- Switzerland

- /

- Medical Equipment

- /

- SWX:ALC

Assessing Alcon’s Valuation After Healthcare Sector Rally and Recent Share Price Jump

Reviewed by Bailey Pemberton

- Ever wondered if Alcon is a hidden gem that is flying under the radar, or if its stock price already reflects all the upside? You are not alone, and this article aims to clear things up.

- Alcon’s shares have gained 7.1% over the past week and 9.3% in the past month. However, they are still down 16.1% year-to-date and 16.8% over the last year.

- Recent news has highlighted renewed interest in the broader healthcare sector as investors look for stability amidst global market uncertainty. Several industry partnerships and R&D milestones have put leading medical device companies like Alcon back into focus, helping explain the jump in its stock price.

- On the value front, Alcon scores a 4 out of 6 on our valuation checks. This suggests there is more to discuss than meets the eye. We will break down these approaches next, and introduce a smarter way to think about valuation by the end of the article.

Approach 1: Alcon Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates the intrinsic value of a company by predicting its future cash flows and then discounting those cash flows back to today's value. This approach helps investors understand what a business is truly worth, based purely on the cash it can generate over time.

For Alcon, the most recent Free Cash Flow (FCF) reported was $1.30 billion over the last twelve months. Analyst forecasts suggest that this figure will grow steadily, with estimates reaching $2.38 billion by 2029. Projections beyond five years are not direct analyst inputs; instead, they are carefully extrapolated to provide a longer-term view of potential growth.

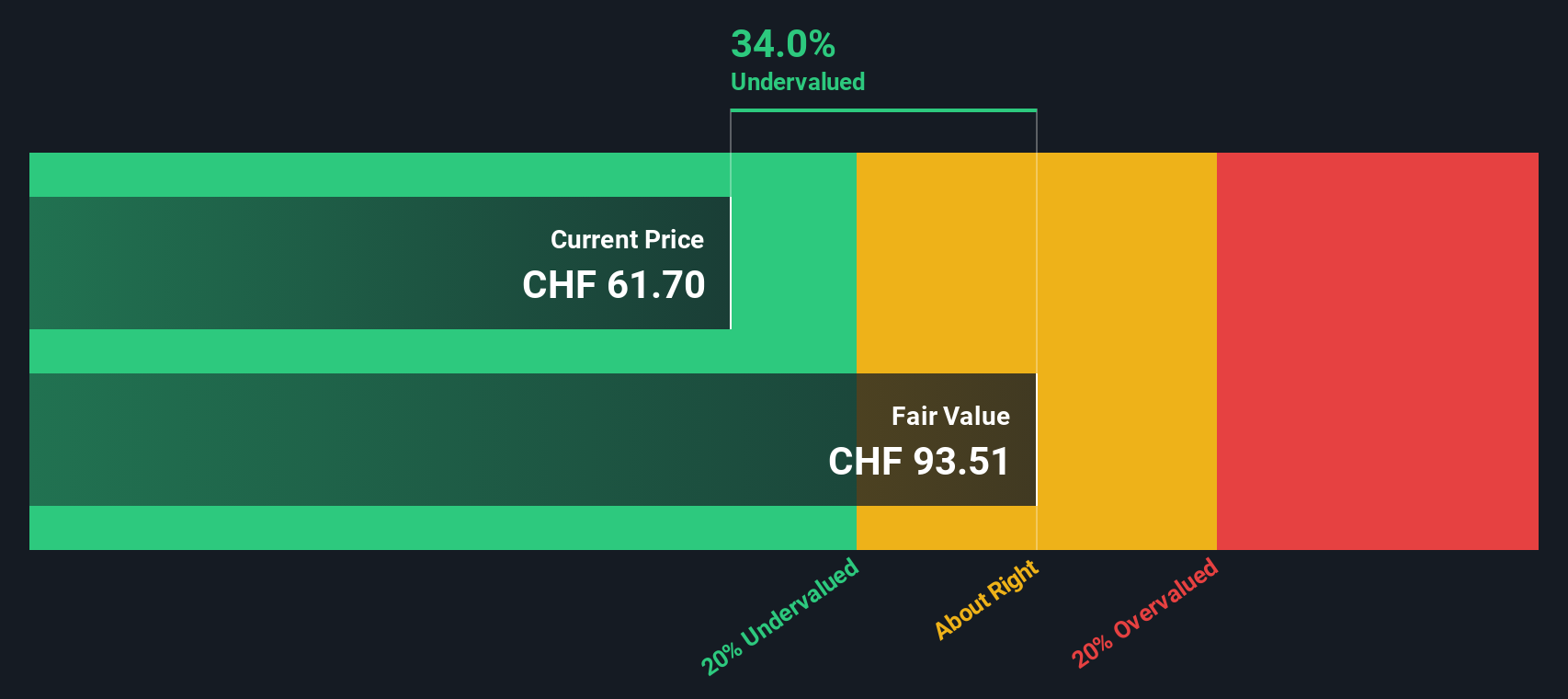

Based on the DCF analysis using the two-stage Free Cash Flow to Equity approach, Alcon's estimated intrinsic value per share is $95.62. The DCF model suggests the stock is currently trading at a 33.0% discount to its intrinsic value. This indicates that Alcon may be meaningfully undervalued at today’s prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alcon is undervalued by 33.0%. Track this in your watchlist or portfolio, or discover 865 more undervalued stocks based on cash flows.

Approach 2: Alcon Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is a go-to metric for valuing established, profitable companies like Alcon. It shows how much investors are willing to pay for each unit of earnings, making it especially useful for companies consistently generating profit and stable cash flow.

What counts as a "fair" P/E ratio depends on a blend of factors like expected growth and potential risks. High-growth companies often justify higher P/E ratios because investors expect earnings to rise quickly, while more mature or riskier companies tend to command lower ratios.

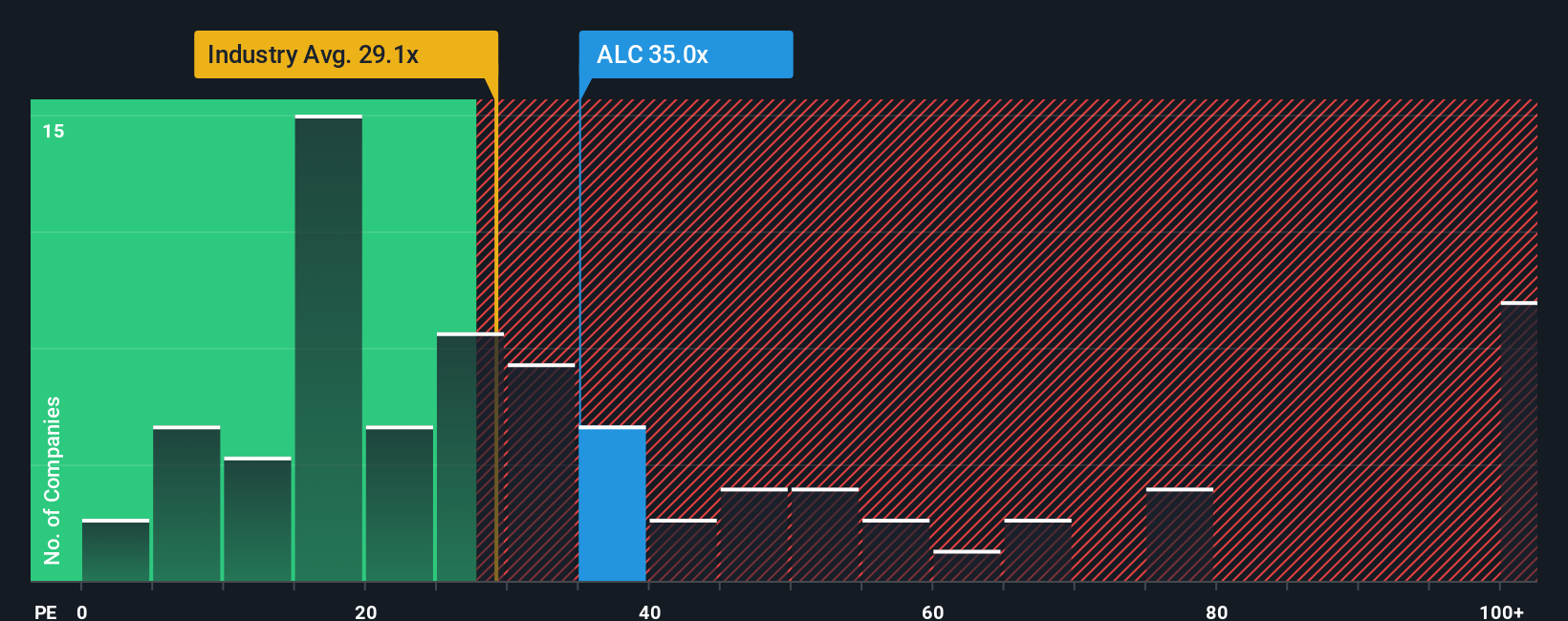

Alcon's current P/E ratio is 36.8x. For comparison, the average P/E among its direct peers sits at 33.3x, and the broader Medical Equipment industry average is 28.3x. At first glance, Alcon seems to trade at a premium, but raw comparisons rarely tell the whole story.

Simply Wall St’s proprietary "Fair Ratio" adjusts for crucial details that basic peer or industry averages overlook, such as Alcon’s earnings growth, profit margins, market cap, and unique industry dynamics. Alcon's Fair P/E Ratio is calculated to be 41.0x, indicating that its current multiple is actually below what would be fair given all these factors.

Because Alcon's actual P/E and its Fair Ratio are reasonably close, the stock appears to be trading in line with its fundamental value when assessed through the lens of expected earnings and company-specific qualities.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1370 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alcon Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story or perspective you bring to a company, linking the underlying business drivers and your expectations for things like revenue, earnings, and margins to a clear financial forecast and fair value estimate.

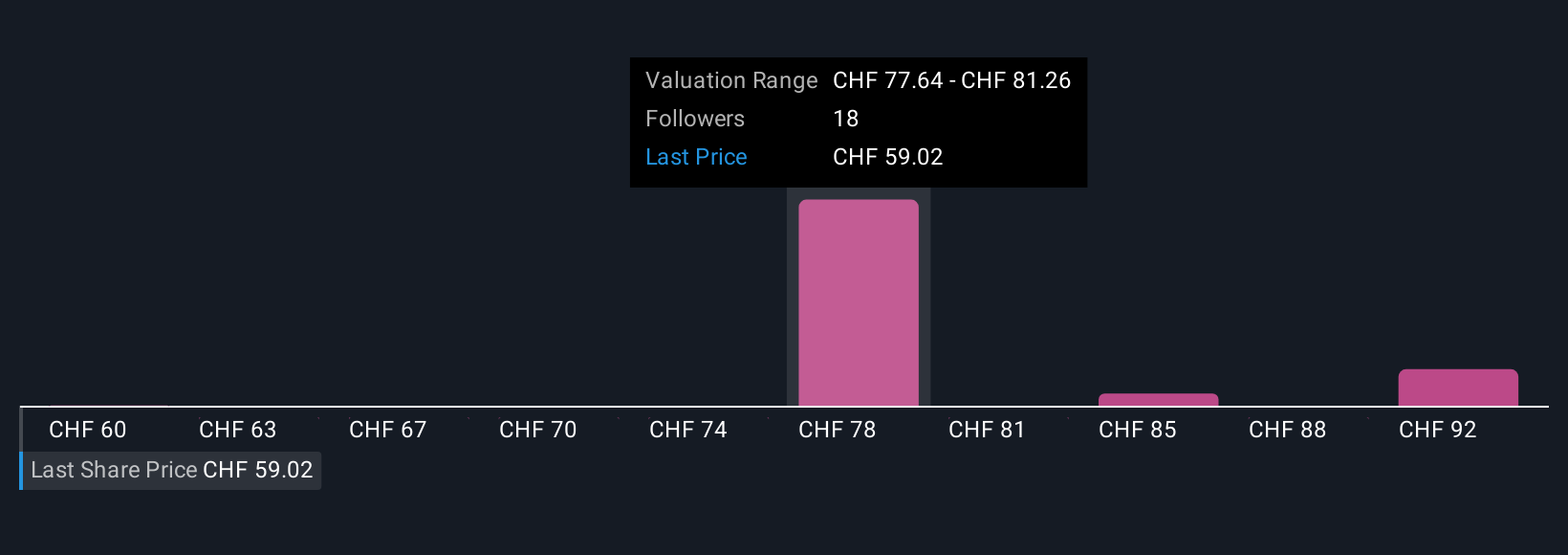

Rather than relying only on the numbers or consensus targets, Narratives help you connect what’s happening at Alcon, such as innovation, shifting demographics, or competitive risks, directly to your investment thesis and a forward-looking valuation. Narratives are easy to use, and you can create or explore hundreds of them on the Simply Wall St Community page. Millions of investors share their unique insights and scenarios there.

These Narratives make it simple to decide if and when to act by always showing you the Fair Value implied by your view compared with today’s share price. The information automatically updates as news and earnings are released. For example, some investors believe Alcon will benefit from sustained innovation and global healthcare trends, so they set a bullish Narrative with a fair value as high as CHF98.9. More cautious investors focus on integration challenges and margin pressures, resulting in a bearish Narrative closer to CHF62.3.

Do you think there's more to the story for Alcon? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALC

Alcon

Researches, develops, manufactures, distributes, and sells eye care products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives