- Switzerland

- /

- Electric Utilities

- /

- SWX:NEAG

Undiscovered Gems In Switzerland To Watch This September 2024

Reviewed by Simply Wall St

The Switzerland market ended notably lower on Thursday due to sustained selling at several counters amid concerns about a slowdown in global economic growth. Data showing an increase in Swiss unemployment weighed as well, with the benchmark SMI ending down 144.83 points or 1.19% at 12,031.34, the day's low. In light of these market conditions, identifying undiscovered gems can provide unique opportunities for investors seeking resilience and potential growth in uncertain times. Here are three small-cap stocks from Switzerland that stand out this September 2024 for their strong fundamentals and promising outlooks despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide with a market cap of CHF1.20 billion.

Operations: The company's revenue streams are segmented by region, with CHF352.67 million from the Americas, CHF273.16 million from Asia-Pacific, and CHF452.85 million from Europe, Middle East, and Africa.

CFT, a financial services firm, has been trading at 32.6% below our estimate of its fair value. Over the past year, earnings grew by 16.1%, outpacing the Capital Markets industry’s -12.1%. The company reported half-year revenue of CHF 538.34 million and net income of CHF 59.99 million as of June 2024. Basic earnings per share increased to CHF 7.98 from CHF 6.86 last year, despite some shareholder dilution in the past year.

naturenergie holding (SWX:NEAG)

Simply Wall St Value Rating: ★★★★★★

Overview: Naturenergie Holding AG, with a market cap of CHF1.28 billion, operates through its subsidiaries to produce, distribute, and sell electricity under the naturenergie brand in Switzerland and internationally.

Operations: Naturenergie Holding AG generates revenue primarily from Customer-Oriented Energy Solutions (€1.15 billion), Renewable Generation Infrastructure (€1.09 billion), and System Relevant Infrastructure (€403.50 million). The company has a market cap of CHF1.28 billion

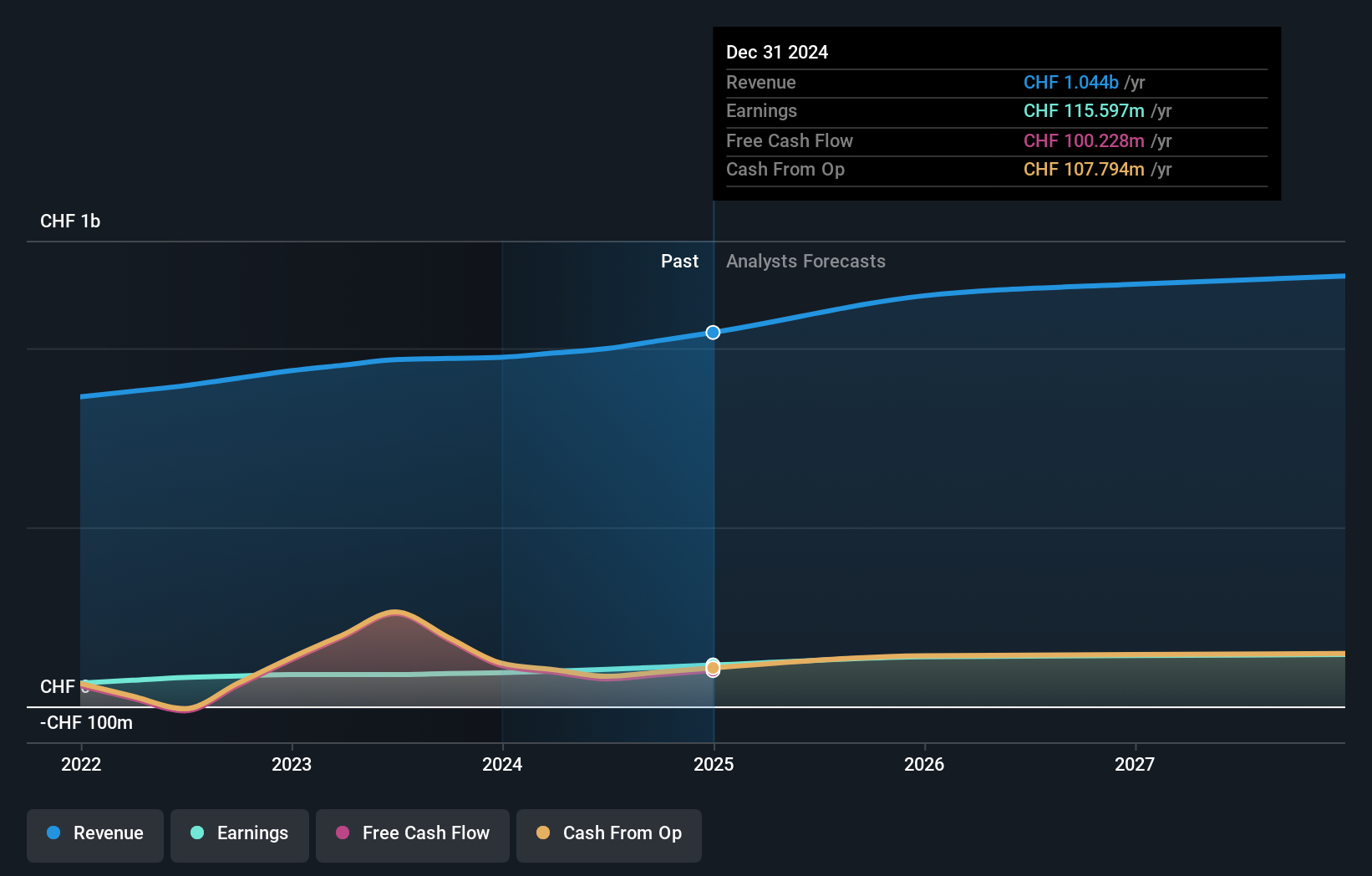

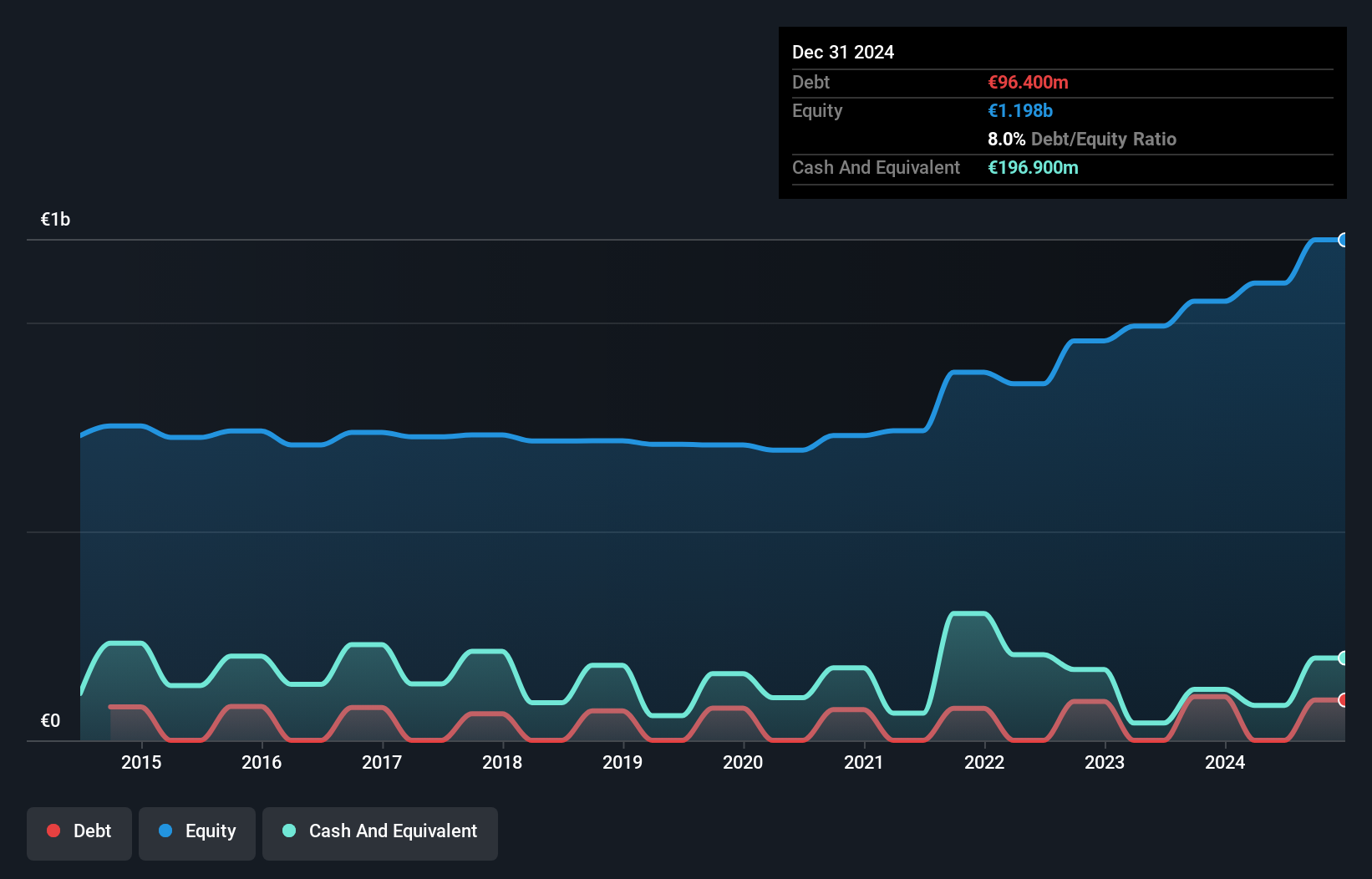

Naturenergie Holding, a small cap in the electric utilities sector, has shown impressive growth with earnings up 40.5% over the past year, surpassing industry growth of 1.3%. Trading at a P/E ratio of 11.8x, it offers good value compared to the Swiss market's 21.3x. The company reported half-year sales of €868.6 million and net income of €77.2 million, reflecting robust performance despite lower sales compared to last year’s €972.5 million.

- Unlock comprehensive insights into our analysis of naturenergie holding stock in this health report.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.52 billion.

Operations: The company's revenue streams include Tamedia (CHF 427 million), Goldbach (CHF 299.10 million), 20 Minutes (CHF 115.60 million), TX Markets (CHF 126.40 million), and Groups & Ventures (CHF 159.40 million).

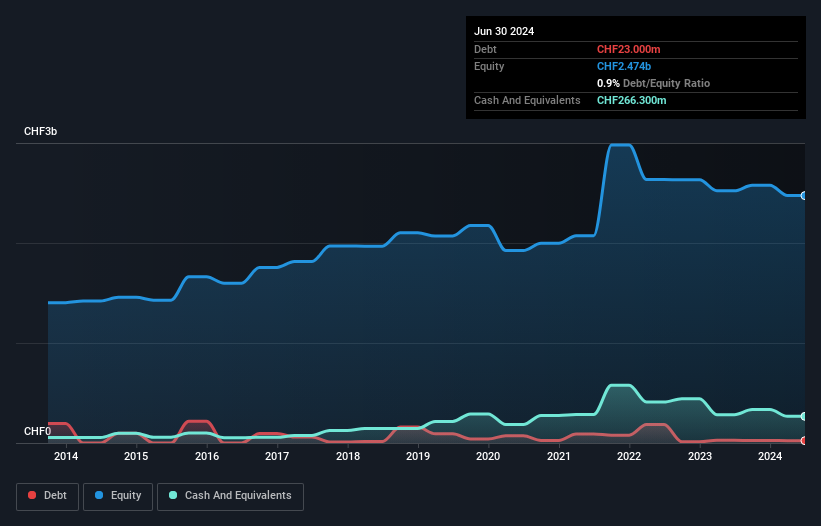

TX Group, a Swiss media company, reported CHF 461 million in revenue for H1 2024, nearly matching last year's CHF 460.5 million. Net income swung to CHF 9.6 million from a previous loss of CHF 1.4 million. Over the past five years, its debt-to-equity ratio improved from 4.4% to 0.9%. The company trades at a significant discount of about 65% below estimated fair value and is expected to grow earnings by approximately 14% annually moving forward.

- Click here to discover the nuances of TX Group with our detailed analytical health report.

Gain insights into TX Group's past trends and performance with our Past report.

Summing It All Up

- Unlock our comprehensive list of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NEAG

naturenergie holding

Through its subsidiaries, engages in the production, distribution, and sale of electricity under the naturenergie brand in Switzerland and internationally.

Flawless balance sheet with solid track record.