Stock Analysis

- Switzerland

- /

- Capital Markets

- /

- SWX:SQN

Shareholders Would Not Be Objecting To Swissquote Group Holding Ltd's (VTX:SQN) CEO Compensation And Here's Why

We have been pretty impressed with the performance at Swissquote Group Holding Ltd (VTX:SQN) recently and CEO Marc Bürki deserves a mention for their role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 06 May 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

Check out our latest analysis for Swissquote Group Holding

Comparing Swissquote Group Holding Ltd's CEO Compensation With the industry

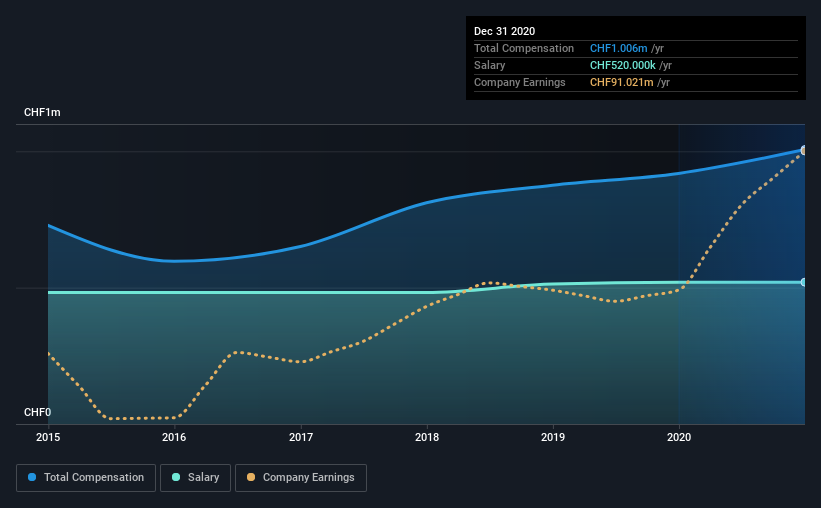

According to our data, Swissquote Group Holding Ltd has a market capitalization of CHF2.1b, and paid its CEO total annual compensation worth CHF1.0m over the year to December 2020. That's a notable increase of 9.5% on last year. We note that the salary of CHF520.0k makes up a sizeable portion of the total compensation received by the CEO.

On examining similar-sized companies in the industry with market capitalizations between CHF912m and CHF2.9b, we discovered that the median CEO total compensation of that group was CHF1.2m. So it looks like Swissquote Group Holding compensates Marc Bürki in line with the median for the industry. Moreover, Marc Bürki also holds CHF256m worth of Swissquote Group Holding stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CHF520k | CHF520k | 52% |

| Other | CHF486k | CHF399k | 48% |

| Total Compensation | CHF1.0m | CHF919k | 100% |

On an industry level, roughly 52% of total compensation represents salary and 48% is other remuneration. Our data reveals that Swissquote Group Holding allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Swissquote Group Holding Ltd's Growth

Swissquote Group Holding Ltd's earnings per share (EPS) grew 31% per year over the last three years. It achieved revenue growth of 39% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Swissquote Group Holding Ltd Been A Good Investment?

We think that the total shareholder return of 166%, over three years, would leave most Swissquote Group Holding Ltd shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's solid performance might have made most shareholders happy, possibly making CEO remuneration the least of the matters to be discussed in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 1 warning sign for Swissquote Group Holding that investors should look into moving forward.

Switching gears from Swissquote Group Holding, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Swissquote Group Holding, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Swissquote Group Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:SQN

Swissquote Group Holding

Provides a suite of online financial services to retail investors, affluent investors, and professional and institutional customers worldwide.

Outstanding track record with reasonable growth potential and pays a dividend.