- Switzerland

- /

- Entertainment

- /

- SWX:HLEE

Improved Revenues Required Before Highlight Event and Entertainment AG (VTX:HLEE) Shares Find Their Feet

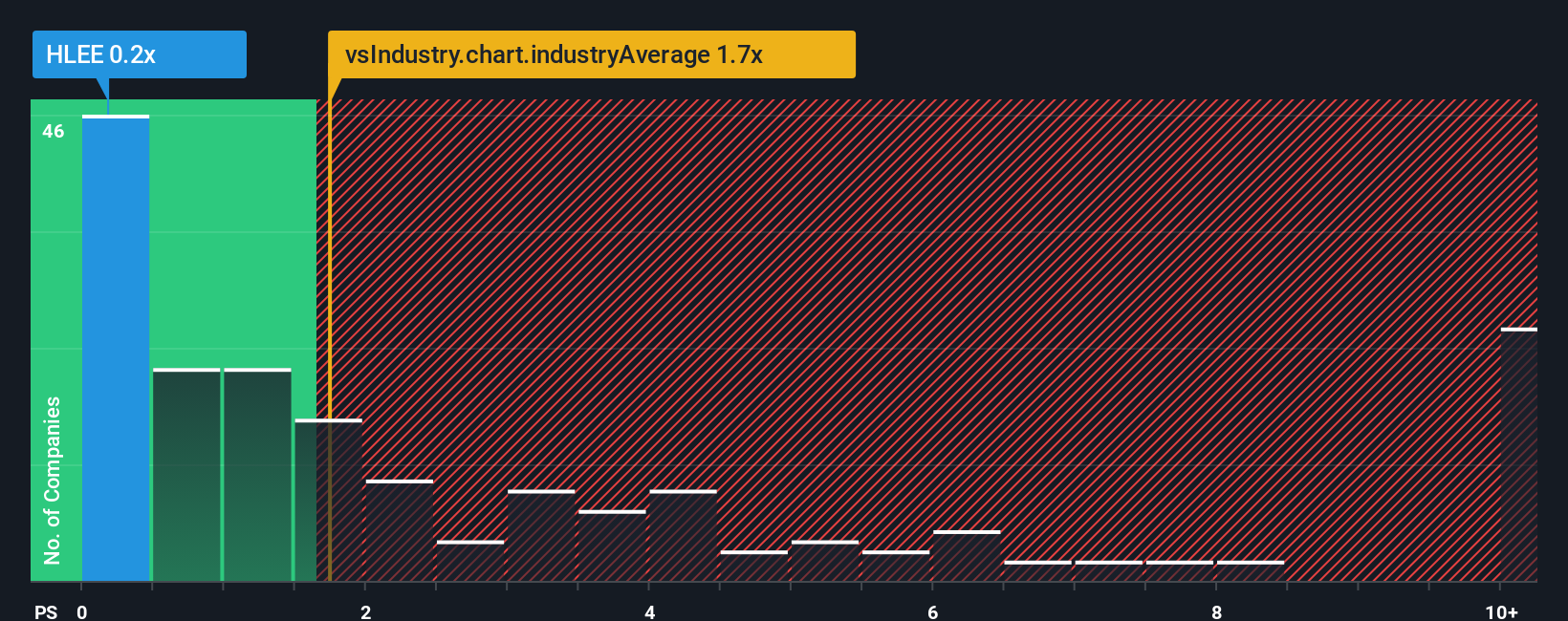

You may think that with a price-to-sales (or "P/S") ratio of 0.2x Highlight Event and Entertainment AG (VTX:HLEE) is a stock worth checking out, seeing as almost half of all the Entertainment companies in Switzerland have P/S ratios greater than 1.7x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Highlight Event and Entertainment

What Does Highlight Event and Entertainment's Recent Performance Look Like?

The revenue growth achieved at Highlight Event and Entertainment over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Highlight Event and Entertainment will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Highlight Event and Entertainment's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a decent 8.6% gain to the company's revenues. However, this wasn't enough as the latest three year period has seen an unpleasant 14% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 3.7% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we understand why Highlight Event and Entertainment's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Highlight Event and Entertainment maintains its low P/S off the back of its sliding revenue over the medium-term. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Highlight Event and Entertainment, and understanding them should be part of your investment process.

If you're unsure about the strength of Highlight Event and Entertainment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Highlight Event and Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:HLEE

Highlight Event and Entertainment

Engages in film, and sports and events businesses in Switzerland, Germany, rest of Europe, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives