It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Metall Zug (VTX:METN). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Metall Zug

Metall Zug's Improving Profits

Metall Zug has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Metall Zug's EPS grew from CHF109 to CHF279, over the previous 12 months. Year on year growth of 157% is certainly a sight to behold.

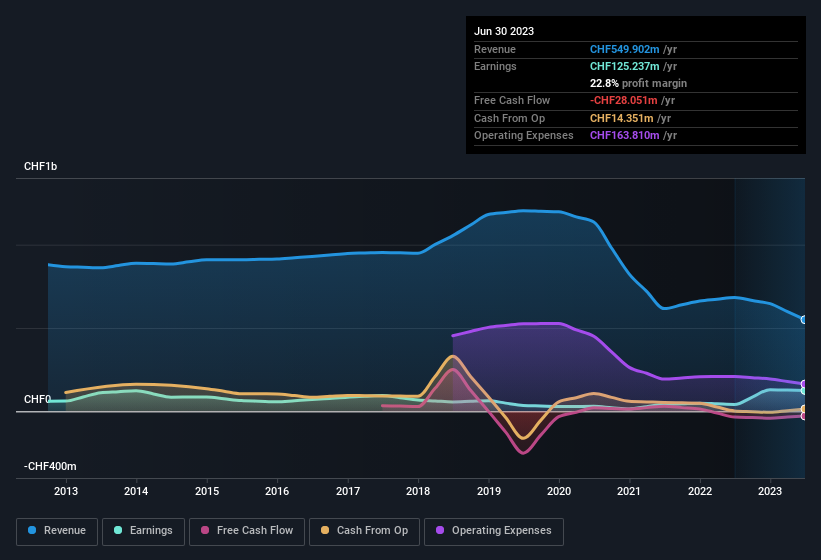

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Metall Zug's EBIT margins have actually improved by 14.2 percentage points in the last year, to reach 21%, but, on the flip side, revenue was down 20%. That's not a good look.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Metall Zug Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Metall Zug insiders own a meaningful share of the business. In fact, they own 47% of the shares, making insiders a very influential shareholder group. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. And their holding is extremely valuable at the current share price, totalling CHF304m. This is an incredible endorsement from them.

Does Metall Zug Deserve A Spot On Your Watchlist?

Metall Zug's earnings have taken off in quite an impressive fashion. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, Metall Zug is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. It is worth noting though that we have found 2 warning signs for Metall Zug (1 is potentially serious!) that you need to take into consideration.

Although Metall Zug certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:METN

Metall Zug

Through its subsidiaries, engages in the medical devices, infection control, technology cluster and infrastructure, and other businesses in Switzerland, rest of Europe, the Americas, the Asia Pacific, and internationally.

Reasonable growth potential and slightly overvalued.

Market Insights

Community Narratives