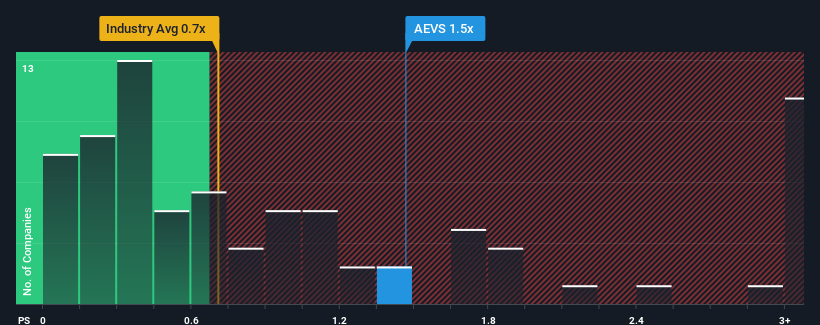

Aevis Victoria SA's (VTX:AEVS) price-to-sales (or "P/S") ratio of 1.5x may not look like an appealing investment opportunity when you consider close to half the companies in the Healthcare industry in Switzerland have P/S ratios below 0.7x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Aevis Victoria

How Has Aevis Victoria Performed Recently?

It looks like revenue growth has deserted Aevis Victoria recently, which is not something to boast about. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Aevis Victoria's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Aevis Victoria's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. However, a few strong years before that means that it was still able to grow revenue by an impressive 48% in total over the last three years. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Comparing that to the industry, which is predicted to shrink 8.1% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's understandable that Aevis Victoria's P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

What We Can Learn From Aevis Victoria's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Aevis Victoria revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Although, if the company's relative performance doesn't change it will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Aevis Victoria (2 are a bit unpleasant!) that you should be aware of before investing here.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:AEVS

Aevis Victoria

Engages in the healthcare, hospitality, lifestyle, and infrastructure sectors in Switzerland.

Questionable track record with very low risk.

Similar Companies

Market Insights

Community Narratives