- Switzerland

- /

- Medical Equipment

- /

- SWX:ALC

Alcon (SWX:ALC): Evaluating Valuation in Light of Upbeat Q3 Results and Positive Growth Signals

Reviewed by Simply Wall St

Alcon (SWX:ALC) delivered third-quarter earnings that surpassed estimates on non-GAAP EPS, while revenue came in slightly below forecasts. The company reaffirmed its 2025 outlook and pointed to ongoing growth in its Surgical and Vision Care segments.

See our latest analysis for Alcon.

Alcon’s share price rose sharply in after-hours trading following its upbeat Q3 report but remains down 19.2% for the year to date. While year-to-date momentum has been pressured by sector headwinds and margin challenges, long-term total shareholder return tells a steadier story with a 9.3% gain over five years. Recent news, including a major product launch, steady buybacks, and reaffirmed guidance, has kept investors focused on growth potential even as short-term performance has lagged historical averages.

If life sciences breakthroughs and medical device launches interest you, it’s a great moment to discover See the full list for free.

With analyst price targets still well above current levels and continued innovation driving optimism, should investors view Alcon’s current valuation as an attractive entry point, or is the market already factoring in the company’s growth plans?

Most Popular Narrative: 22.8% Undervalued

Alcon's share price last closed at CHF61.7, while the most widely followed narrative pegs a fair value near CHF79.92. This suggests a significant gap between current market value and long-term projections. The narrative draws on recent product launches and market expansion to support optimism about future earnings and margins.

Accelerated new product launches, including Unity VCS (next-gen surgical platform), PanOptix Pro (premium IOL), Tryptyr (first-in-class dry eye Rx), Precision7 (novel contact lens), and recent pipeline-accretive M&A (STAAR, LumiThera, Voyager), provide significant near and medium-term opportunities for share gain, mix improvement, and new market entry. These developments are seen as underpinning potential upside to both revenue and net margins as these innovations scale.

What financial forecast does this ambitious future require? Find out which performance targets and which record-setting margins are crucial to justify Alcon’s premium price. Get the inside story that powers this bullish valuation to see the full picture in the complete narrative.

Result: Fair Value of CHF79.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent competitive pressure, especially in intraocular lenses, and integration risks from recent acquisitions could present challenges for Alcon’s ambitious growth projections.

Find out about the key risks to this Alcon narrative.

Another View: Multiples Send a Different Signal

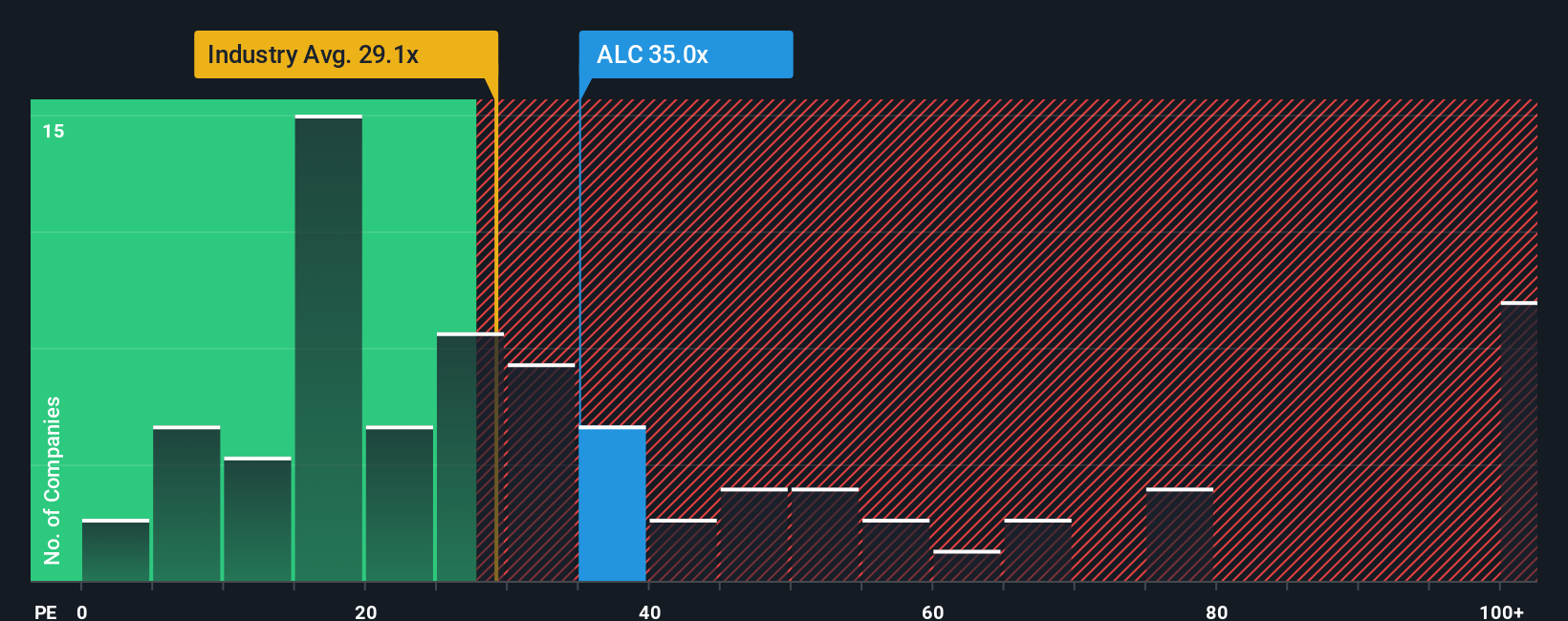

While the fair value estimate points to Alcon being undervalued, looking at price-to-earnings ratios tells a more cautious story. Shares trade at 36.5 times earnings, which is higher than both peer and industry averages of 32.3x and 28.4x, respectively. Even compared to the fair ratio of 40.4x, there is a risk that market sentiment could shift the multiple lower and affect future returns. Could valuation risk outweigh the perceived opportunity here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alcon Narrative

If you think there is another side to the story or want to dig into the numbers firsthand, crafting your own narrative takes just a few minutes. So why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alcon.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Unlock more ways to grow your portfolio by checking out proven strategies that other successful investors follow every day.

- Tap into tomorrow's growth with these 24 AI penny stocks, which are shaping game-changing innovations across sectors from automation to machine learning.

- Capture steady income by accessing these 16 dividend stocks with yields > 3%, offering reliable yields above 3% for consistent returns in any market.

- Spot hidden gems among these 878 undervalued stocks based on cash flows, which are trading below their intrinsic value before they catch the mainstream spotlight.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ALC

Alcon

Researches, develops, manufactures, distributes, and sells eye care products worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives