- Switzerland

- /

- Chemicals

- /

- SWX:GIVN

Assessing Givaudan's (SWX:GIVN) Valuation Following J.P. Morgan Downgrade on Prestige Fragrance Slowdown

Reviewed by Kshitija Bhandaru

J.P. Morgan’s recent downgrade of Givaudan (SWX:GIVN) has sparked discussion among investors. The move comes as the fine fragrance segment, especially prestige fragrances, faces a slowdown. This slowdown is likely to weigh on growth projections for 2026.

See our latest analysis for Givaudan.

While Givaudan’s participation at recent industry conferences has kept it in the spotlight, the market hasn’t been kind this year. After a tough stretch, the stock shows a year-to-date share price return of -15.3%, and the 1-year total shareholder return is down 23.2%. Despite this, Givaudan’s three-year total shareholder return stands at a healthy 24.6%, which underscores longer-term resilience even as short-term momentum cools.

If sector shifts have you scanning for new opportunities, it might be time to broaden your search and uncover fast growing stocks with high insider ownership

But with the share price now nearly 20% below analyst targets and recent growth concerns weighing on sentiment, could Givaudan be trading at an attractive discount, or is the market already factoring in any future upside?

Most Popular Narrative: 16% Undervalued

At CHF 3,341, Givaudan shares are well below the narrative-derived fair value of CHF 3,996. This gap is catching investors’ attention. This pricing difference highlights the central debate: do Givaudan’s projected growth drivers stand up to market skepticism, or is there hidden value waiting to be unlocked?

*The company continues to outpace industry peers, in part due to its innovation pipeline. Launches of sustainable, natural ingredients (for example, FDA-approved color solutions and algae-derived beauty actives) directly align with consumer shifts toward health, wellness, and clean label products, supporting both top-line growth and potential margin expansion.*

What’s behind this bold valuation call? It hinges on major revenue and profit upgrades, as well as a future PE ratio that would surprise most. Craving the details? Uncover the forecast assumptions giving Givaudan this edge.

Result: Fair Value of $3,996 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure from higher input costs and negative free cash flow could quickly shift the outlook if these trends persist.

Find out about the key risks to this Givaudan narrative.

Another View: Multiples Tell a Different Story

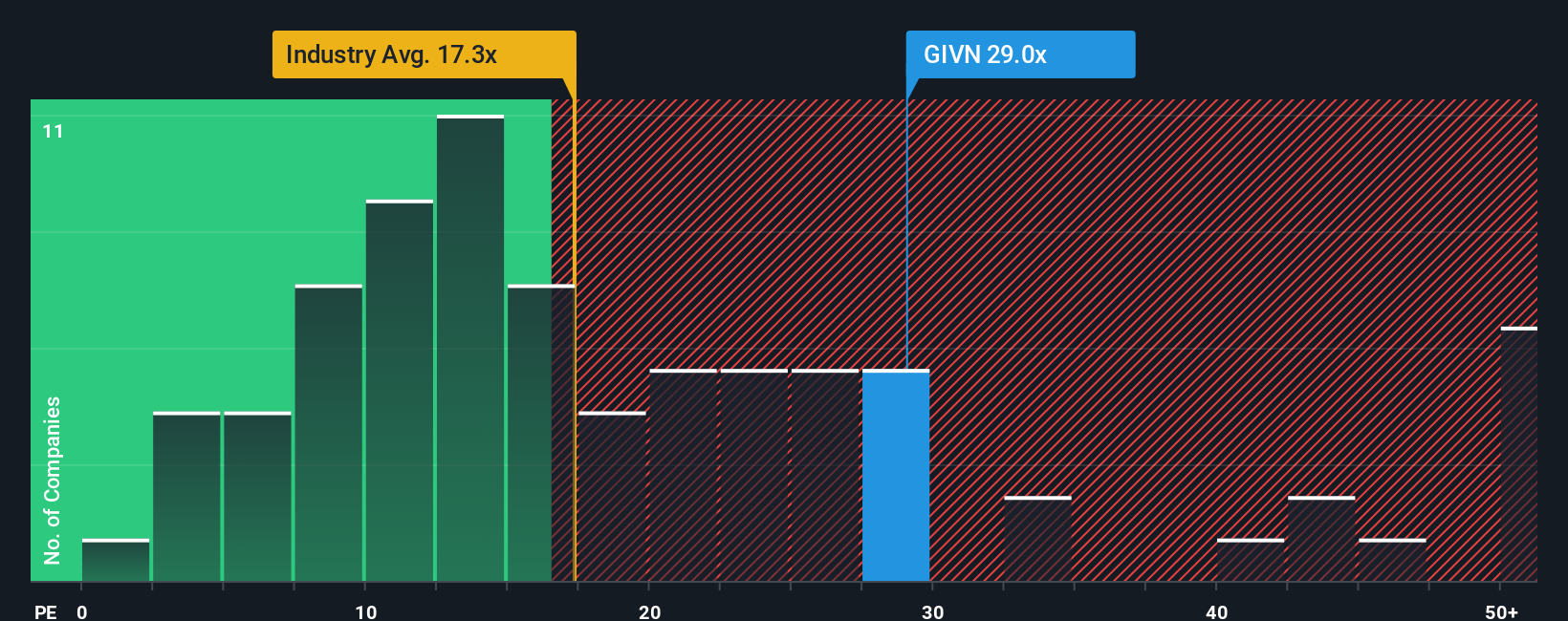

A look at Givaudan’s price-to-earnings ratio puts recent optimism under the spotlight. At 28.2x, the shares are noticeably more expensive than the European chemicals industry average of 17.1x and a peer average of 20.6x. The fair ratio, seen at 17.8x, suggests the current price leaves little margin for disappointment. Could the market be overestimating Givaudan's earnings power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Givaudan Narrative

If you see things differently, or want to dig deeper into the numbers on your own terms, you can build a personal thesis and shape your own view in just a few minutes. Do it your way

A great starting point for your Givaudan research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

There’s a world of opportunity beyond Givaudan. Make your next move count by uncovering stocks with strong potential in fast-growing, innovative sectors right now.

- Tap into high yields by checking out these 19 dividend stocks with yields > 3%, which offers steady income alongside growth prospects in diverse industries.

- Boost your strategy with the upside of these 892 undervalued stocks based on cash flows, where top picks could be flying under the market’s radar.

- Get ahead of trends and capture the momentum behind the latest breakthroughs by following these 24 AI penny stocks, making headlines in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GIVN

Givaudan

Manufactures, supplies, and sells fragrance, beauty, taste, and wellbeing products to the consumer goods industry.

Established dividend payer with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success