Discover Clariant And Two Other Stocks On SIX Swiss Exchange That May Be Undervalued

Reviewed by Simply Wall St

The Switzerland market closed weak on Tuesday as stocks drifted lower after a slightly positive move in early trades. The mood was cautious with investors looking for direction ahead of some key economic data, including inflation reports from the U.S. this week. In such uncertain times, identifying undervalued stocks can be crucial for investors seeking opportunities amidst market volatility. This article will explore Clariant and two other potentially undervalued stocks on the SIX Swiss Exchange that may present promising investment prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1224.00 | CHF1816.21 | 32.6% |

| Swissquote Group Holding (SWX:SQN) | CHF302.00 | CHF568.41 | 46.9% |

| Georg Fischer (SWX:GF) | CHF64.40 | CHF112.31 | 42.7% |

| Clariant (SWX:CLN) | CHF13.17 | CHF21.74 | 39.4% |

| lastminute.com (SWX:LMN) | CHF19.50 | CHF29.69 | 34.3% |

| SoftwareONE Holding (SWX:SWON) | CHF15.64 | CHF21.96 | 28.8% |

| Comet Holding (SWX:COTN) | CHF334.00 | CHF663.33 | 49.6% |

| Emmi (SWX:EMMN) | CHF873.00 | CHF1606.37 | 45.7% |

| SGS (SWX:SGSN) | CHF93.58 | CHF145.83 | 35.8% |

| Dätwyler Holding (SWX:DAE) | CHF172.60 | CHF249.65 | 30.9% |

Let's explore several standout options from the results in the screener.

Clariant (SWX:CLN)

Overview: Clariant AG develops, manufactures, distributes, and sells specialty chemicals globally and has a market cap of CHF4.33 billion.

Operations: Clariant's revenue segments include Catalysis (CHF927 million), Care Chemicals (CHF2.22 billion), and Adsorbents & Additives (CHF1.02 billion).

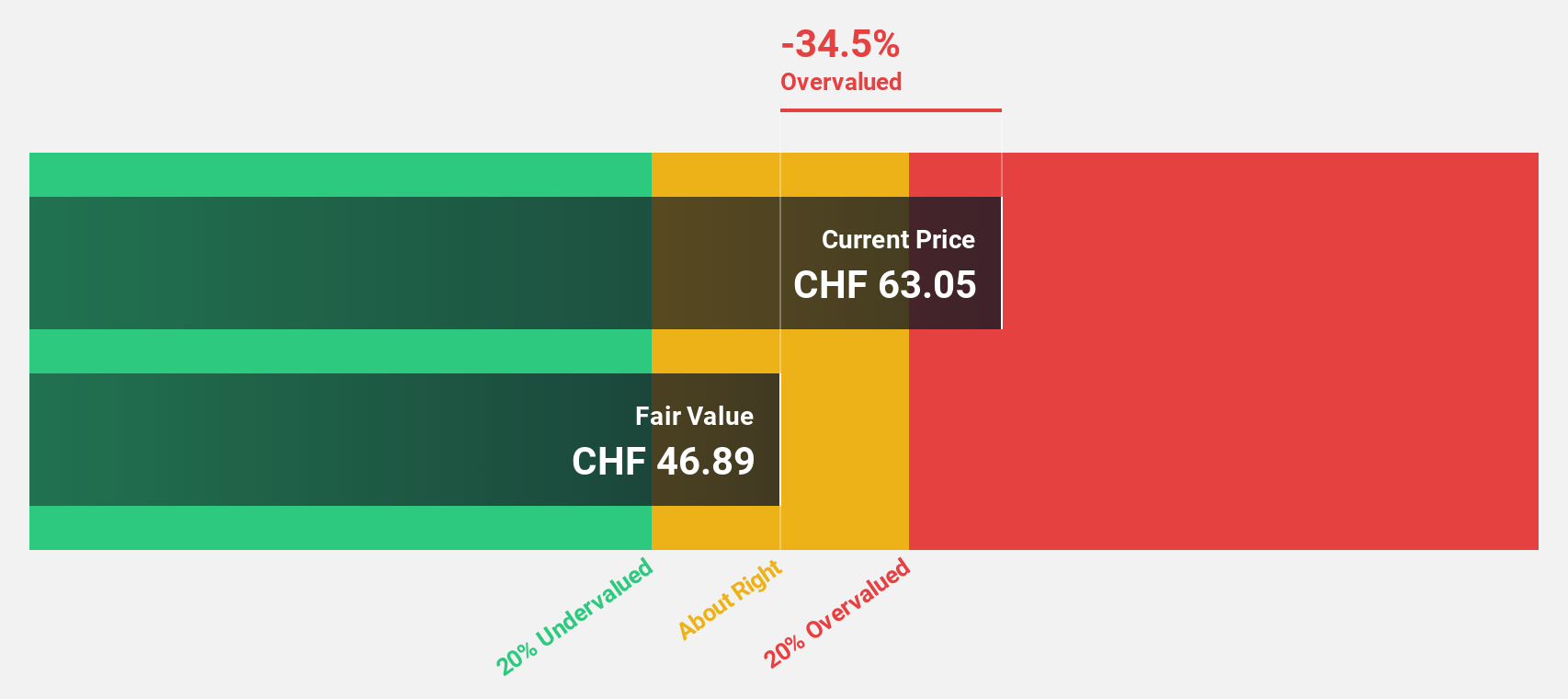

Estimated Discount To Fair Value: 39.4%

Clariant is trading at CHF13.17, significantly below its estimated fair value of CHF21.74, indicating it may be undervalued based on cash flows. Despite a challenging first half in 2024 with sales dropping to CHF2.07 billion and net income falling to CHF157 million, the company remains profitable and forecasts earnings growth of 30.2% annually over the next three years, outpacing the Swiss market's expected growth rate of 11.9%. However, its dividend coverage is weak and debt levels are high.

- Our earnings growth report unveils the potential for significant increases in Clariant's future results.

- Get an in-depth perspective on Clariant's balance sheet by reading our health report here.

Georg Fischer (SWX:GF)

Overview: Georg Fischer AG provides piping systems, casting, and machining solutions globally with a market cap of CHF 5.27 billion.

Operations: The company's revenue segments include CHF 1.99 billion from piping systems, CHF 901 million from casting solutions, and CHF 853 million from machining solutions.

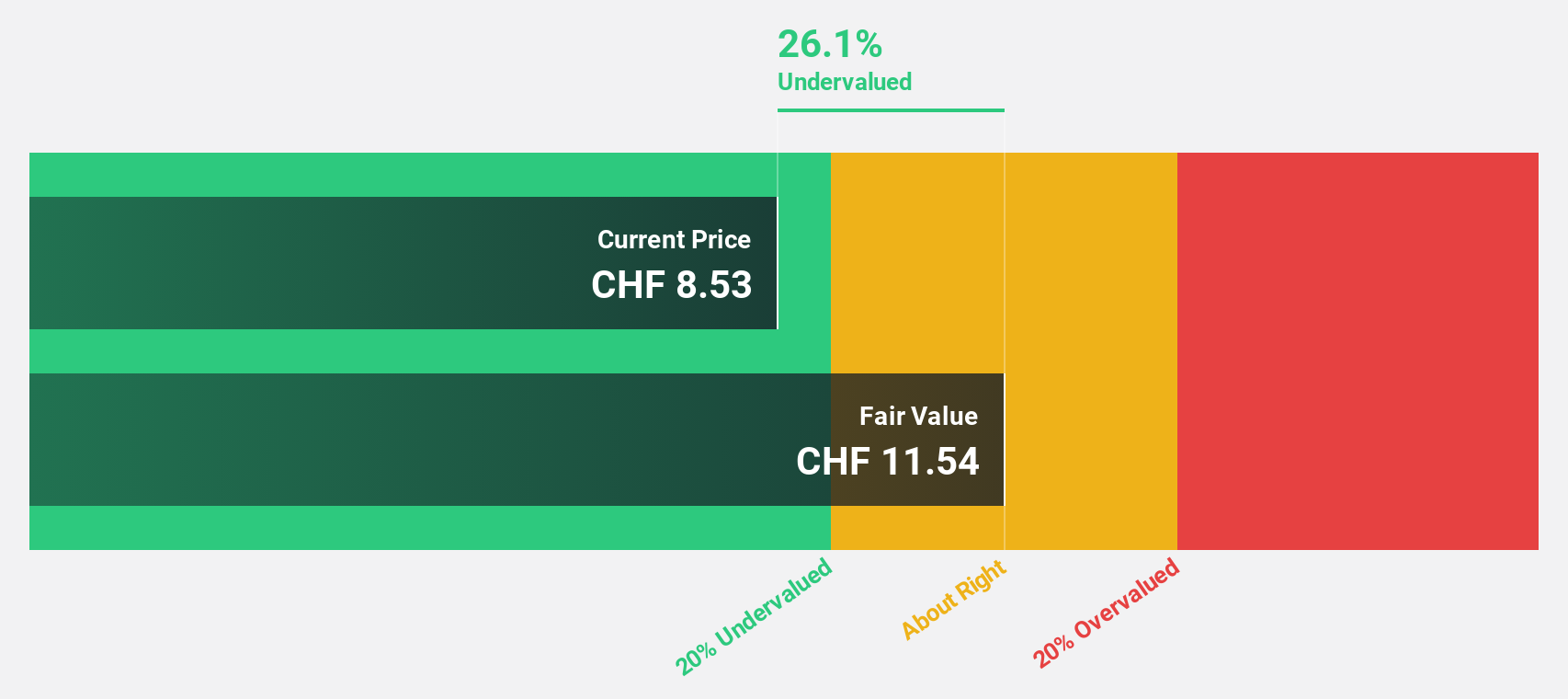

Estimated Discount To Fair Value: 42.7%

Georg Fischer AG, trading at CHF64.4, appears undervalued with an estimated fair value of CHF112.31. Despite a revenue increase to CHF2.43 billion for the first half of 2024, net income fell to CHF97 million from CHF123 million a year ago, impacting profit margins (4.6% vs 6.8%). Earnings are forecast to grow significantly at 23% annually over the next three years, outperforming the Swiss market's expected growth rate of 11.9%. However, debt coverage by operating cash flow remains weak and its dividend track record is unstable.

- In light of our recent growth report, it seems possible that Georg Fischer's financial performance will exceed current levels.

- Click here to discover the nuances of Georg Fischer with our detailed financial health report.

Sensirion Holding (SWX:SENS)

Overview: Sensirion Holding AG, with a market cap of CHF1.07 billion, develops, produces, sells, and services sensor systems, modules, and components globally.

Operations: Revenue from sensor systems, modules, and components amounted to CHF237.91 million.

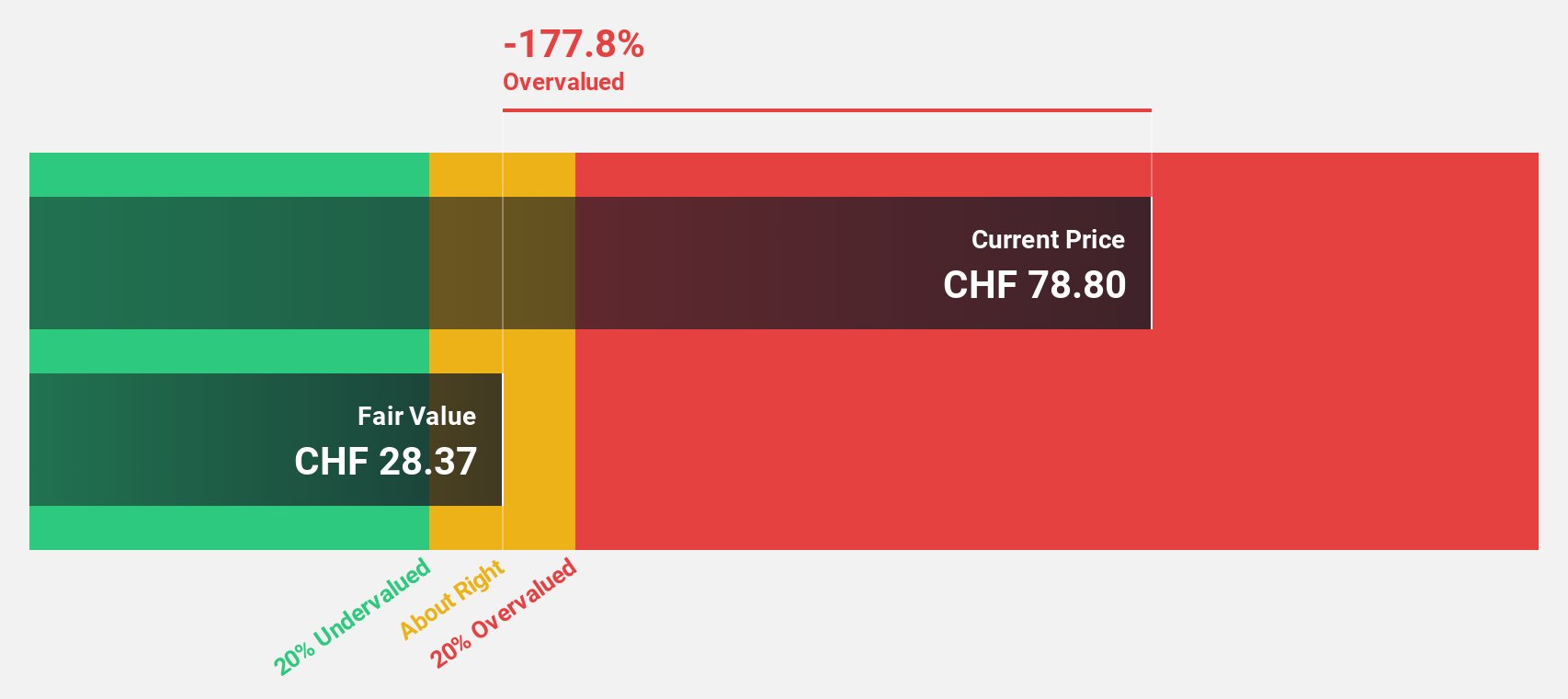

Estimated Discount To Fair Value: 24.5%

Sensirion Holding AG, trading at CHF68.5, is undervalued with an estimated fair value of CHF90.74. Despite recent half-year earnings showing a net loss of CHF36.01 million compared to a net income of CHF1.43 million last year, the stock trades 24.5% below its fair value estimate and is forecasted to see revenue growth of 14% annually, outpacing the Swiss market's 4.4%. Earnings are expected to grow significantly at 104.68% per year over the next three years, although return on equity remains modest at 13.5%.

- Insights from our recent growth report point to a promising forecast for Sensirion Holding's business outlook.

- Navigate through the intricacies of Sensirion Holding with our comprehensive financial health report here.

Seize The Opportunity

- Delve into our full catalog of 17 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet with reasonable growth potential.