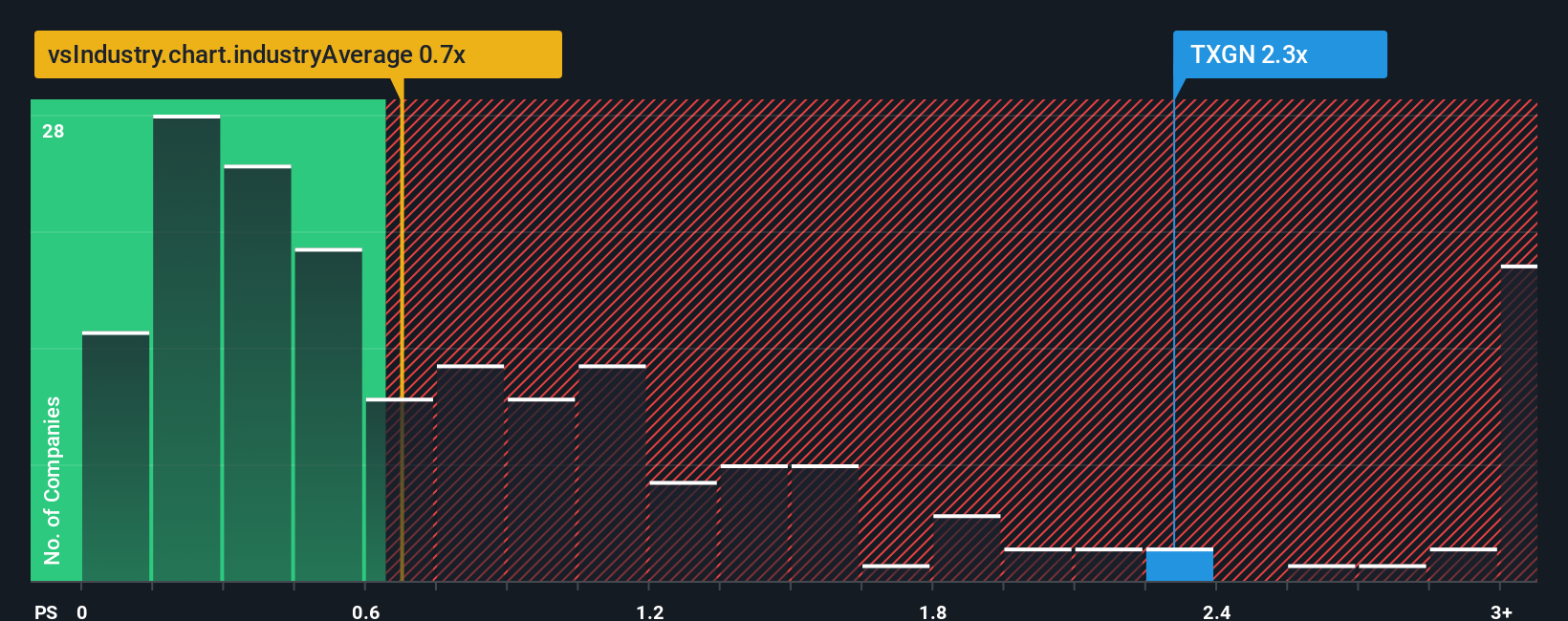

When close to half the companies in the Media industry in Switzerland have price-to-sales ratios (or "P/S") below 0.7x, you may consider TX Group AG (VTX:TXGN) as a stock to potentially avoid with its 2.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for TX Group

How TX Group Has Been Performing

For instance, TX Group's receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on TX Group will help you shine a light on its historical performance.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as TX Group's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 4.2% decrease to the company's top line. As a result, revenue from three years ago have also fallen 1.5% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

For that matter, there's little to separate that medium-term revenue trajectory on an annualised basis against the broader industry's one-year forecast for a contraction of 0.4% either.

In light of this, it's somewhat peculiar that TX Group's P/S sits above the majority of other companies. With revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. There's strong potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of TX Group revealed its three-year contraction in revenue growth isn't impacting its high P/S as much as we would have predicted, given the industry is set to shrink at a similar rate. At present, we find the high P/S concerning, as we do not believe that the current revenue performance can sustain such optimistic market sentiment for an extended period. In addition, we are concerned whether the company can maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 2 warning signs for TX Group (of which 1 makes us a bit uncomfortable!) you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and other services in Switzerland.

Excellent balance sheet and fair value.

Market Insights

Community Narratives