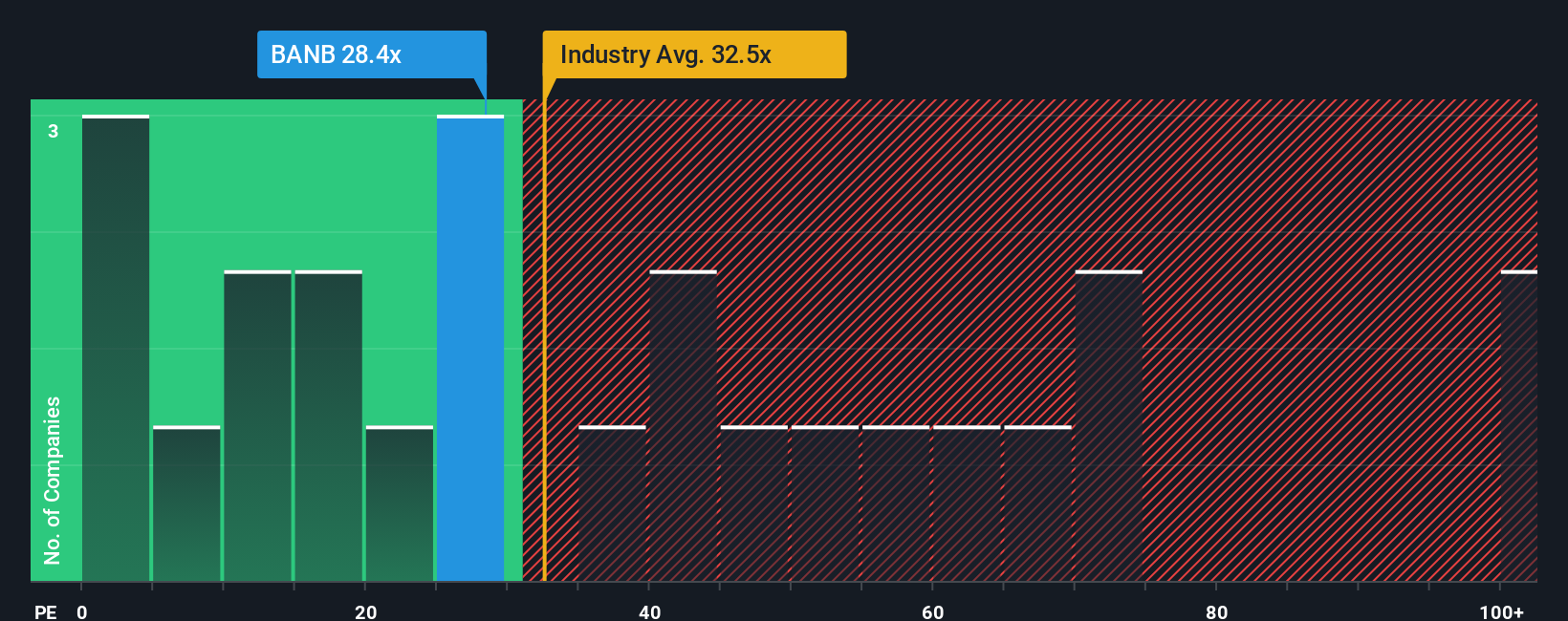

While analyst targets suggest the shares are undervalued, a look at market valuation ratios offers a reality check. Bachem trades at 29 times earnings, cheaper than European Life Sciences peers at 32.4x and its direct peer group at 42.9x, but more expensive than a fair ratio of 25.2x that reflects company fundamentals. This higher-than-fair valuation could limit upside if future results fall short. Is the market already pricing in too much hope?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bachem Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bachem Holding Narrative

If our perspective doesn’t quite match your view, keep in mind that digging into the data and shaping your own storyline is always an option. Build your individual narrative in just a few minutes. Do it your way

A great starting point for your Bachem Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors know the best opportunities can be just beyond your usual watchlist. Give yourself an edge and check out these hand-picked areas today. Waiting could mean missing out.

- Grow your passive income by targeting reliable payers and jump into these 14 dividend stocks with yields > 3% offering attractive yields over 3%.

- Secure your spot at the forefront of healthcare innovation by reviewing these 32 healthcare AI stocks pushing boundaries with AI-driven diagnostics and biotech breakthroughs.

- Capitalize on tomorrow's technologies by seizing the momentum with these 27 quantum computing stocks companies leading the next big leap in computing power and security.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bachem Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BANB

Bachem Holding

Provides products for research, clinical development, and commercial application to pharmaceutical and biotechnology companies worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives