- Switzerland

- /

- Food

- /

- SWX:BARN

3 Stocks On SIX Swiss Exchange Estimated To Be Trading At Up To 38.8% Discount

Reviewed by Simply Wall St

The Switzerland market ended notably lower on Thursday due to sustained selling at several counters amid concerns about a slowdown in global economic growth. Data showing an increase in Swiss unemployment weighed as well, with the benchmark SMI ending down 144.83 points or 1.19% at 12,031.34. In such uncertain times, identifying undervalued stocks can offer potential opportunities for investors seeking value amidst broader market declines. Here are three stocks on the SIX Swiss Exchange estimated to be trading at up to a 38.8% discount that may warrant closer examination given the current economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1190.00 | CHF1829.80 | 35% |

| ALSO Holding (SWX:ALSN) | CHF256.50 | CHF413.09 | 37.9% |

| Georg Fischer (SWX:GF) | CHF64.20 | CHF113.89 | 43.6% |

| lastminute.com (SWX:LMN) | CHF18.70 | CHF29.69 | 37% |

| Comet Holding (SWX:COTN) | CHF312.00 | CHF531.88 | 41.3% |

| Clariant (SWX:CLN) | CHF12.75 | CHF21.68 | 41.2% |

| Barry Callebaut (SWX:BARN) | CHF1451.00 | CHF2370.57 | 38.8% |

| SGS (SWX:SGSN) | CHF94.60 | CHF145.34 | 34.9% |

| SoftwareONE Holding (SWX:SWON) | CHF15.16 | CHF22.13 | 31.5% |

| Sensirion Holding (SWX:SENS) | CHF62.50 | CHF91.55 | 31.7% |

Let's uncover some gems from our specialized screener.

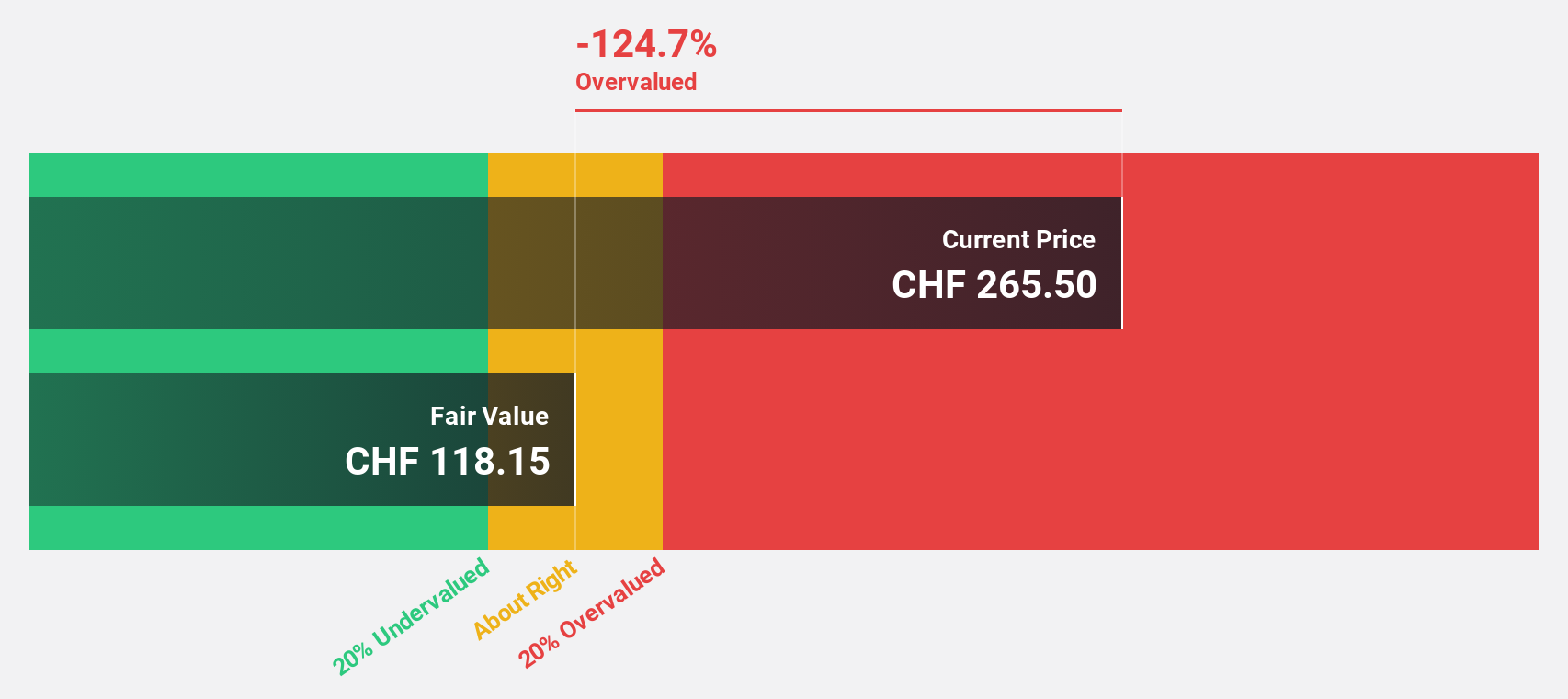

ALSO Holding (SWX:ALSN)

Overview: ALSO Holding AG is a technology services provider for the ICT industry operating in Switzerland, Germany, the Netherlands, Poland, and internationally with a market cap of CHF3.14 billion.

Operations: The company generates revenue of €4.62 billion from Central Europe and €5.24 billion from Northern/Eastern Europe.

Estimated Discount To Fair Value: 37.9%

ALSO Holding is trading at CHF256.5, significantly below its estimated fair value of CHF413.09, suggesting it may be undervalued based on cash flows. Despite recent earnings showing a decline in sales to €4.28 billion and net income to €41.66 million for H1 2024, the company's revenue is forecast to grow at 12% annually, outpacing the Swiss market's 4.4%. Additionally, earnings are expected to grow significantly at 24% per year over the next three years.

- The growth report we've compiled suggests that ALSO Holding's future prospects could be on the up.

- Dive into the specifics of ALSO Holding here with our thorough financial health report.

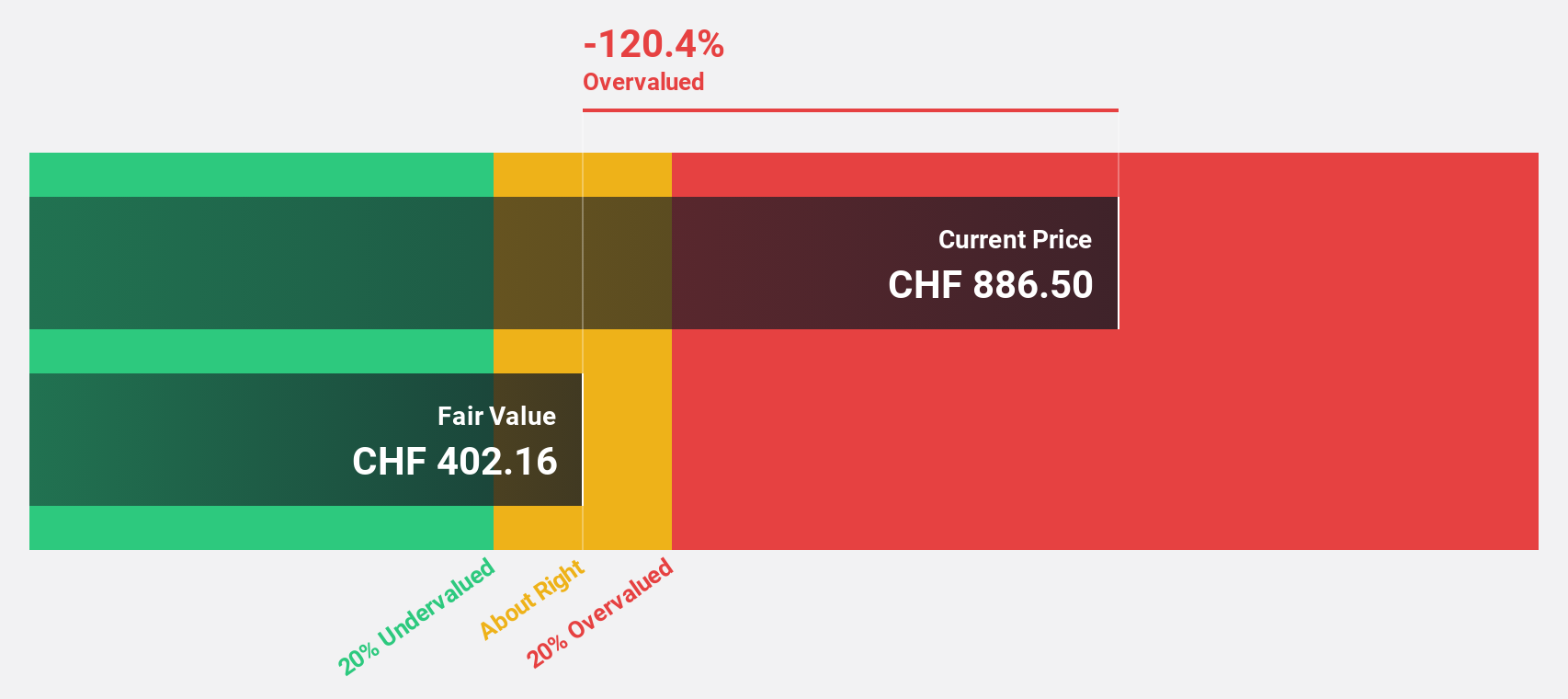

Barry Callebaut (SWX:BARN)

Overview: Barry Callebaut AG, with a market cap of CHF7.94 billion, manufactures and sells chocolate and cocoa products through its subsidiaries.

Operations: Barry Callebaut generates revenue of CHF5.31 billion from its Global Cocoa segment.

Estimated Discount To Fair Value: 38.8%

Barry Callebaut, trading at CHF1451, is significantly undervalued compared to its estimated fair value of CHF2370.57. Despite a low forecasted Return on Equity (14.8%), the company's revenue and earnings are expected to grow faster than the Swiss market, with annual growth rates of 6% and 25.3%, respectively. However, debt coverage by operating cash flow is inadequate, and its 2% dividend is not well covered by free cash flows.

- Our comprehensive growth report raises the possibility that Barry Callebaut is poised for substantial financial growth.

- Get an in-depth perspective on Barry Callebaut's balance sheet by reading our health report here.

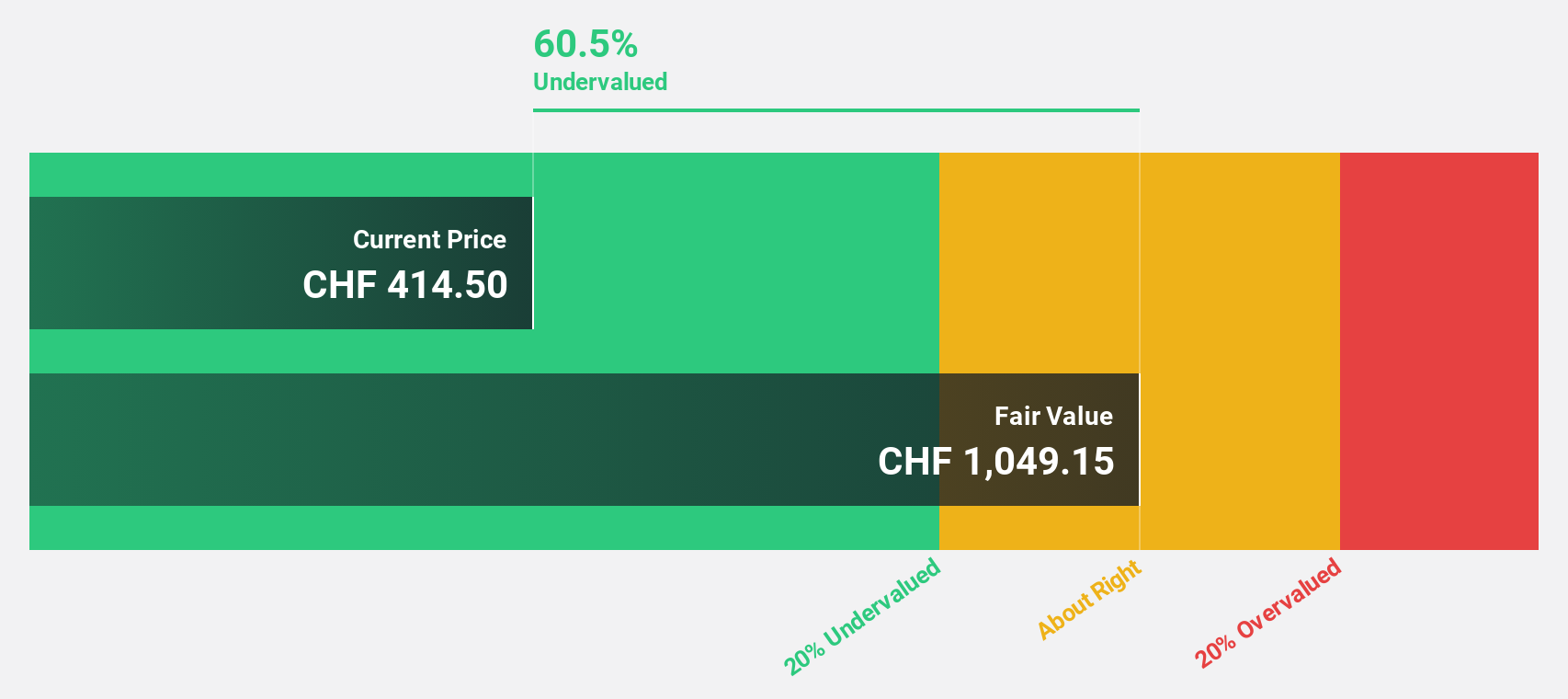

Ypsomed Holding (SWX:YPSN)

Overview: Ypsomed Holding AG, with a market cap of CHF5.75 billion, develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies through its subsidiaries.

Operations: Ypsomed generates revenue from two primary segments: Ypsomed Diabetes Care, which contributes CHF151.05 million, and Ypsomed Delivery Systems, adding CHF385.15 million.

Estimated Discount To Fair Value: 21.2%

Ypsomed Holding, trading at CHF421.5, is undervalued by over 20% compared to its estimated fair value of CHF535.05. The company's earnings are forecast to grow significantly at 33.3% per year, outpacing the Swiss market's growth rate of 11.7%. Recent collaboration with Astria Therapeutics for an autoinjector development could enhance future cash flows and profitability, although Ypsomed's Return on Equity is projected to remain modest at 17.8%.

- Our growth report here indicates Ypsomed Holding may be poised for an improving outlook.

- Take a closer look at Ypsomed Holding's balance sheet health here in our report.

Where To Now?

- Click through to start exploring the rest of the 16 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barry Callebaut might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BARN

Barry Callebaut

Engages in the manufacture and sale of chocolate and cocoa products.

Reasonable growth potential with adequate balance sheet and pays a dividend.