- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Partners Group (SWX:PGHN): Exploring Valuation as Shares Trade in a Narrow Range

Reviewed by Simply Wall St

See our latest analysis for Partners Group Holding.

Partners Group Holding has faced some volatility this year, with its share price slipping in recent months, but the long-term picture remains constructive. While the 1-year total shareholder return is down 17.8 percent, investors who stuck around for three or five years have seen solid gains of almost 24 percent and 43 percent respectively. This demonstrates that momentum can shift, but long-haul performance still stands out.

If you’re looking to expand your search beyond this sector, now is an ideal time to discover fast growing stocks with high insider ownership.

With shares trading below analyst price targets and steady earnings growth, the question is whether Partners Group Holding is an undervalued opportunity or if the market has already factored in its future prospects.

Most Popular Narrative: 19.5% Undervalued

With Partners Group Holding’s narrative-driven fair value sitting well above the last close, the consensus sees considerable upside based on forward financials and catalysts on the horizon. Before diving deeper, consider one of the key perspectives shaping analyst sentiment.

The trend toward broader access to private markets, accelerated by regulatory moves enabling inclusion of private assets in retirement plans and more democratized products, positions Partners Group to benefit from rising asset flows from both high-net-worth and retail clients. This is likely to lead to higher long-term AUM and increased recurring management fee revenues.

Are you curious which bold forecasts underpin this bullish outlook? The model hinges on a tandem of robust top-line growth and steady profit margins, along with an earnings multiple that rivals some of the most valuable firms in global finance. Want to uncover the full financial blueprint fueling that premium price target?

Result: Fair Value of $1238.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and unpredictable fund inflows could challenge Partners Group Holding’s growth story and put pressure on profitability in the coming years.

Find out about the key risks to this Partners Group Holding narrative.

Another View: Price Ratios Tell a Cautionary Tale

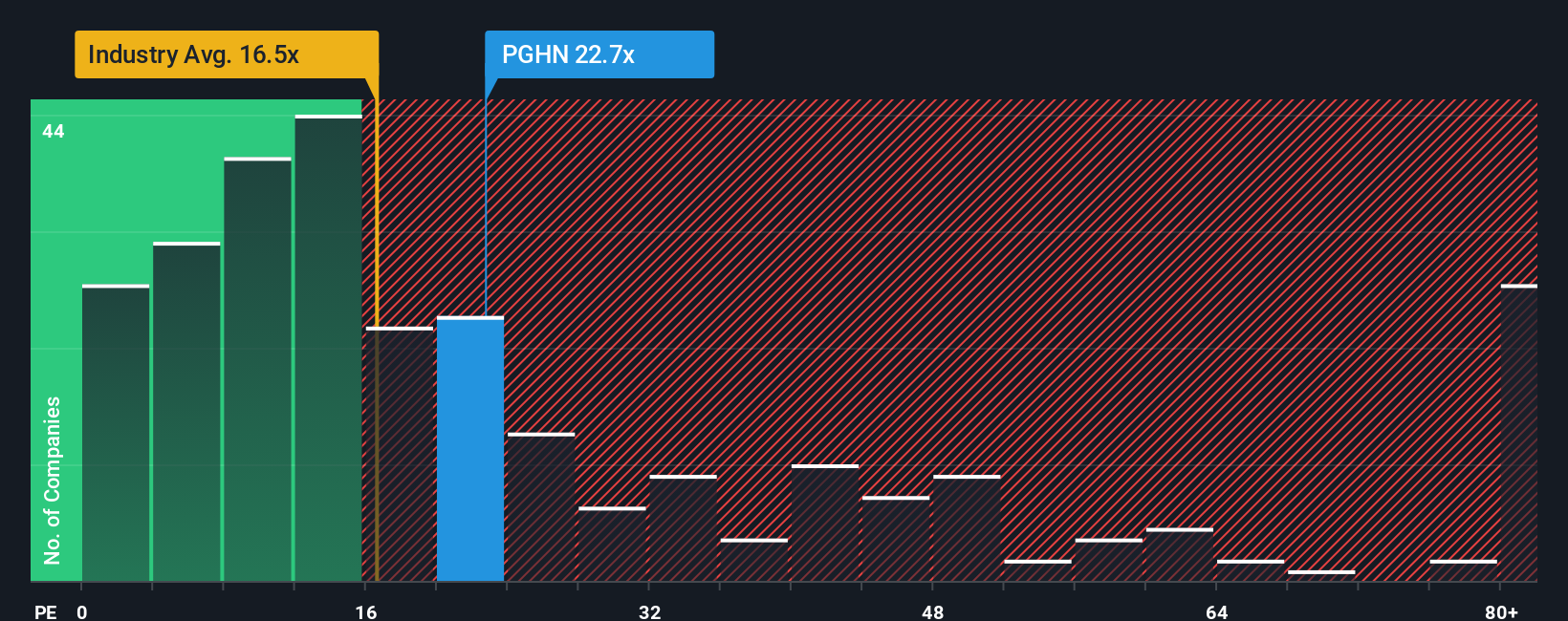

While the fair value model shows Partners Group Holding as undervalued, a look at its price-to-earnings ratio paints a different picture. Trading at 21.6x, it is noticeably more expensive than both the European industry average of 16.2x and its closest peers at 16.7x. Even when compared to the fair ratio of 20.6x, the current price stands out as stretched, suggesting a valuation premium that could limit future upside.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Partners Group Holding Narrative

If you’d rather chart your own path and see the numbers firsthand, you can craft a personalized take on Partners Group Holding’s story in just a few minutes. Do it your way.

A great starting point for your Partners Group Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Make your next smart move by checking out investment opportunities you won't want to overlook. The market is full of unique possibilities for sharp investors.

- Capitalize on breakthrough innovation by searching these 27 AI penny stocks, which are pushing boundaries with artificial intelligence and redefining what is possible in tech.

- Maximize your long-term returns as you evaluate these 876 undervalued stocks based on cash flows, which may offer untapped potential based on strong fundamentals and attractive valuations.

- Secure steady income streams by reviewing these 17 dividend stocks with yields > 3%, with yields above 3 percent and robust financial health supporting consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives