- Netherlands

- /

- Capital Markets

- /

- ENXTAM:CVC

CVC Capital Partners And 2 Other European Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As European markets navigate concerns over inflated AI stock valuations and receding expectations for a U.S. interest rate cut, the pan-European STOXX Europe 600 Index recently ended 2.21% lower, reflecting broader market apprehensions. In such an environment, identifying stocks that may be trading below their estimated value can be particularly appealing to investors seeking opportunities amidst prevailing market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.02 | €5.96 | 49.4% |

| STEICO (XTRA:ST5) | €20.25 | €40.17 | 49.6% |

| Spindox (BIT:SPN) | €12.90 | €25.17 | 48.7% |

| Roche Bobois (ENXTPA:RBO) | €35.00 | €69.47 | 49.6% |

| KB Components (OM:KBC) | SEK41.75 | SEK83.26 | 49.9% |

| HMS Bergbau (XTRA:HMU) | €52.00 | €103.88 | 49.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.395 | €0.78 | 49.7% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.19 | 49.6% |

| EcoUp Oyj (HLSE:ECOUP) | €1.36 | €2.66 | 48.9% |

| Delivery Hero (XTRA:DHER) | €16.31 | €31.97 | 49% |

Here we highlight a subset of our preferred stocks from the screener.

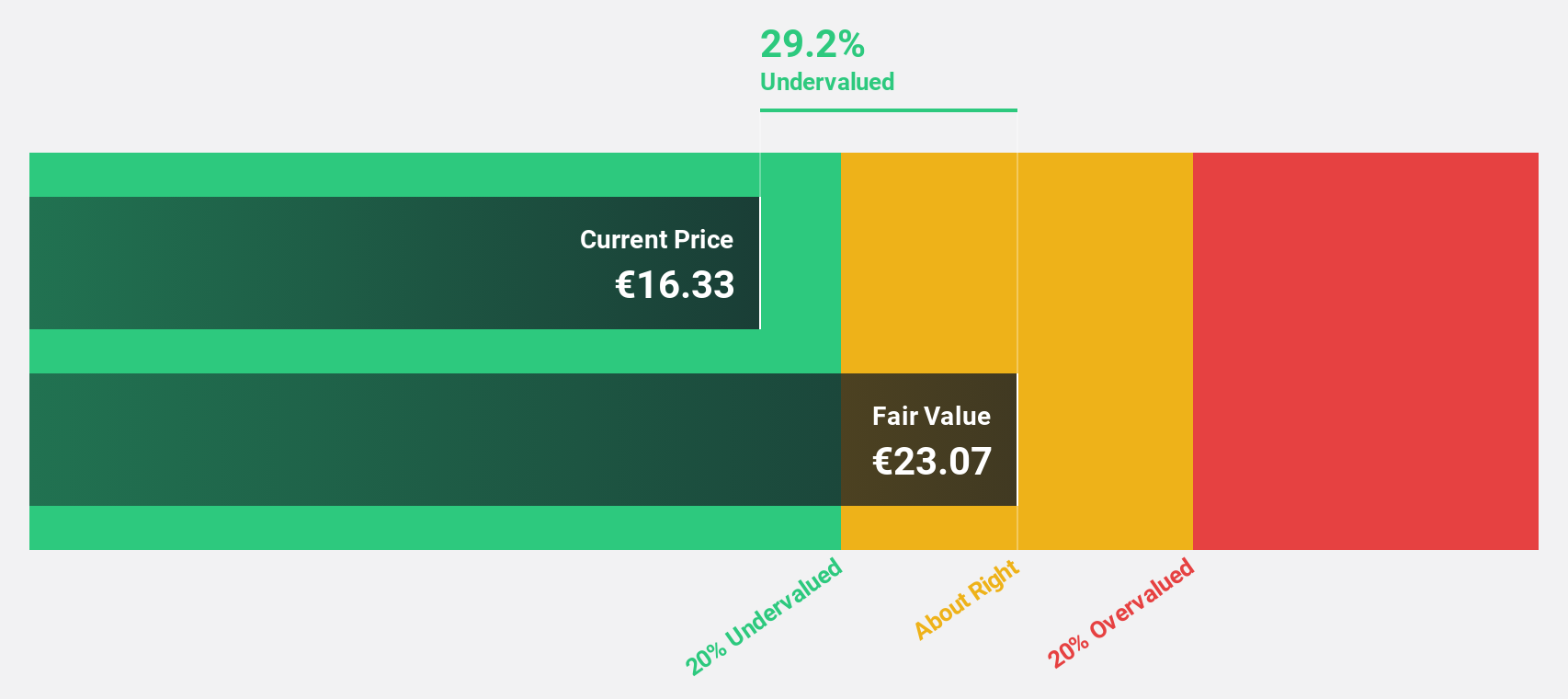

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €15 billion.

Operations: The firm's revenue is primarily derived from its Private Equity segment (€951.11 million), followed by Credit (€197.65 million) and Secondaries (€124.38 million).

Estimated Discount To Fair Value: 22.2%

CVC Capital Partners is trading at €14.12, significantly below its estimated fair value of €18.14, suggesting undervaluation based on discounted cash flow analysis. Despite high debt levels, the company's earnings are forecast to grow 13.07% annually, outpacing the Dutch market's 11.7%. Recent earnings showed substantial growth with net income reaching €573.73 million for H1 2025 compared to €44.79 million a year ago, highlighting strong cash flow potential amidst ongoing strategic M&A activities in enterprise tech sectors.

- The growth report we've compiled suggests that CVC Capital Partners' future prospects could be on the up.

- Dive into the specifics of CVC Capital Partners here with our thorough financial health report.

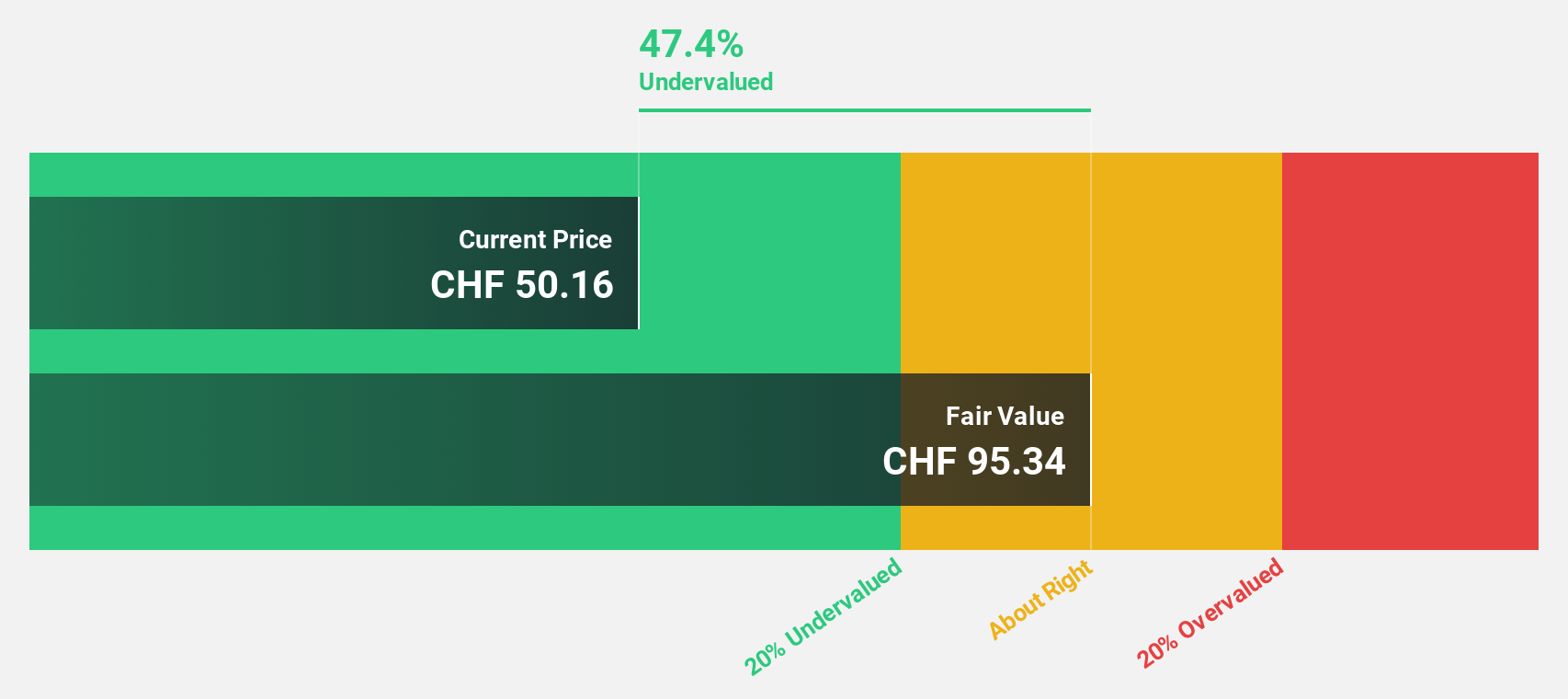

Sandoz Group (SWX:SDZ)

Overview: Sandoz Group AG is a global company that develops, manufactures, and markets generic pharmaceuticals and biosimilars, with a market cap of CHF23.95 billion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, which generated $10.59 billion.

Estimated Discount To Fair Value: 37.4%

Sandoz Group is trading at CHF55.6, substantially below its fair value estimate of CHF88.81, indicating undervaluation based on cash flow analysis. The company's earnings are projected to grow significantly at 29.8% annually, surpassing the Swiss market's 10.4% growth rate. Despite low return on equity forecasts and interest payments not well covered by earnings, recent strategic moves like the global license agreement for a biosimilar oncology medicine highlight potential for enhanced cash flows and market positioning in the biosimilars sector.

