- Switzerland

- /

- Medical Equipment

- /

- SWX:MED

Medartis Holding (VTX:MED) Shareholders Have Enjoyed A 10% Share Price Gain

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. To wit, the Medartis Holding AG (VTX:MED) share price is 10% higher than it was a year ago, much better than the market return of around 0.2% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

View our latest analysis for Medartis Holding

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Medartis Holding saw its earnings per share (EPS) drop below zero. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. We might get a clue to explain the share price move by looking to other metrics.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

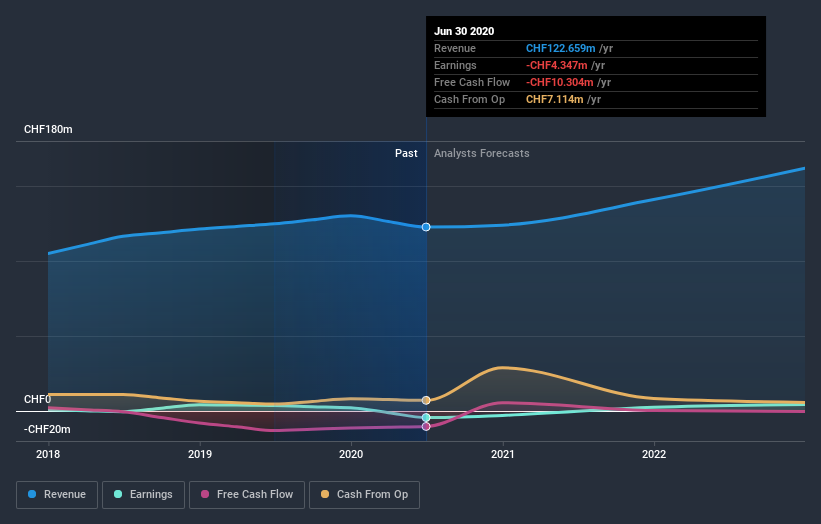

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Medartis Holding's financial health with this free report on its balance sheet.

A Different Perspective

Medartis Holding shareholders should be happy with the total gain of 10% over the last twelve months. We regret to report that the share price is down 5.8% over ninety days. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

When trading Medartis Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:MED

Medartis Holding

A medical device company, engages in the development, manufacturing, and sales of implant solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives