Stock Analysis

- Switzerland

- /

- Chemicals

- /

- SWX:SIKA

Exploring Three Stocks On SIX Swiss Exchange With Estimated Intrinsic Discounts Ranging From 13.1% To 22.9%

Reviewed by Simply Wall St

In recent trading sessions, the Switzerland market has shown volatility, with the SMI experiencing fluctuations amid investor caution regarding global economic indicators and interest rate expectations. In such a market environment, identifying stocks that appear undervalued relative to their intrinsic value could offer interesting opportunities for investors seeking potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sulzer (SWX:SUN) | CHF136.40 | CHF220.95 | 38.3% |

| COLTENE Holding (SWX:CLTN) | CHF45.60 | CHF73.89 | 38.3% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF615.00 | CHF854.31 | 28.0% |

| Temenos (SWX:TEMN) | CHF64.60 | CHF84.34 | 23.4% |

| Georg Fischer (SWX:GF) | CHF65.65 | CHF85.20 | 22.9% |

| Barry Callebaut (SWX:BARN) | CHF1411.00 | CHF1827.66 | 22.8% |

| Julius Bär Gruppe (SWX:BAER) | CHF52.34 | CHF93.58 | 44.1% |

| Sonova Holding (SWX:SOON) | CHF268.10 | CHF467.80 | 42.7% |

| Comet Holding (SWX:COTN) | CHF363.00 | CHF588.94 | 38.4% |

| Medartis Holding (SWX:MED) | CHF71.60 | CHF131.36 | 45.5% |

We'll examine a selection from our screener results.