- Our expertly prepared growth report on Sandoz Group implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Sandoz Group with our comprehensive financial health report here.

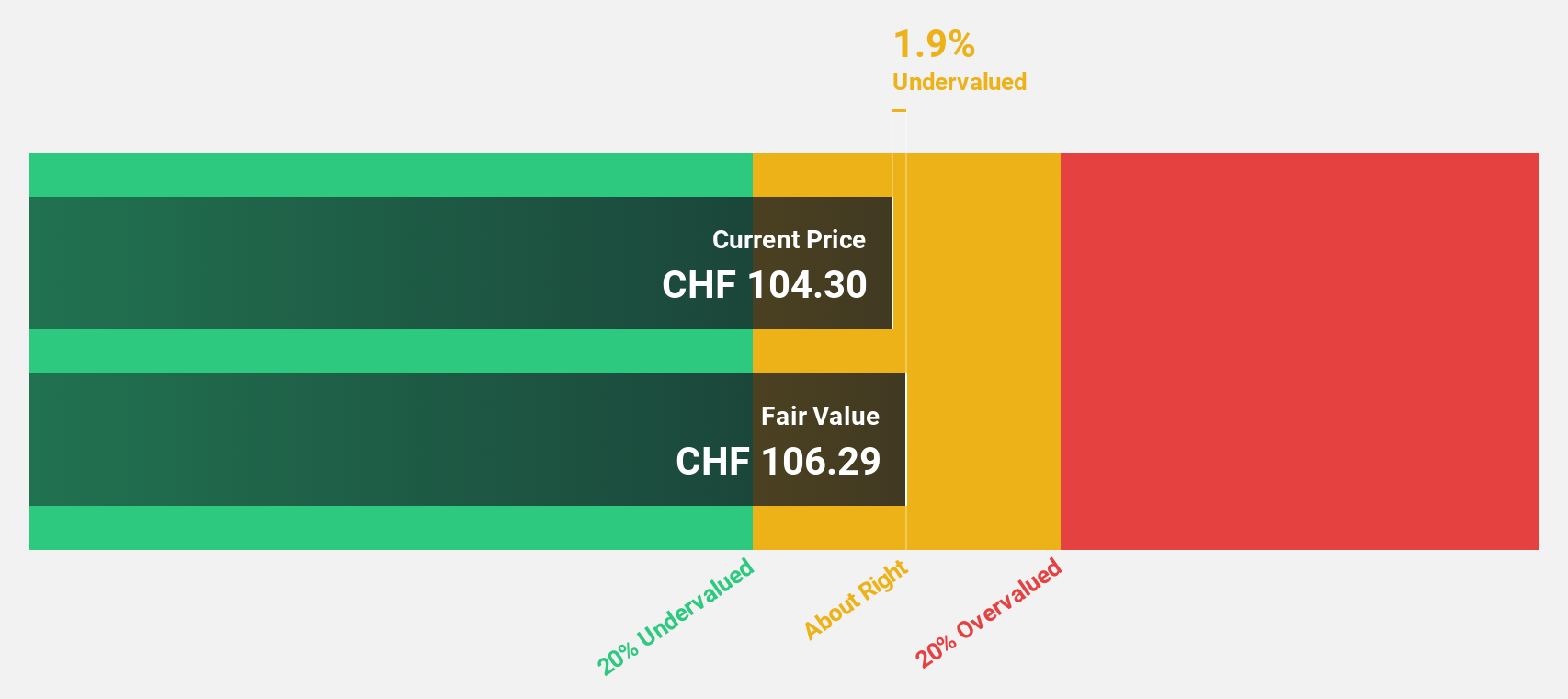

Straumann Holding (SWX:STMN)

Overview: Straumann Holding AG is a global provider of tooth replacement and orthodontic solutions, with a market cap of CHF15.74 billion.

Operations: The company's revenue is derived from its operations, with CHF1.38 billion from Europe, Middle East and Africa (EMEA), CHF783.18 million from North America (NAM), CHF655.77 million from Asia Pacific (APAC), and CHF292.92 million from Latin America (LATAM).

Estimated Discount To Fair Value: 38.4%

Straumann Holding is trading at CHF98.7, significantly below its estimated fair value of CHF160.28, suggesting it is undervalued based on cash flow analysis. Earnings are projected to grow 15% annually, outpacing the Swiss market's 10.4%. Recent strategic partnerships with Smartee aim to enhance profitability and innovation in orthodontics, potentially boosting cash flows further. Despite modest revenue growth forecasts of 8.8%, Straumann's strong international presence supports its long-term growth prospects.

- Our earnings growth report unveils the potential for significant increases in Straumann Holding's future results.

- Click here to discover the nuances of Straumann Holding with our detailed financial health report.

Summing It All Up

- Access the full spectrum of 198 Undervalued European Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:CVC

CVC Capital Partners

A private equity and venture capital firm specializing in middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature, recapitalizations, strip sales, and spinouts.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success