- Switzerland

- /

- Personal Products

- /

- SWX:LLQ

Lalique Group SA's (VTX:LLQ) 30% Jump Shows Its Popularity With Investors

Lalique Group SA (VTX:LLQ) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 8.2% isn't as impressive.

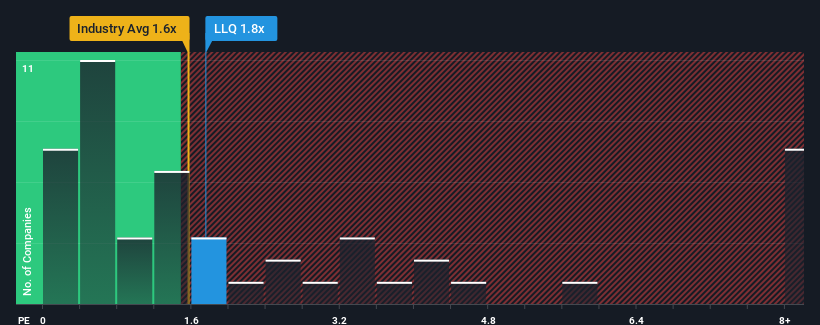

Even after such a large jump in price, it's still not a stretch to say that Lalique Group's price-to-sales (or "P/S") ratio of 1.8x right now seems quite "middle-of-the-road" compared to the Personal Products industry in Switzerland, where the median P/S ratio is around 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Lalique Group

What Does Lalique Group's Recent Performance Look Like?

Recent revenue growth for Lalique Group has been in line with the industry. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think Lalique Group's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Lalique Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 5.5% gain to the company's revenues. Pleasingly, revenue has also lifted 62% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 5.9% over the next year. That's shaping up to be similar to the 5.7% growth forecast for the broader industry.

With this in mind, it makes sense that Lalique Group's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does Lalique Group's P/S Mean For Investors?

Lalique Group appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Lalique Group maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

You need to take note of risks, for example - Lalique Group has 4 warning signs (and 1 which is potentially serious) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:LLQ

Lalique Group

Lalique Group SA creates, develops, markets, and distributes luxury goods worldwide.

Adequate balance sheet slight.

Market Insights

Community Narratives