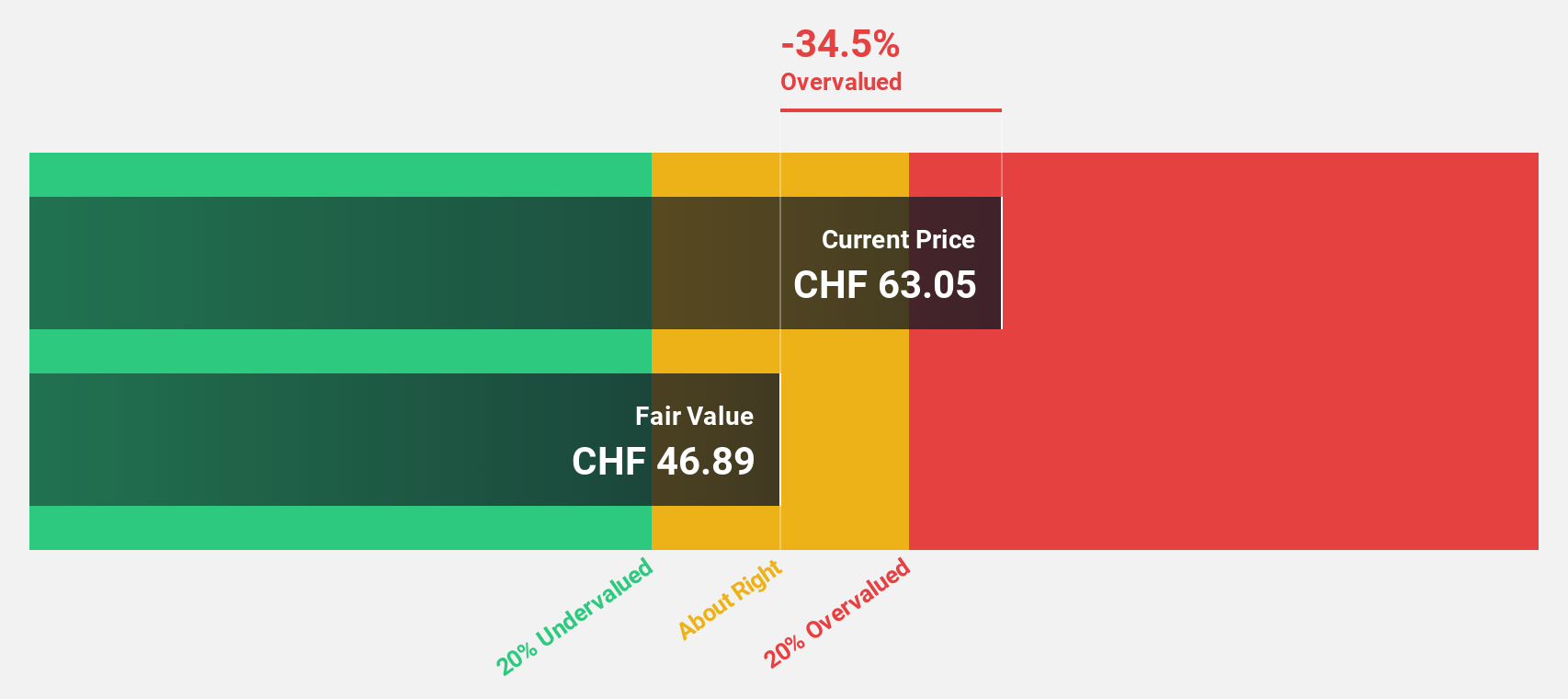

Georg Fischer (SWX:GF)

Overview: Georg Fischer AG operates globally, providing piping systems, as well as casting and machining solutions across Europe, the Americas, and Asia, with a market capitalization of approximately CHF 5.38 billion.

Operations: The company's revenue is primarily generated from three segments: GF Piping Systems with CHF 1.99 billion, GF Casting Solutions at CHF 901 million, and GF Machining Solutions contributing CHF 853 million.

Estimated Discount To Fair Value: 22.9%

Georg Fischer AG, with a recent sales increase to CHF 2.41 billion, shows potential despite a net income drop to CHF 97 million from last year's CHF 123 million. The company is trading at CHF 65.65, below the estimated fair value of CHF 85.20, indicating undervaluation based on discounted cash flow analysis. Although debt coverage by operating cash flow is weak and profit margins have declined, Georg Fischer's earnings are expected to grow significantly over the next three years, outpacing the Swiss market average.

- In light of our recent growth report, it seems possible that Georg Fischer's financial performance will exceed current levels.

- Dive into the specifics of Georg Fischer here with our thorough financial health report.

