- Switzerland

- /

- Food

- /

- SWX:BELL

We Wouldn't Be Too Quick To Buy Bell Food Group AG (VTX:BELL) Before It Goes Ex-Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Bell Food Group AG (VTX:BELL) is about to trade ex-dividend in the next three days. Investors can purchase shares before the 24th of March in order to be eligible for this dividend, which will be paid on the 29th of March.

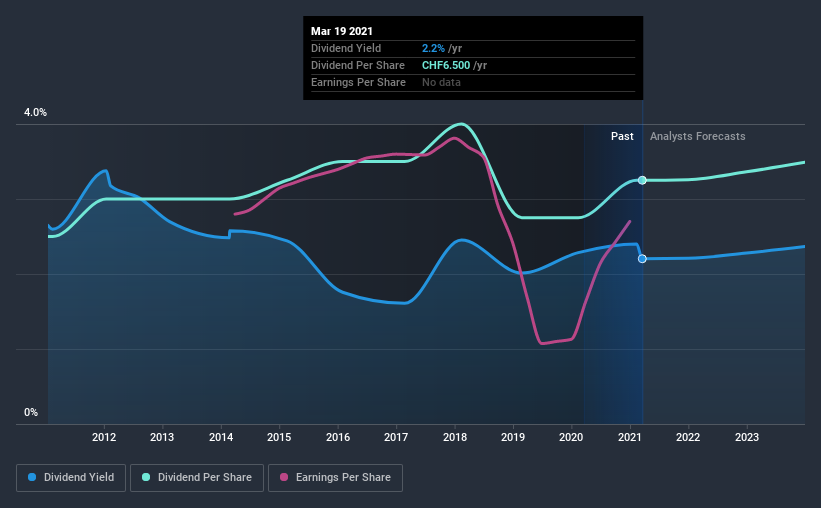

Bell Food Group's next dividend payment will be CHF6.50 per share, on the back of last year when the company paid a total of CHF6.50 to shareholders. Last year's total dividend payments show that Bell Food Group has a trailing yield of 2.2% on the current share price of CHF295. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Bell Food Group

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Fortunately Bell Food Group's payout ratio is modest, at just 34% of profit. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year, it paid out dividends equivalent to 250% of what it generated in free cash flow, a disturbingly high percentage. Our definition of free cash flow excludes cash generated from asset sales, so since Bell Food Group is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

While Bell Food Group's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Were this to happen repeatedly, this would be a risk to Bell Food Group's ability to maintain its dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. So we're not too excited that Bell Food Group's earnings are down 4.5% a year over the past five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Bell Food Group has delivered 2.7% dividend growth per year on average over the past 10 years.

To Sum It Up

Should investors buy Bell Food Group for the upcoming dividend? It's disappointing to see earnings per share declining, and this would ordinarily be enough to discourage us from most dividend stocks, even though Bell Food Group is paying out less than half its income as dividends. However, it's also paying out an uncomfortably high percentage of its cash flow, which makes us wonder just how sustainable the dividend really is. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Bell Food Group.

So if you're still interested in Bell Food Group despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. For example, we've found 2 warning signs for Bell Food Group that we recommend you consider before investing in the business.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Bell Food Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bell Food Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:BELL

Bell Food Group

Engages in the processing of meat and convenience products in Switzerland.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026