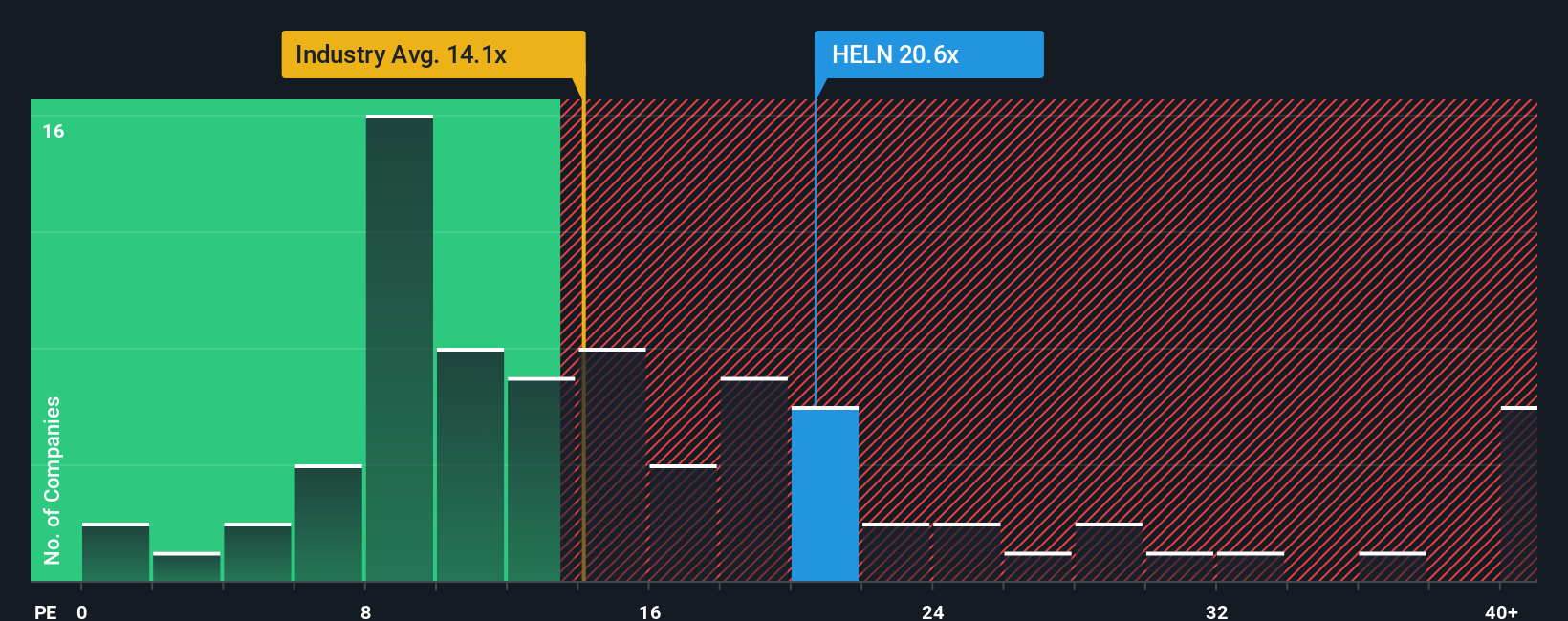

There wouldn't be many who think Helvetia Holding AG's (VTX:HELN) price-to-earnings (or "P/E") ratio of 20.6x is worth a mention when the median P/E in Switzerland is similar at about 20x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

With earnings growth that's superior to most other companies of late, Helvetia Holding has been doing relatively well. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Helvetia Holding

How Is Helvetia Holding's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Helvetia Holding's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 72%. Still, incredibly EPS has fallen 2.0% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 11% per year over the next three years. Meanwhile, the rest of the market is forecast to expand by 8.9% per annum, which is not materially different.

With this information, we can see why Helvetia Holding is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Helvetia Holding maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. Unless these conditions change, they will continue to support the share price at these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Helvetia Holding, and understanding should be part of your investment process.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Helvetia Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:HELN

Helvetia Holding

Engages in life and non-life insurance, and reinsurance business in Switzerland, Germany, Austria, Spain, Italy, France, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives