- Switzerland

- /

- Healthcare Services

- /

- SWX:GALE

Galenica (SWX:GALE): Evaluating Valuation After CHF 250 Million Bond Strengthens Balance Sheet

Reviewed by Simply Wall St

Galenica (SWX:GALE) made headlines by issuing a CHF 250 million fixed rate bond with a 7-year maturity at a 1.08% coupon. This strategic move strengthens long-term financing and repays earlier acquisition-related bridge debt.

See our latest analysis for Galenica.

The recent bond issuance fits into a year that has seen Galenica focus on stability and longer-term growth, with refinancing efforts building confidence. While the past month’s share price return was a modest negative 2.65%, momentum has improved, helping to deliver a solid 15.2% year-to-date share price gain. Including dividends, the one-year total shareholder return sits at an impressive 18.9%, highlighting ongoing investor optimism regarding Galenica’s strategy.

If moves like this have you looking for your next opportunity, it’s a good time to expand your search and discover fast growing stocks with high insider ownership

With a robust total return and improving balance sheet, investors might wonder if Galenica shares still offer value or if the market has already accounted for the company’s future growth prospects.

Most Popular Narrative: Fairly Valued

Compared to the last close of CHF86.45, the most widely followed narrative puts Galenica's fair value almost in lockstep with the current share price. This close alignment signals a market consensus reflecting steady confidence in the company's growth trajectory.

The shift toward pharmacy-based healthcare services, bolstered by recent regulatory changes enabling broader insurance reimbursement for preventive and interprofessional services, is likely to increase pharmacy foot traffic and higher-margin service revenues. This is expected to support future earnings growth. Expansion and promotion of proprietary and exclusive brands (e.g., Spagyros, PADMA, Cooper Consumer Health) is supporting margin improvement and product differentiation, which is expected to have a favorable impact on net margins and overall earnings.

Why does this consensus narrative back such a precise fair value? There is a hidden recipe behind the numbers— a blend of margin upgrades, revenue momentum, and cautious profit forecasts. Want to see which financial wildcards anchor this carefully calculated target? The full narrative exposes the quantitative drivers.

Result: Fair Value of CHF85.5 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing price cuts in diagnostics and increased digital competition could quickly challenge current profit expectations and disrupt Galenica’s carefully balanced outlook.

Find out about the key risks to this Galenica narrative.

Another View: The SWS DCF Model Says Shares Are Undervalued

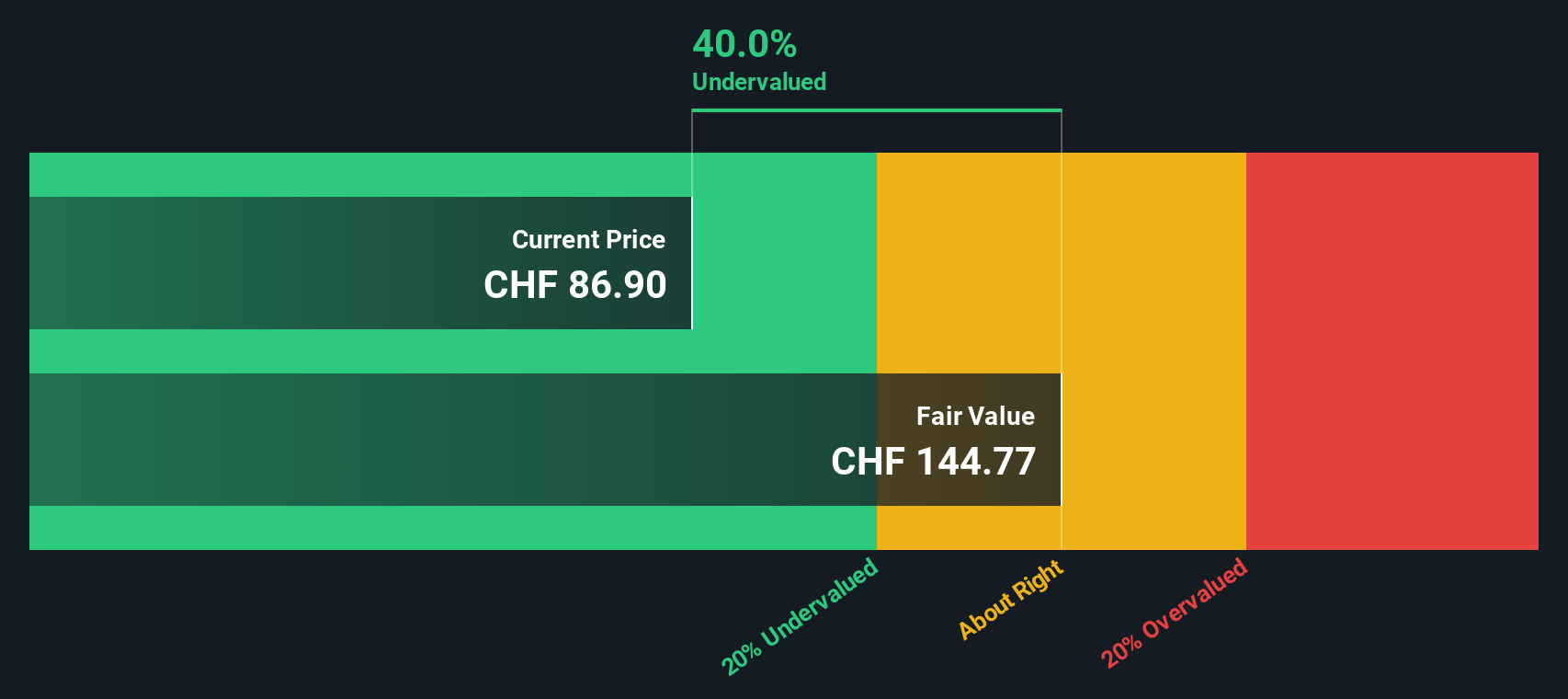

While analysts see Galenica as fairly valued based on expected earnings, our SWS DCF model arrives at a much higher fair value of CHF144.77. This represents a striking 40% above today’s price. This wide gap challenges the consensus and raises a key question: could the market be underestimating Galenica’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Galenica for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 865 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Galenica Narrative

If you have a different perspective or want to analyze the numbers firsthand, you can build your own Galenica narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Galenica.

Looking for More Smart Investment Ideas?

Why limit your opportunities to just one stock? Make your next move count by checking out new angles and industries with focused investment screens below.

- Capture the growth potential of AI-driven businesses by starting with these 25 AI penny stocks, where tomorrow’s technological leaders are emerging now.

- Secure potential income with steady, high-yield picks through these 14 dividend stocks with yields > 3%, powering your portfolio with reliable returns above 3%.

- Tap into undervalued gems ready for a turnaround using these 865 undervalued stocks based on cash flows, ensuring you never overlook the next breakout opportunity.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GALE

Galenica

Operates as a healthcare service provider in Switzerland and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives