- Switzerland

- /

- Capital Markets

- /

- SWX:VPBN

Undiscovered Gems in Switzerland to Watch This August 2024

Reviewed by Simply Wall St

The Switzerland market ended marginally down on Tuesday despite trading higher till a couple of hours past noon, as investors digested the latest batch of economic data from the European region and looked ahead to key announcements from the Federal Reserve. Amid this backdrop, identifying promising small-cap stocks can be particularly rewarding for investors seeking growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| TX Group | 0.96% | -2.25% | 15.99% | ★★★★★★ |

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 49.32% | 1.35% | 11.45% | ★★★★★☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Jungfraubahn Holding | 17.74% | 3.55% | 9.25% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burkhalter Holding AG, with a market cap of CHF954.27 million, operates through its subsidiaries to offer electrical engineering services to the construction sector in Switzerland.

Operations: Burkhalter Holding AG generates CHF1.16 billion in revenue from its electrical engineering services to the construction sector in Switzerland.

Burkhalter Holding has shown robust performance, with earnings growth of 34.7% over the past year, outpacing the construction industry's 8.7%. The company's net debt to equity ratio stands at a satisfactory 16.7%, and its interest payments are well covered by EBIT at 39.7x coverage. Despite an increase in debt to equity from 12.8% to 59.9% over five years, Burkhalter remains profitable with high-quality earnings and is trading at 30.9% below our fair value estimate.

- Click here to discover the nuances of Burkhalter Holding with our detailed analytical health report.

Evaluate Burkhalter Holding's historical performance by accessing our past performance report.

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG, with a market cap of CHF1.13 billion, operates cogwheel railway and winter sports facilities in the Jungfrau region of Switzerland.

Operations: Jungfraubahn Holding AG generates revenue primarily from its Jungfraujoch - TOP of Europe segment (CHF188.24 million), Experience Mountains (CHF45.94 million), and Winter Sports (CHF41.26 million).

Jungfraubahn Holding, a small Swiss transportation company, has seen impressive earnings growth of 81.6% over the past year, significantly outpacing the industry average of -8.6%. With a price-to-earnings ratio of 14.2x, it is attractively valued compared to the broader Swiss market's 22.1x. The company's net debt to equity ratio stands at a satisfactory 13%, and it has consistently generated positive free cash flow in recent years, indicating strong financial health and operational efficiency.

- Get an in-depth perspective on Jungfraubahn Holding's performance by reading our health report here.

VP Bank (SWX:VPBN)

Simply Wall St Value Rating: ★★★★★☆

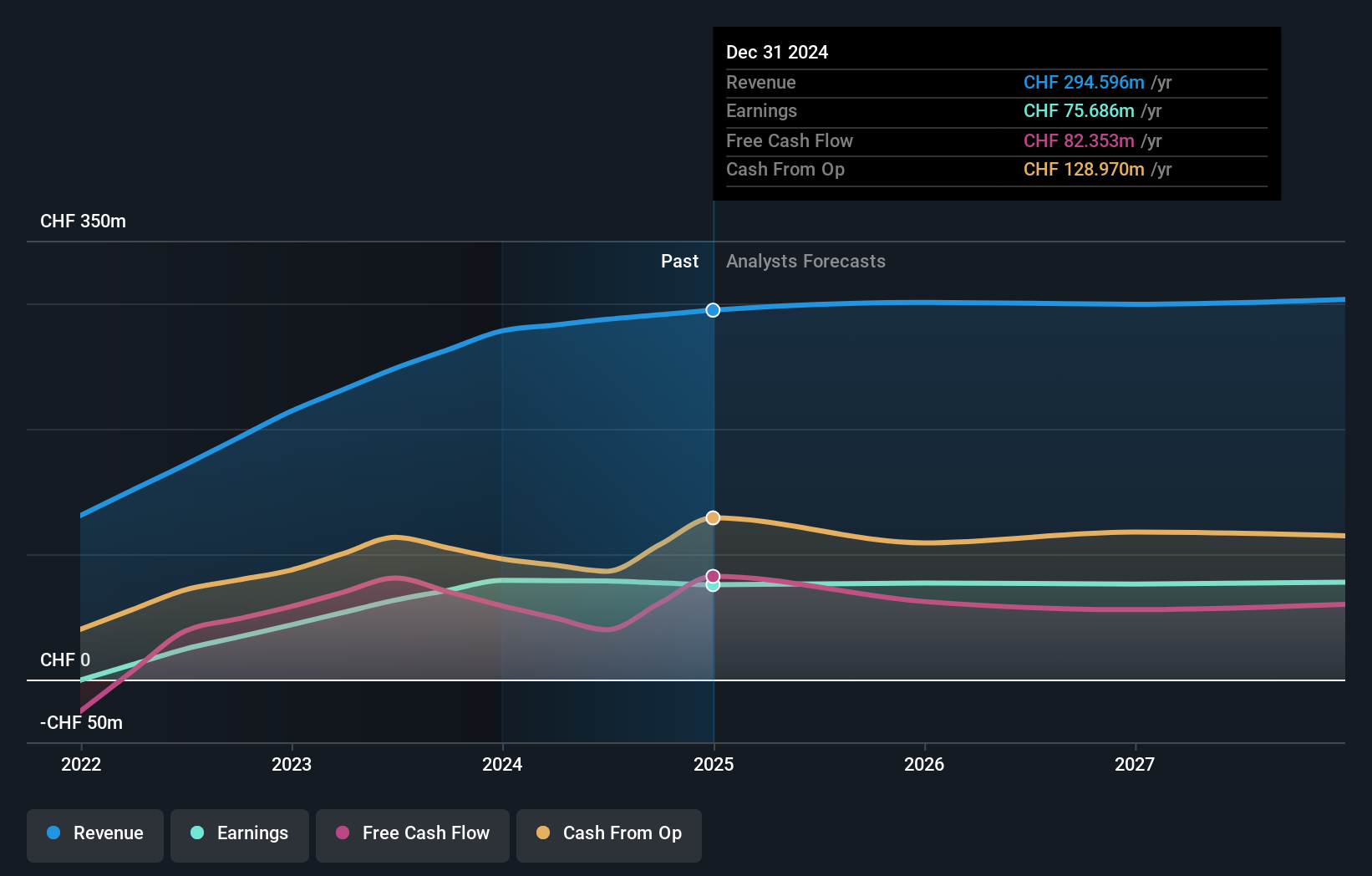

Overview: VP Bank AG, with a market cap of CHF459.80 million, offers wealth management and investment consulting services to private and institutional investors in Liechtenstein, Europe, and internationally through its subsidiaries.

Operations: VP Bank AG generates revenue from four segments: International (CHF146.14 million), Asset Servicing (CHF43.44 million), Corporate Center (-CHF16.95 million), and Liechtenstein & BVI (CHF186.85 million).

VP Bank, with total assets of CHF11.4B and equity of CHF1.1B, holds deposits amounting to CHF9.5B and loans at CHF5.5B. The bank has a low allowance for bad loans (35%) and an appropriate level of non-performing loans (1.1%). Despite a dip in net income to CHF11.51M for H1 2024 from last year's CHF25.47M, the company trades at 43% below its estimated fair value, signaling potential upside for investors seeking undervalued opportunities in the financial sector.

- Click to explore a detailed breakdown of our findings in VP Bank's health report.

Examine VP Bank's past performance report to understand how it has performed in the past.

Key Takeaways

- Unlock more gems! Our SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals screener has unearthed 16 more companies for you to explore.Click here to unveil our expertly curated list of 19 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VPBN

VP Bank

Provides wealth management and investment consulting services for private and institutional investors in Liechtenstein, rest of Europe, and internationally.

Excellent balance sheet, good value and pays a dividend.