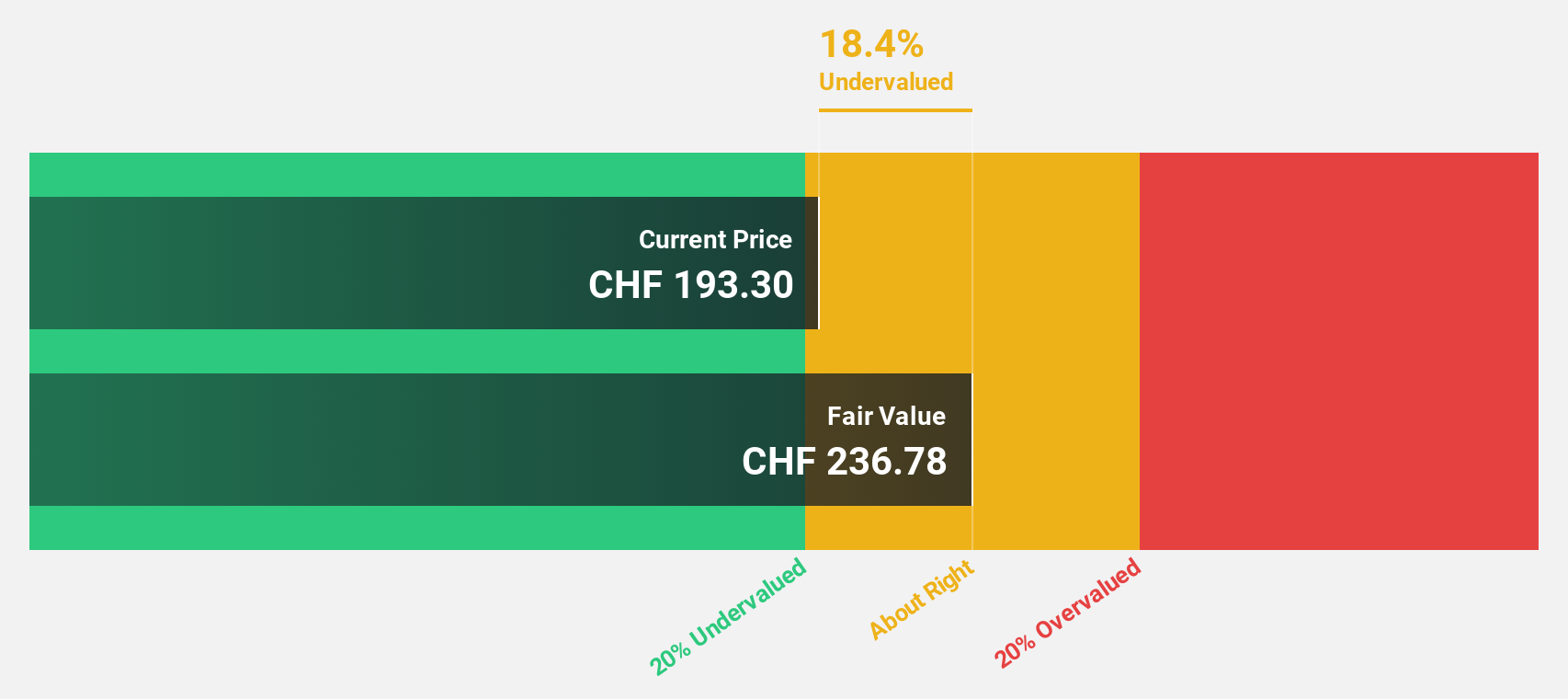

Helvetia Holding (SWX:HELN)

Overview: Helvetia Holding AG operates in life and non-life insurance and reinsurance sectors across Switzerland, Germany, Austria, Spain, Italy, France, and internationally with a market capitalization of approximately CHF 6.90 billion.

Operations: Helvetia Holding AG generates CHF 1.81 billion from its life insurance segment and CHF 7.09 billion from non-life insurance operations.

Estimated Discount To Fair Value: 13.1%

Helvetia Holding, priced at CHF 130.6, is considered undervalued against a fair value of CHF 150.2, reflecting a moderate discrepancy. While the company's earnings are projected to increase by 22.7% annually, surpassing the Swiss market's growth rate of 8.3%, its return on equity is expected to remain low at 14.3%. Additionally, despite revenue growth forecasts of 7.2% per year outpacing the market average of 4.7%, Helvetia's dividends are poorly covered by earnings and profit margins have declined from last year’s figures.

- Insights from our recent growth report point to a promising forecast for Helvetia Holding's business outlook.

- Click to explore a detailed breakdown of our findings in Helvetia Holding's balance sheet health report.

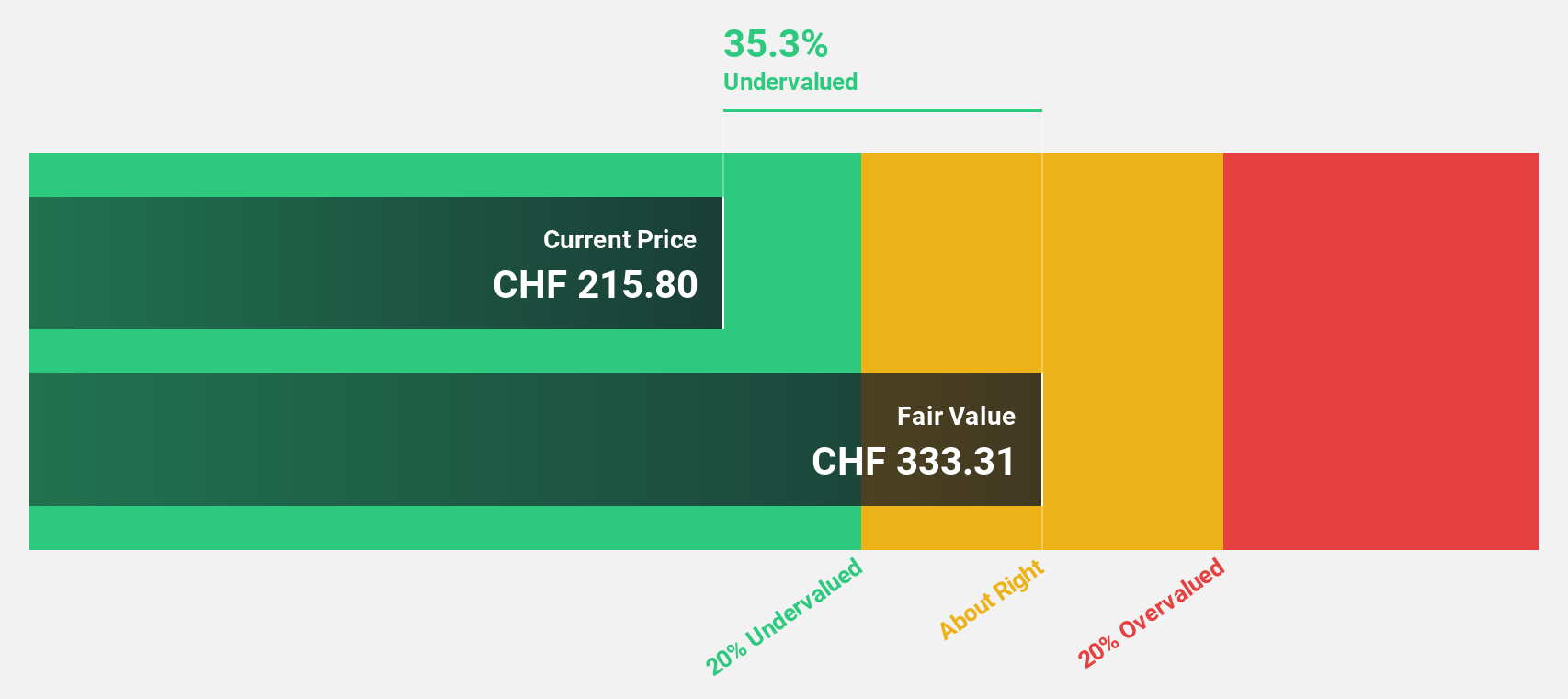

Sika (SWX:SIKA)

Overview: Sika AG is a specialty chemicals company that offers products and systems for bonding, sealing, damping, reinforcing, and protecting in the construction and automotive industries globally, with a market capitalization of CHF 42.66 billion.

Operations: Sika generates CHF 9.45 billion from its construction industry products and CHF 1.78 billion from industrial manufacturing products.

Estimated Discount To Fair Value: 22.4%

Sika, with a current trading price of CHF 265.9, is perceived as undervalued based on DCF analysis, showing a significant gap below its fair value of CHF 342.54. Despite this potential for value, Sika's forecasted earnings growth at 13.05% per year and revenue growth at 6.2% per year are modest compared to more aggressive market averages. The company's strategic expansions in China and Peru underscore its commitment to innovation and market penetration but also highlight the challenges of managing high debt levels while pursuing growth in competitive sectors.

- Our expertly prepared growth report on Sika implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Sika.

Taking Advantage

- Dive into all 15 of the Undervalued SIX Swiss Exchange Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SIKA

Sika

A specialty chemicals company, develops, produces, and sells systems and products for bonding, sealing, damping, reinforcing, and protecting in the building sector and motor vehicle industry worldwide.

Reasonable growth potential with adequate balance sheet.