- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Exploring Partners Group (SWX:PGHN) Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Partners Group Holding (SWX:PGHN) shares have seen a range of movement over the past several months, with investors weighing the company’s financial results and long-term growth outlook. Recent data suggests a varied pattern in performance, which points to evolving market sentiment.

See our latest analysis for Partners Group Holding.

Partners Group Holding’s share price has slipped nearly 24% year-to-date, reflecting softer momentum after a strong run in previous years. Its 1-year total shareholder return of -19.7% shows recent challenges have weighed more than any short-term rallies. While the company delivered a 10.2% total return over three years, the last several months suggest the market’s appetite has shifted, perhaps as investors reassess growth prospects and risk.

If you're interested in discovering what else the market offers right now, this could be an ideal moment to broaden your search and explore fast growing stocks with high insider ownership

With shares trading at a discount to analyst targets despite double-digit annual growth, the key question is whether Partners Group is truly undervalued at today’s levels or if the market has already priced in all future gains.

Most Popular Narrative: 23.9% Undervalued

Partners Group Holding’s most widely-followed narrative suggests its fair value is significantly above the recent closing price, a gap that highlights upbeat earnings expectations and ongoing growth drivers. There are deeper catalysts and bold projections underneath this seemingly attractive discount.

The trend toward broader access to private markets, accelerated by regulatory moves enabling inclusion of private assets in retirement plans and more democratized products, positions Partners Group to benefit from rising asset flows from both high-net-worth and retail clients. This is likely to lead to higher long-term AUM and increased recurring management fee revenues.

Curious what specific assumptions are fueling this optimistic price target? The narrative’s fair value math depends on one key revenue growth lever and a future profit outlook that insiders might envy. There is a surprising story behind the forecasts; dive in to find out what really pushes this fair value so much higher than today’s price.

Result: Fair Value of $1,251.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, increased competition from rival private equity firms and margin pressure from changing client preferences could present challenges to the optimistic outlook reflected in current valuations.

Find out about the key risks to this Partners Group Holding narrative.

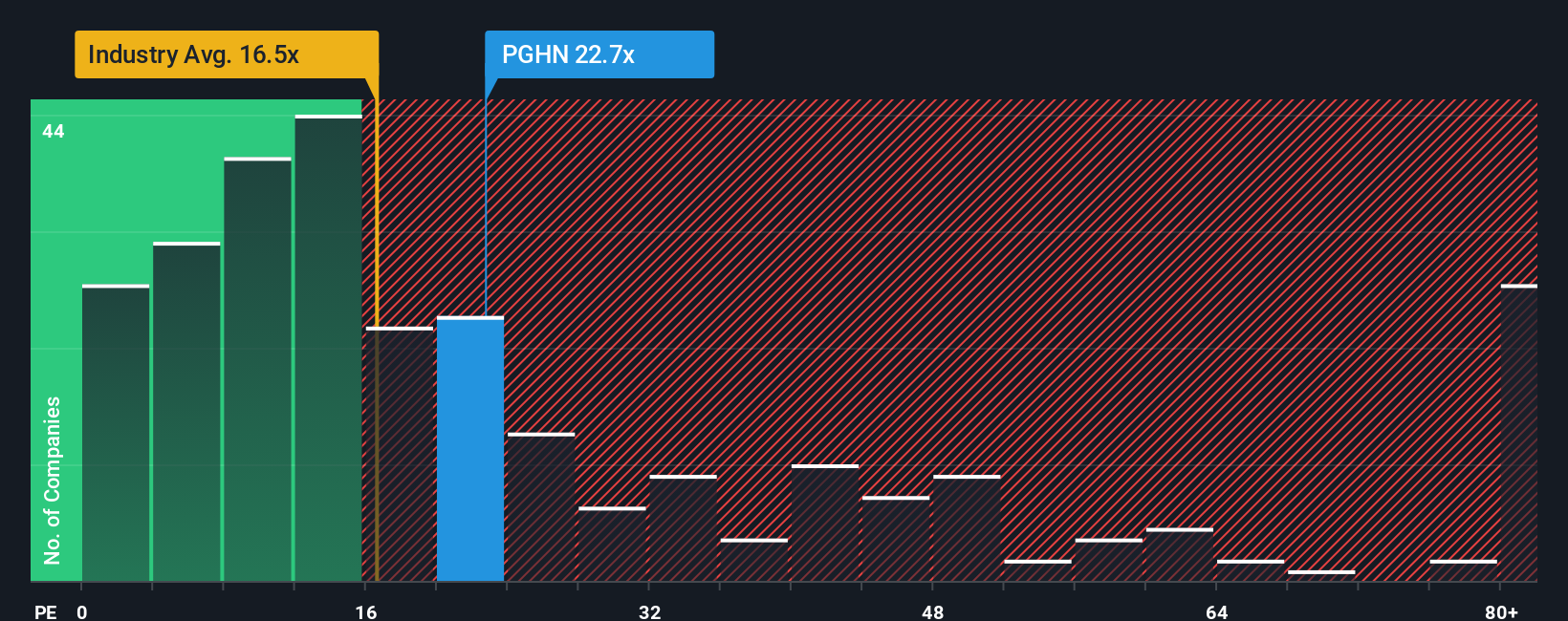

Another View: Looking at Multiples

While the consensus fair value suggests Partners Group Holding is undervalued, traditional price-to-earnings ratios paint a different picture. The company trades at 20.6x earnings, which is higher than both its peer average (16.9x) and the wider European industry (16.6x). It also exceeds its own fair ratio of 20.2x. This makes it look relatively expensive compared to similar firms, suggesting the market might already be building in optimistic assumptions about future growth. Does this raise concerns, or is the premium justified by its quality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Partners Group Holding Narrative

If you see things differently or want to dig into the data on your own terms, you can shape your own perspective in just a few minutes, and Do it your way.

A great starting point for your Partners Group Holding research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

Don’t leave your next great stock on the sidelines. Tap into exclusive opportunities others might miss by searching smarter with these powerful tools from Simply Wall Street:

- Capture steady income streams by targeting these 16 dividend stocks with yields > 3%, which delivers high yields above 3% and robust fundamentals.

- Seize innovations changing healthcare by browsing these 31 healthcare AI stocks, which is pioneering medical breakthroughs with artificial intelligence.

- Supercharge your portfolio with potential value unlocks using these 874 undervalued stocks based on cash flows, highlighting stocks trading below their true worth based on strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives